Dallas Texas Loan Agreement for Vehicle is a legal document that outlines the terms and conditions of a loan obtained for purchasing a vehicle in Dallas, Texas. This agreement is crucial to protect the rights of both the lender and the borrower and ensure a clear understanding of the loan. The Loan Agreement for Vehicle in Dallas, Texas typically includes essential details such as the names and addresses of both parties involved, the vehicle identification number (VIN), make and model of the vehicle, loan amount, interest rate, repayment schedule, and any additional terms agreed upon. There can be different types of Loan Agreements for Vehicle in Dallas, Texas, each designed to cater to specific needs and circumstances. Some common types of loan agreements include: 1. Secured Loan Agreement: This type of agreement involves leveraging the vehicle itself as collateral for the loan. In case of default, the lender can repossess the vehicle to recover their funds. 2. Unsecured Loan Agreement: Unlike a secured loan agreement, an unsecured agreement does not require collateral. However, since there is no security, these loans often have stricter eligibility criteria and higher interest rates. 3. Installment Loan Agreement: This is the most common type of Loan Agreement for Vehicle in Dallas, Texas. It outlines the monthly repayment amounts and their due dates until the loan is fully repaid, including interest and any additional fees. 4. Balloon Payment Loan Agreement: This type of agreement includes regular monthly payments like an installment loan. However, at the end of the loan term, there is one large "balloon" payment due, making it essential to plan for this lump sum payment. 5. Lease Agreement: Though not technically a loan agreement, a lease agreement allows individuals to use a vehicle for a specific period in exchange for regular payments. At the end of the lease term, the lessee usually has the option to purchase the vehicle or return it. It is essential for both parties to carefully read and understand the terms and conditions of the Loan Agreement for Vehicle in Dallas, Texas before signing. Consulting with legal professionals or experts in the field can help ensure a fair and mutually beneficial agreement for all parties involved.

Dallas Texas Loan Agreement for Vehicle

Description

How to fill out Dallas Texas Loan Agreement For Vehicle?

