Maricopa Arizona Loan Agreement for Car: A Comprehensive Guide If you reside in Maricopa, Arizona, and are considering financing a car purchase, understanding the Maricopa Arizona Loan Agreement for Car is vital. This detailed description will provide an overview of what this agreement entails, its importance, and the different types available. A loan agreement for a car is a legal contract between a borrower (car buyer) and a lender (financial institution or credit union). This agreement outlines the terms and conditions of borrowing money to purchase a vehicle. It specifies the loan amount, interest rate, repayment schedule, consequences of default, and any additional fees or charges associated with the loan. The Maricopa Arizona Loan Agreement for Car serves as a legal safeguard for both the borrower and the lender. It ensures that all parties are aware of their responsibilities and liabilities throughout the loan term. By signing this agreement, the borrower agrees to repay the loan amount in regular installments while the lender agrees to provide financing based on the agreed-upon terms. Different Types of Maricopa Arizona Loan Agreement for Car: 1. Traditional Auto Loan: This is the most common type of car loan agreement. Borrowers receive a lump sum amount from the lender, usually to pay the vehicle's purchase price in full. The loan is repaid over a fixed period, typically ranging from three to seven years, with monthly installments including principal and interest. 2. Leasing Agreement: Unlike traditional loans, leasing agreements offer the borrower the opportunity to use a vehicle for a specific period, typically two to four years, in exchange for regular monthly payments. At the end of the lease term, the borrower can either purchase the car or return it to the lender. 3. Personal Contract Purchase (PCP) Agreement: This type of loan agreement combines elements of both traditional auto loans and leasing. PCP agreements allow borrowers to make lower monthly payments by deferring a portion of the loan amount to the end of the term. At the end of the agreement, the borrower has the option to purchase the car by paying the deferred amount, return it, or trade it in for a new vehicle. 4. Title Loan: In this agreement, the lender provides a short-term loan to the borrower, using the vehicle's title as collateral. The borrower retains possession of the car but risks losing it if loan repayments are not made as per the agreement. Title loans typically have high interest rates and are suitable for those needing quick cash but with the ability to repay the loan promptly. In conclusion, the Maricopa Arizona Loan Agreement for Car is a crucial legal document that outlines the terms and conditions of financing a vehicle purchase. Whether it's a traditional auto loan, leasing agreement, personal contract purchase, or a title loan, understanding the different types of loan agreements can help borrowers select the most suitable option for their needs.

