Collin Texas Loan Agreement for Property is a legal document that outlines the terms and conditions of a loan obtained for residential or commercial property located in Collin County, Texas. This agreement binds the borrower and lender and ensures that both parties understand their rights and responsibilities throughout the loan process. The key purpose of a Collin Texas Loan Agreement for Property is to clearly define the loan amount, interest rate, repayment schedule, and other essential factors related to the loan. It also specifies the collateral that will secure the loan, which is often the property being financed. This ensures that in case of default, the lender has the right to take possession of the property to recover their investment. There are primarily two types of Collin Texas Loan Agreements for Property: 1. Residential Loan Agreement: This type of agreement is used when the loan is obtained for a residential property, such as a house, condo, or apartment. It includes provisions specific to residential transactions, covering aspects such as homeowner's insurance, property taxes, and maintenance responsibilities. 2. Commercial Loan Agreement: This type of agreement is utilized for loans procured for commercial properties, including office buildings, retail spaces, warehouses, and industrial facilities. Commercial loan agreements often have unique clauses regarding lease agreements, zoning requirements, and the potential for rental income. In Collin County, Texas, these loan agreements must comply with the applicable state and federal laws governing real estate transactions. It is crucial for both borrowers and lenders to consult legal professionals well-versed in Collin County real estate regulations and documentation. Obtaining a Collin Texas Loan Agreement for Property is an important step towards securing a loan for a property in Collin County. Through this legally enforceable contract, borrowers and lenders can establish a clear understanding of their obligations, rights, and protections, minimizing the risk of disputes related to the loan in the future.

Collin Texas Loan Agreement for Property

Description

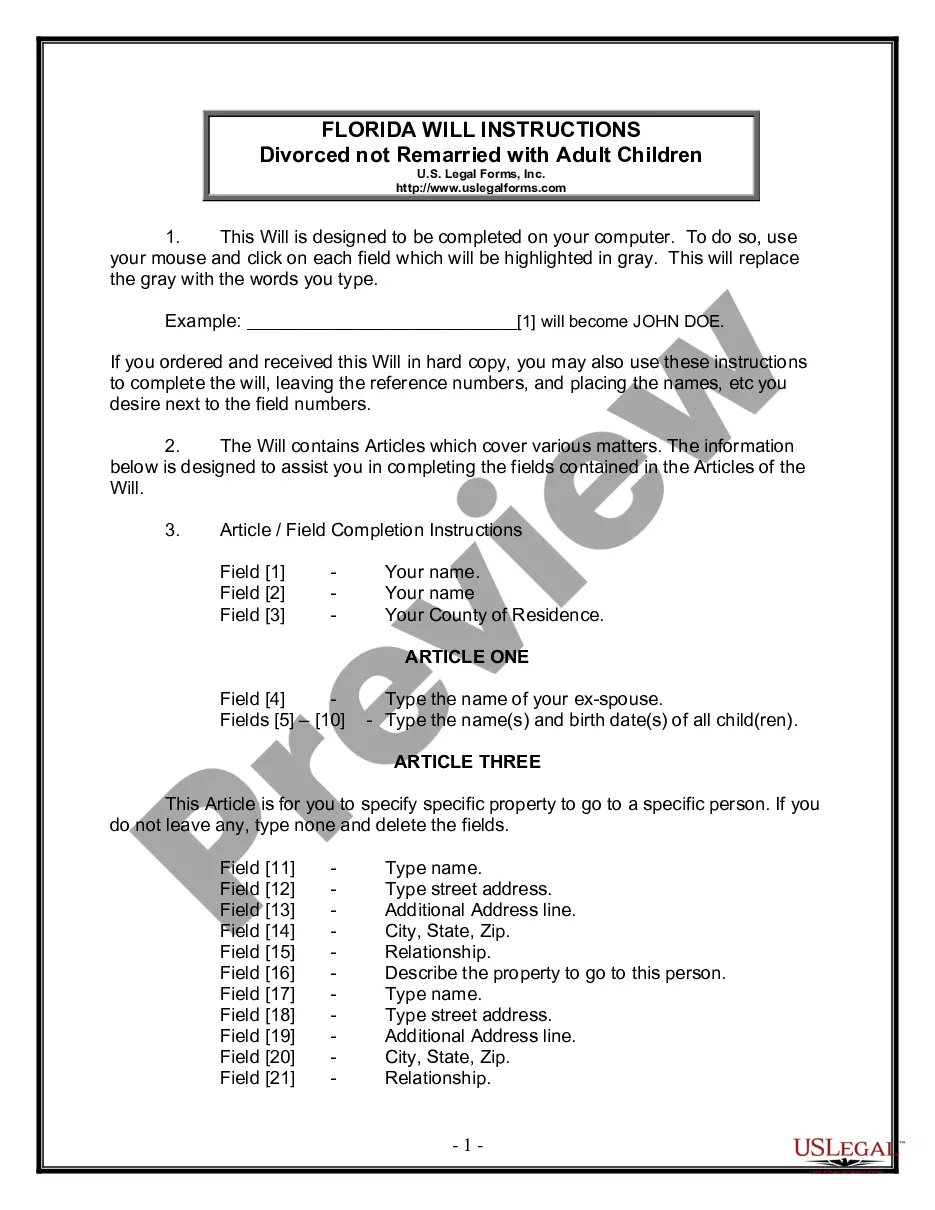

How to fill out Collin Texas Loan Agreement For Property?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Collin Loan Agreement for Property is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Collin Loan Agreement for Property. Follow the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Collin Loan Agreement for Property in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!