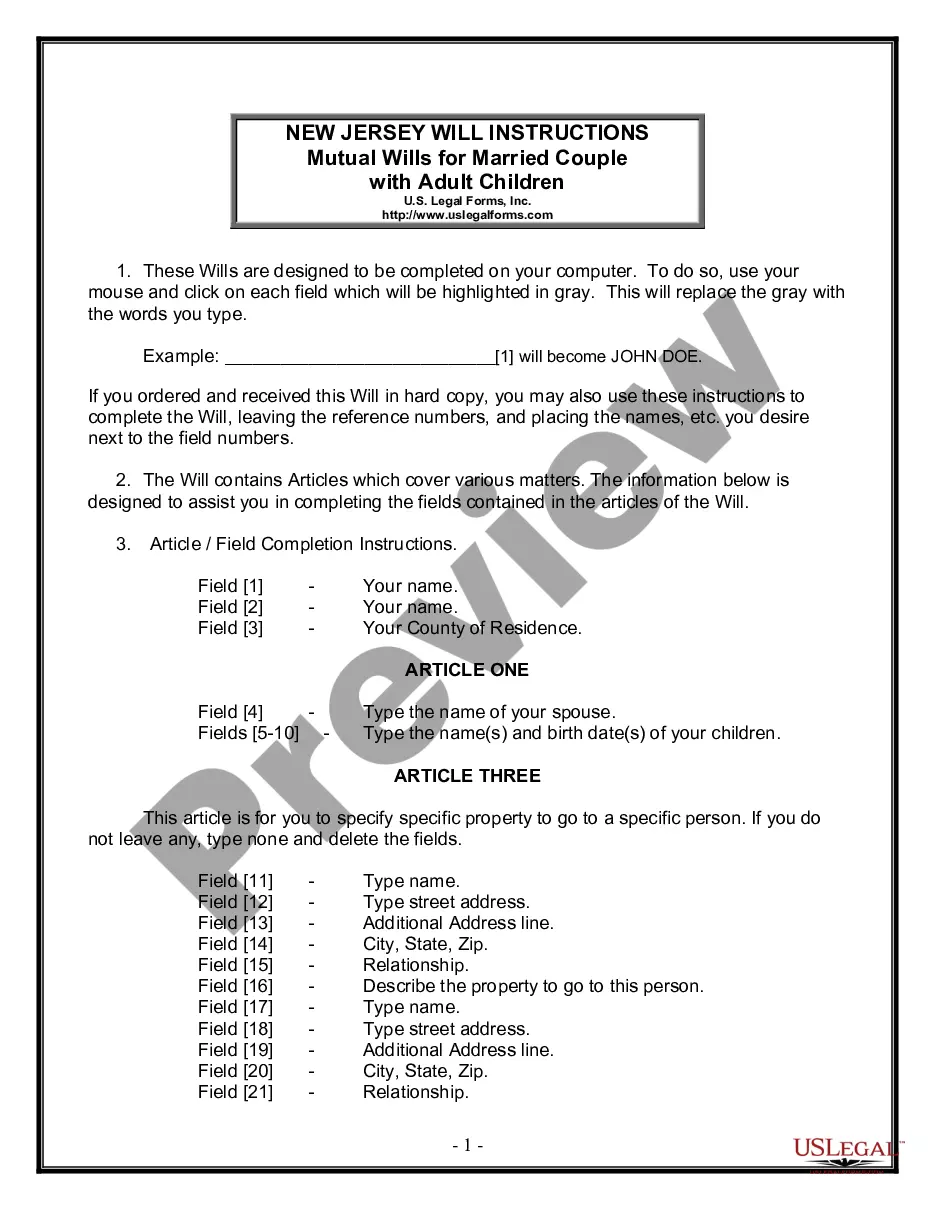

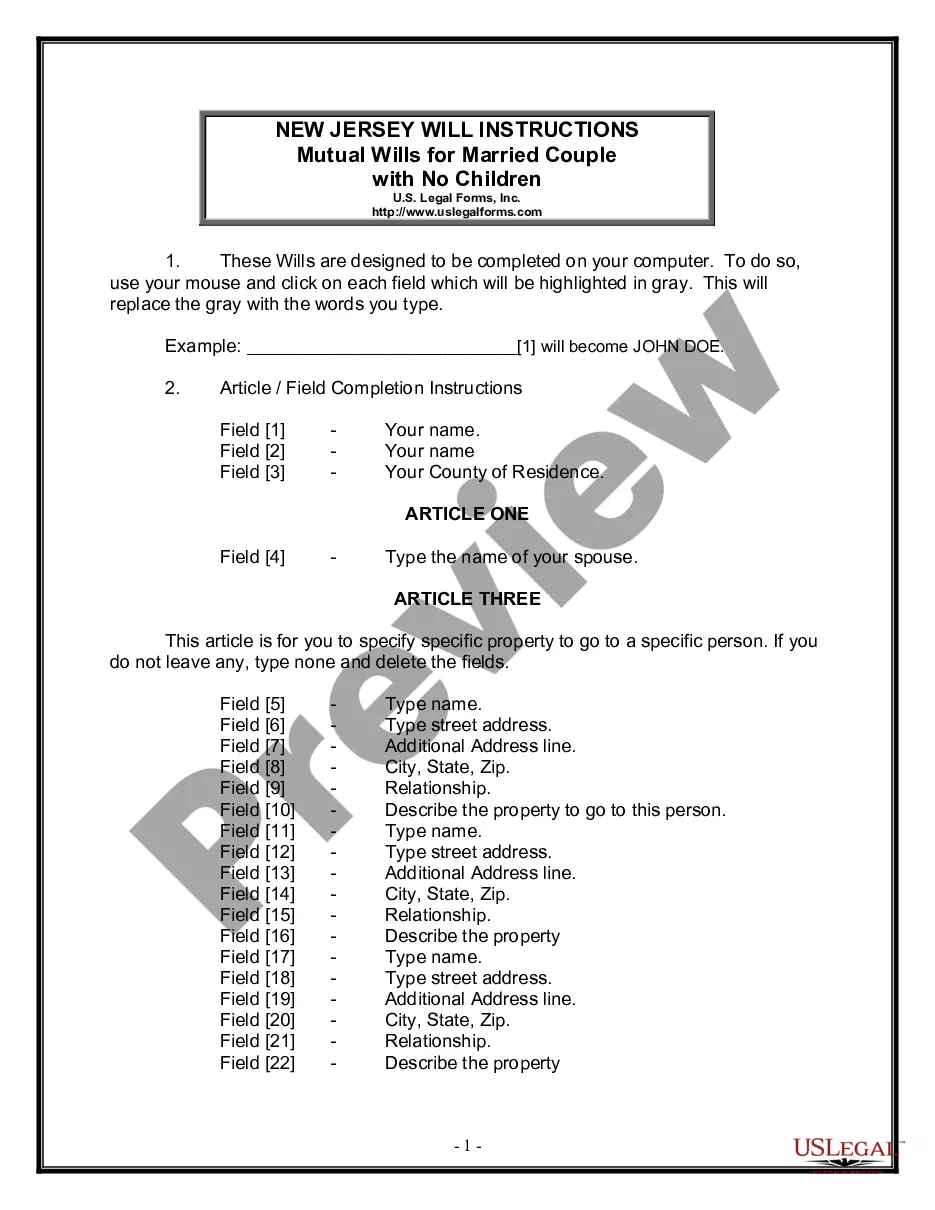

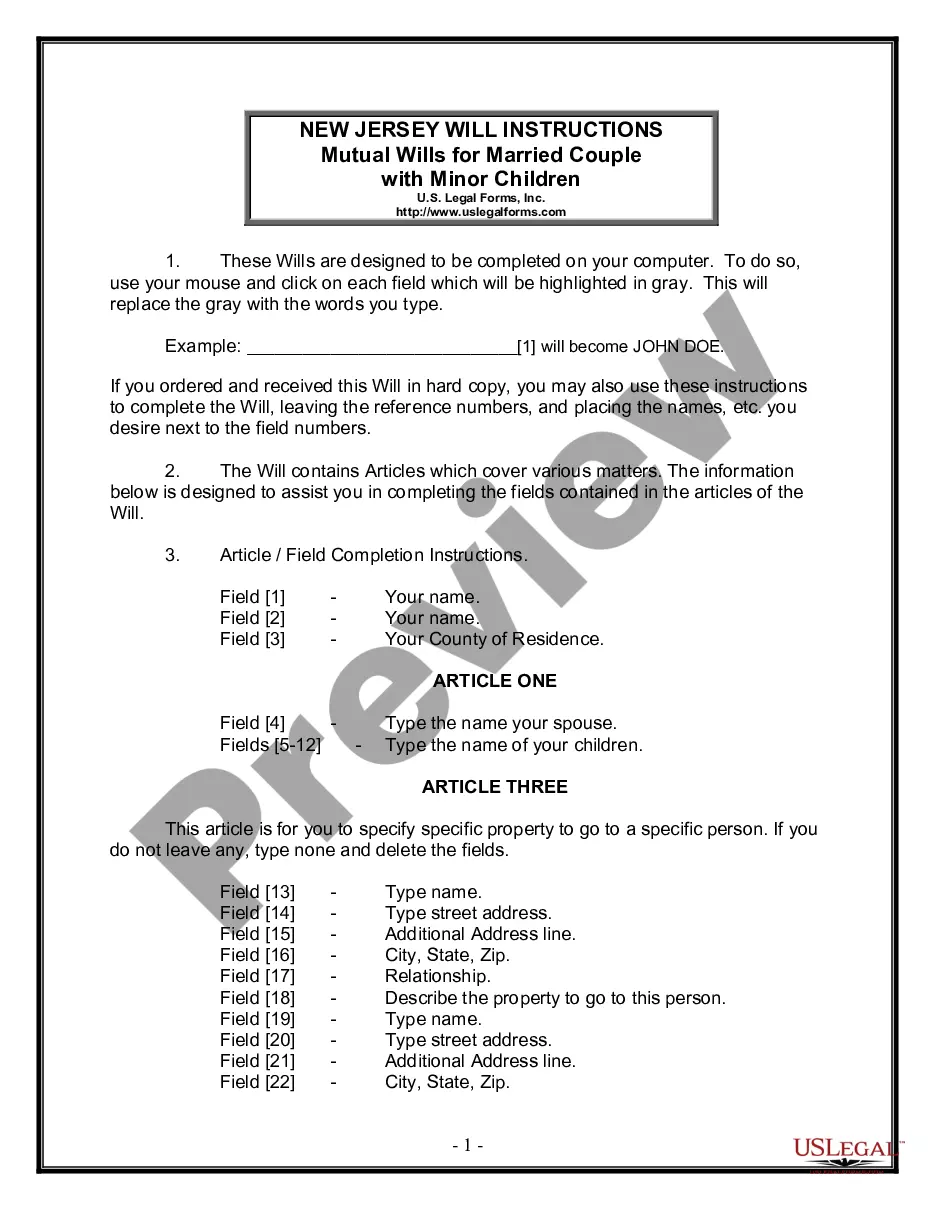

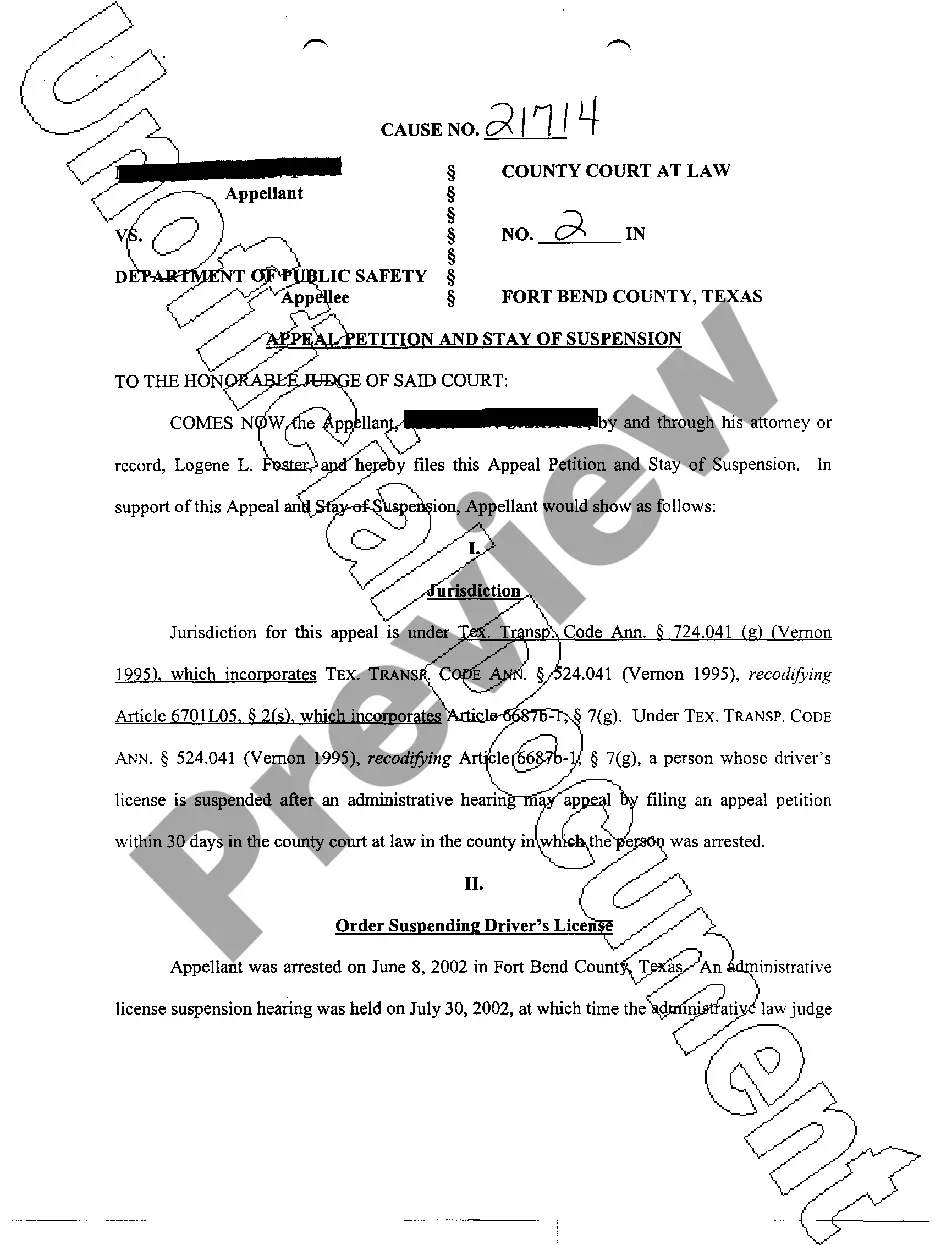

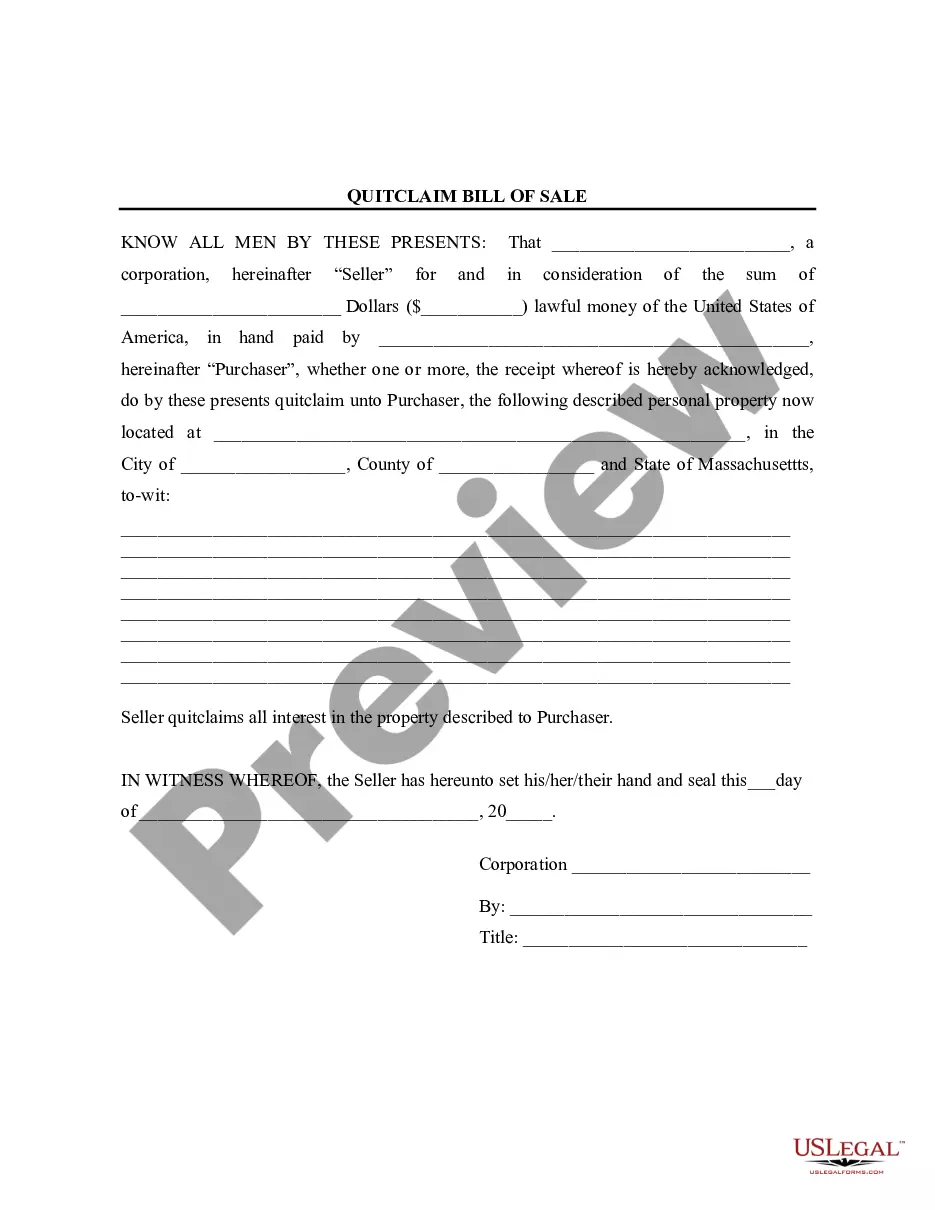

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Dallas Loan Agreement for Vehicle suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Aside from the Dallas Loan Agreement for Vehicle, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Dallas Loan Agreement for Vehicle:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Dallas Loan Agreement for Vehicle.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

What is a car finance agreement? If you buy a car using finance, there's a credit agreement between you and the lender. This allows you to