Maricopa Arizona Loan Agreement for Car

Description

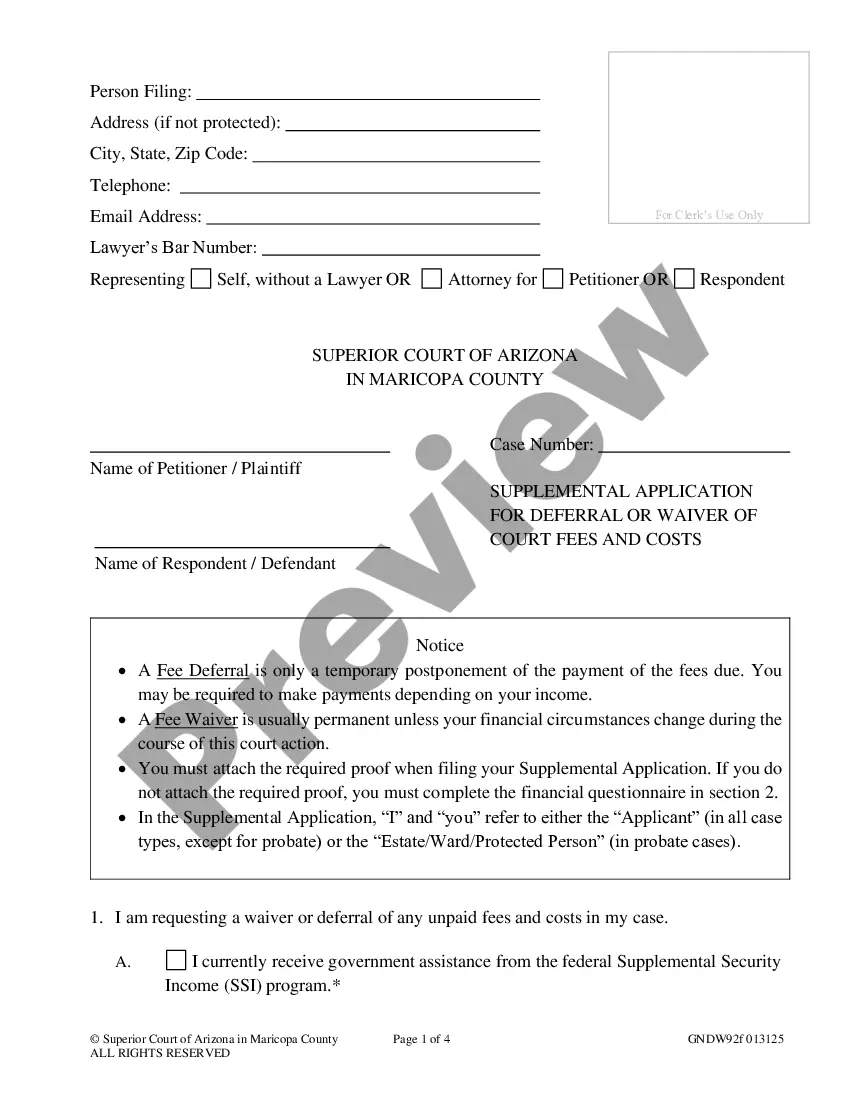

How to fill out Maricopa Arizona Loan Agreement For Car?

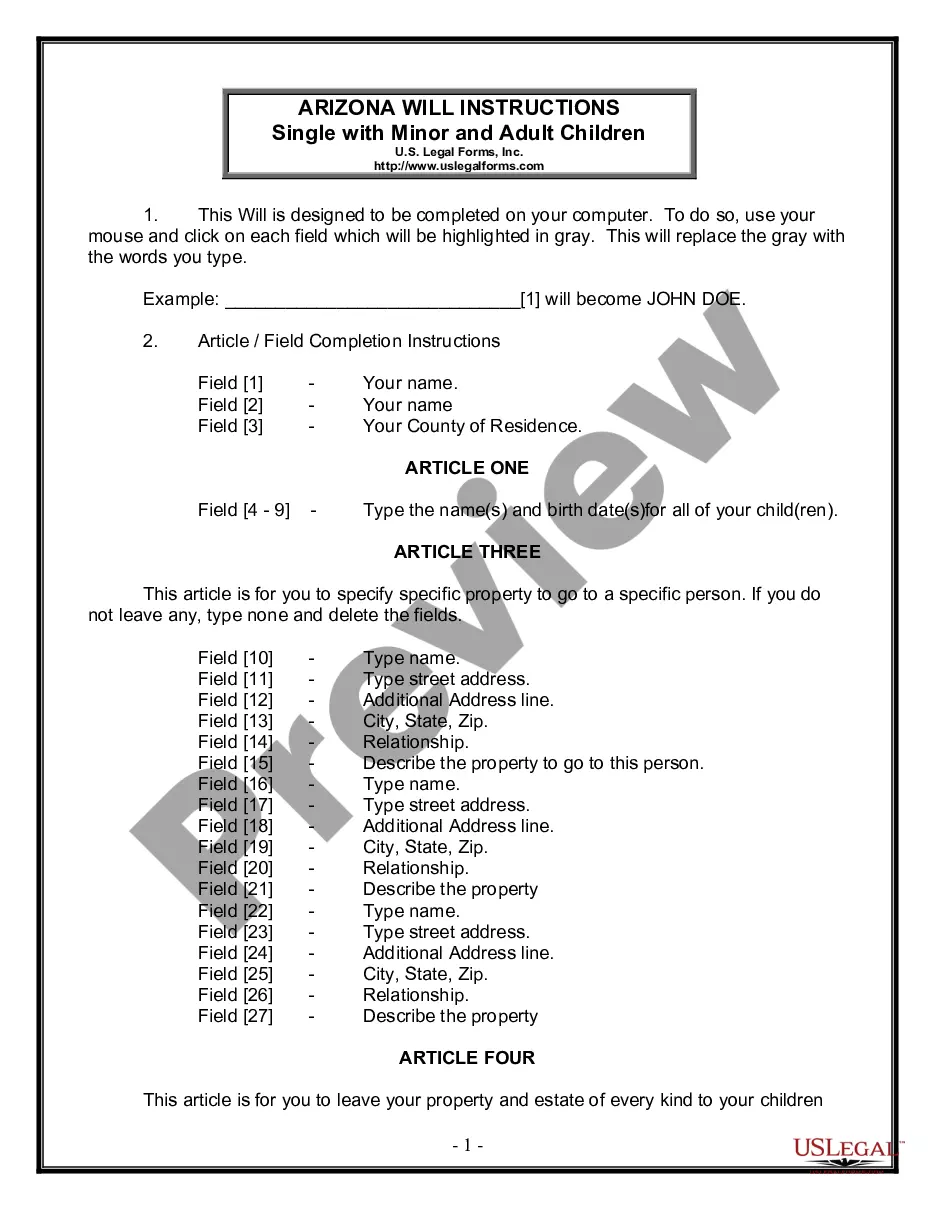

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Loan Agreement for Car, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the latest version of the Maricopa Loan Agreement for Car, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Loan Agreement for Car:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Maricopa Loan Agreement for Car and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!