Mecklenburg North Carolina Loan Agreement for Vehicle is a legal document that outlines the terms and conditions between a lender and a borrower when financing a vehicle purchase in the Mecklenburg County area. This agreement ensures that both parties fully understand their rights and obligations throughout the loan repayment period. The Mecklenburg North Carolina Loan Agreement for Vehicle typically includes the following key components: 1. Parties: It identifies the lender (often a financial institution or dealership) and the borrower (individual or entity) involved in the loan transaction. 2. Vehicle details: It provides comprehensive information about the vehicle being financed, including the make, model, year, identification number, and any other relevant details. 3. Loan amount and interest rate: This section specifies the total amount of money being borrowed by the borrower and the applicable interest rate. It also mentions any charges, fees, or penalties associated with the loan. 4. Repayment terms: It outlines the repayment schedule, including the number of installments, due dates, and the amount to be paid for each installment. Additionally, it may state the consequences of late or missed payments. 5. Security agreement: In some cases, a lender may require the borrower to provide collateral, such as the vehicle itself or other assets, to secure the loan. This section would detail the rights and obligations of both parties regarding this security interest. 6. Insurance requirements: The agreement might outline the type and minimum coverage of insurance the borrower is required to maintain on the vehicle throughout the loan term to protect both parties' interests. 7. Prepayment and default clauses: It may specify the conditions under which the borrower can make early repayments without penalties or any consequences of default, such as repossession or legal actions. Types of Mecklenburg North Carolina Loan Agreement for Vehicle: 1. Secured Loan Agreement: This type of agreement is executed when the lender requires the borrower to provide collateral, typically the vehicle itself, to secure the loan. If the borrower fails to make timely payments, the lender has the right to repossess the vehicle. 2. Unsecured Loan Agreement: In some cases, lenders may offer unsecured loans for vehicle purchases, where no collateral is required. However, these agreements often come with higher interest rates and stricter eligibility criteria due to the increased risk for the lender. 3. Lease Agreement: Though not a loan agreement, a lease agreement is an alternative financing option for acquiring a vehicle. It involves the borrower making regular lease payments to the lessor for the use of the vehicle over a specified period. Ownership does not transfer to the borrower but remains with the lessor. The Mecklenburg County Loan Agreement for Vehicle is a legally binding contract that protects both parties involved in a vehicle financing transaction. It is essential for borrowers to carefully review and understand the terms and conditions outlined in the agreement before signing to ensure a smooth loan repayment process and mitigate any potential issues in the future.

Mecklenburg North Carolina Loan Agreement for Vehicle

Description

How to fill out Mecklenburg North Carolina Loan Agreement For Vehicle?

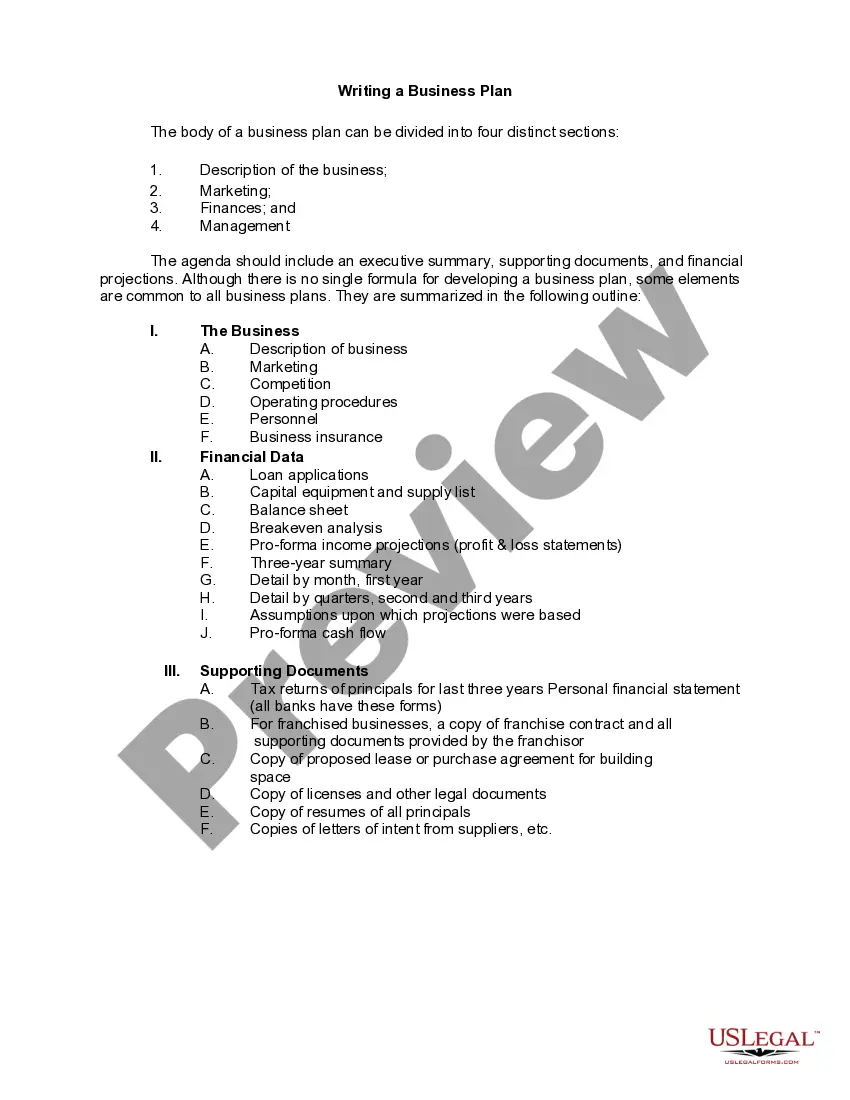

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Mecklenburg Loan Agreement for Vehicle is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Mecklenburg Loan Agreement for Vehicle. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Loan Agreement for Vehicle in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!