pay for the car over a period of time, with interest payable on the loan balance. This is what's called a car finance agreement.

You can make a down payment of 20% or more when purchasing the car. You can take out a car loan with a term of four years or less. You can have your total transportation costsnot just your car loanbe less than 10% of your monthly income.

The 20/4/10 rule is a car-buying principle that states you should only by a car if: You can afford a 20% down payment. You're financing the car for four years (48 months) or less. The cost of owning the car (including insurance and your loan payment) is less than 10% of your gross monthly income.

Whether you're paying cash, leasing, or financing a car, your upper spending limit really shouldn't be a penny more than 35% of your gross annual income. That means if you make $36,000 a year, the car price shouldn't exceed $12,600.

If you got your loan through the bank directly, it's rare to have your loan revoked after you've purchased your car. Banks may be able to revoke your car loan if your contract had language that protects the bank's right to do so.

You and the dealer enter into a contract where you buy a car and agree to pay, over a period of time, the amount financed plus a finance charge. The dealer typically sells the contract to a bank, finance company, or credit union that will service the account and collect your payments. Multiple financing options.

Under Texas Law, you do not have 3 days to cancel the purchase like you may with some transactions the dealer is required to register and title the vehicle in your name within 30 days, regardless of if you owe money on the vehicle to the dealer or another financier.

When a car is financed, the dealership wins and the buyer loses because interest rates are much higher for the buyer through financing a car.

The 20/4/10 rule of thumb for car buying helps you shop for a vehicle that will fit your budget. The rule is to make a 20% down payment on a four-year car loan and spend no more than 10% of your monthly income on transportation expenses.

You should always put down at least 20% of the car value as a down payment, keep the length of the car loan to no longer than 4 years, and spend no more than 10% of your gross monthly salary on your car expenses.