Title: Alameda California Loan Agreement for Property: Explained in Detail Introduction: An Alameda California Loan Agreement for Property is a legal contract that governs the borrowing and lending of funds specifically related to real estate transactions in Alameda, California. This agreement serves to outline the terms and conditions agreed upon between the borrower and the lender, ensuring a transparent and binding agreement. Let's delve into the particulars of this loan agreement and explore any different types that may exist. 1. Basics of an Alameda California Loan Agreement for Property: — A Loan Agreement for Property is a legally binding contract between a borrower and a lender. — It outlines the terms of the loan, including the loan amount, interest rate, repayment schedule, and any collateral provided. — This agreement is specific to real estate transactions in Alameda, California, ensuring compliance with local regulations and laws. 2. Key Elements of an Alameda California Loan Agreement for Property: a) Loan Amount and Interest Rate: — Specifies the principal loan amount, which is the total borrowed sum. — Outlines the interest rate charged on the loan, either fixed or variable, based on the agreement. b) Repayment Schedule: — Defines the repayment period, including the number of installments, frequency (monthly, bi-monthly, etc.), and due dates. — May include any provisions for early repayment or prepayment penalties. c) Collateral: — Details any property or assets put forward as collateral to secure the loan, providing an assurance to the lender in case of default. d) Default and Remedies: — Specifies the actions that will be taken if the borrower fails to fulfill the agreed-upon terms. — Outlines potential remedies for the lender, such as foreclosure or seizure of collateral. 3. Different Types of Alameda California Loan Agreement for Property: a) Residential Property Loan Agreement: — Pertains to loans for residential properties, such as houses, condos, or apartments. — Could be used for home purchases, refinancing, equity loans, or construction loans. b) Commercial Property Loan Agreement: — Relates to loans for commercial properties like office buildings, retail spaces, or industrial facilities. — Used for purchasing properties, refinancing existing loans, or funding property development. c) Land Loan Agreement: — Specifically designed for loans secured by vacant land or parcels. — Used for recreational, agricultural, development, or investment purposes. d) Construction Loan Agreement: — Applies to loans that fund the construction or renovation of a property. — Typically involves disbursements in stages, based on the progress of the project. Conclusion: An Alameda California Loan Agreement for Property is an essential document in real estate transactions within Alameda, California. Whether it's residential, commercial, land, or construction-related, this agreement safeguards the interests of both borrowers and lenders, ensuring clarity in the financial arrangement. It is vital for all parties involved to consult legal professionals to ensure compliance and protect their rights and investments.

Alameda California Loan Agreement for Property

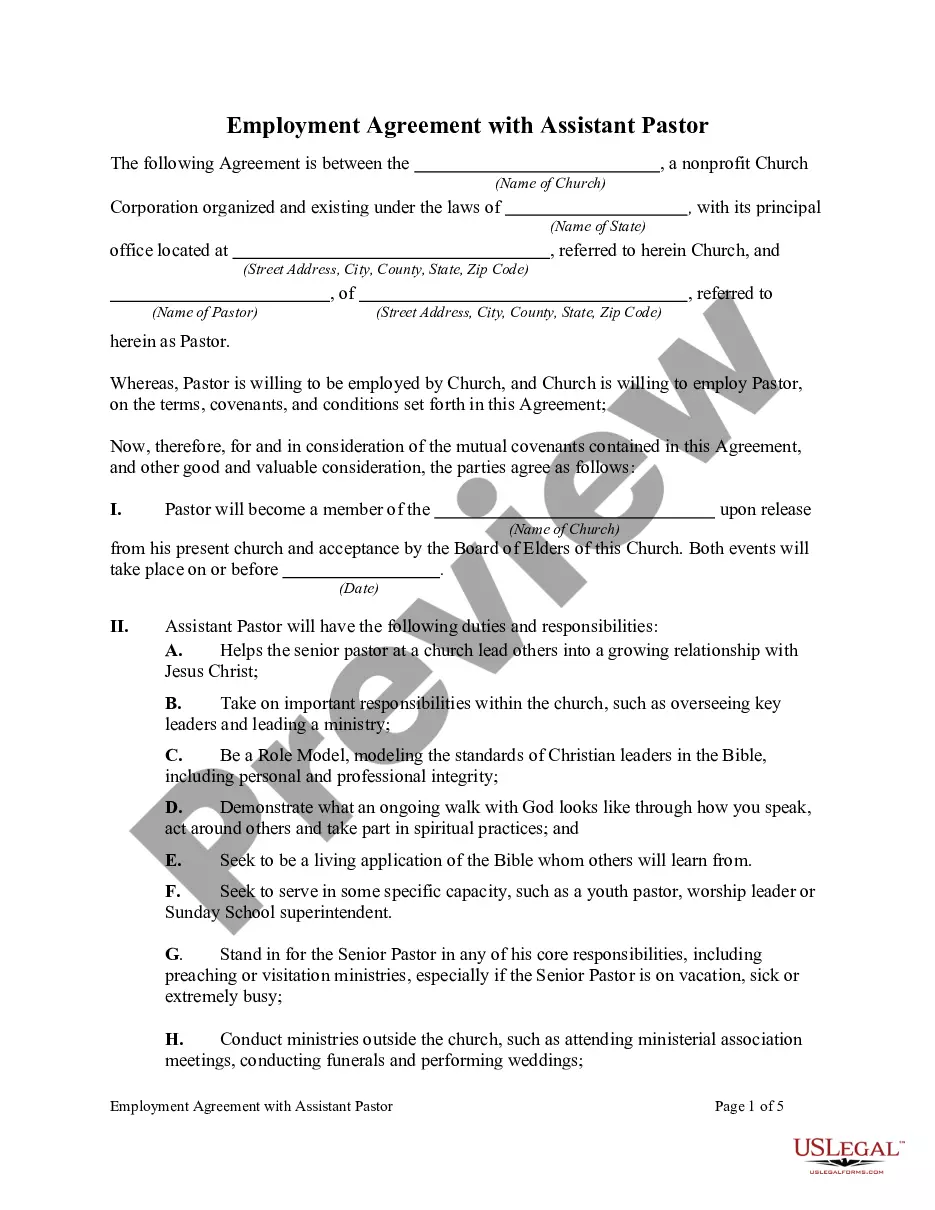

Description

How to fill out Alameda California Loan Agreement For Property?

If you need to find a trustworthy legal form provider to obtain the Alameda Loan Agreement for Property, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Alameda Loan Agreement for Property, either by a keyword or by the state/county the document is created for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Alameda Loan Agreement for Property template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or execute the Alameda Loan Agreement for Property - all from the convenience of your home.

Join US Legal Forms now!