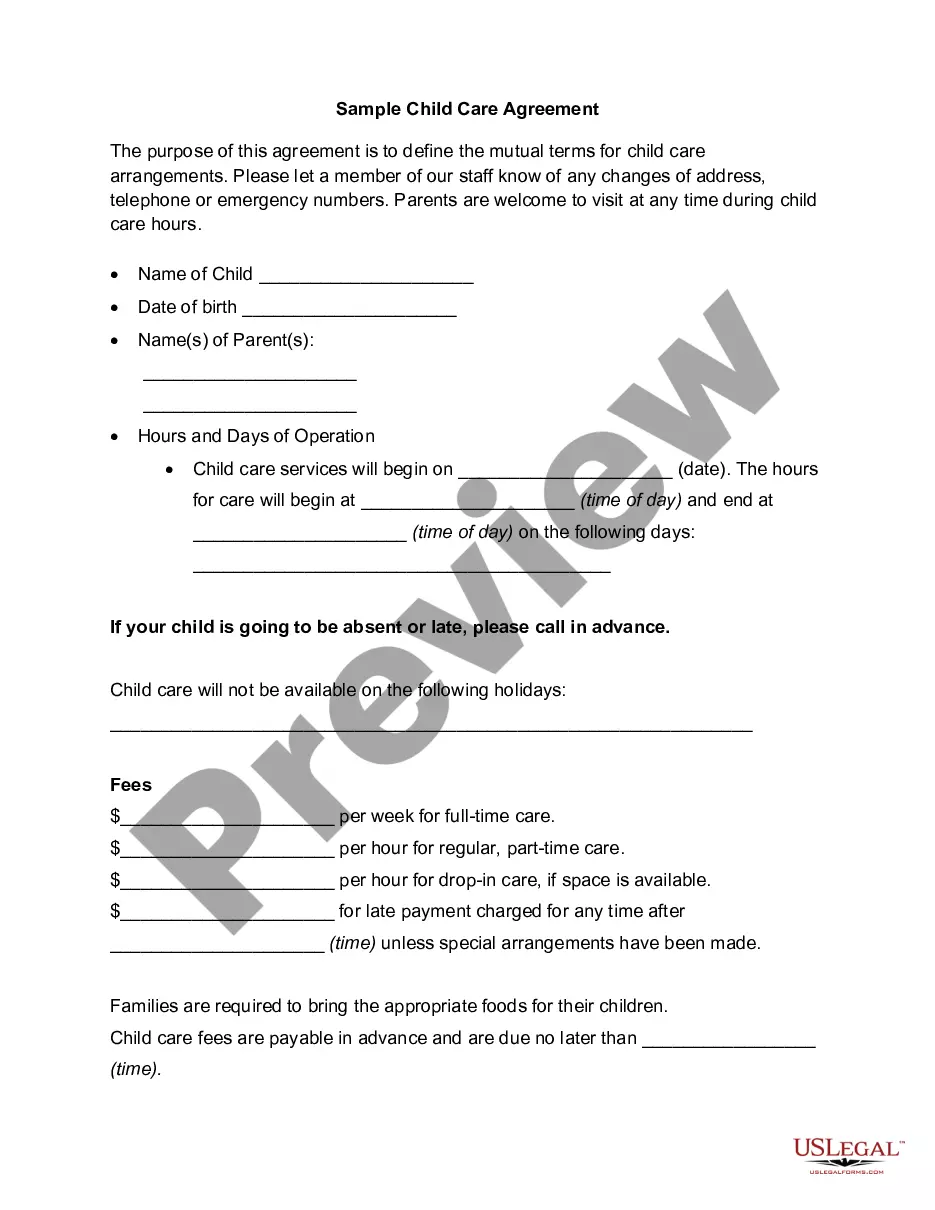

Mecklenburg North Carolina Loan Agreement for Property serves as a legally binding contract between a lender and a borrower in Mecklenburg County, North Carolina. It outlines the terms and conditions under which a loan is provided for the purchase, refinancing, or improvement of a property within the county. This comprehensive agreement ensures that both parties are aware of their rights and obligations in order to protect their interests. The Loan Agreement for Property in Mecklenburg North Carolina typically includes various key elements: 1. Parties involved: The agreement names the lender, who provides the loan, and the borrower, who receives the funds. They are identified by their legal names and addresses. 2. Loan terms: The agreement specifies the loan amount, interest rate, repayment period, and payment schedule. It may also outline any grace period or penalties for late payment or default. 3. Property details: The agreement describes the property being financed, such as its address, legal description, and any associated collateral. This ensures that both parties have a clear understanding of the property involved in the agreement. 4. Security interest: In some cases, the lender may require the borrower to provide additional security, such as a mortgage or deed of trust, for the loan. This helps protect the lender's interest in case of default. 5. Conditions precedent: The agreement may include conditions that must be fulfilled before the loan can be disbursed. For example, the borrower might need to provide certain documentation, such as proof of income or insurance coverage. 6. Representations and warranties: Both parties may make certain representations and warranties regarding their legal capacity, authority, and financial condition to ensure transparency and trust. 7. Event of default: The agreement details the events that would constitute a default by the borrower, such as non-payment or the violation of any terms. It may also outline the consequences of default, such as acceleration of the loan or repossession of the property. Different types of Mecklenburg North Carolina Loan Agreements for Property may exist, depending on the specific purpose or nature of the loan. Some examples include: 1. Mortgage Loan Agreement: This agreement is used when financing the purchase of a property in Mecklenburg County, where the property itself serves as collateral for the loan. 2. Refinance Loan Agreement: This agreement is utilized when replacing an existing loan on a property with a new loan, often at more favorable terms. 3. Construction Loan Agreement: This agreement is employed when financing the construction or renovation of a property in Mecklenburg County. The loan disbursement may be structured in stages based on the progress of the construction. In conclusion, a Mecklenburg North Carolina Loan Agreement for Property is a crucial document that outlines the terms and conditions of a loan involving real estate in Mecklenburg County. It helps ensure clarity, transparency, and protection for both the lender and the borrower.

Mecklenburg North Carolina Loan Agreement for Property

Description

How to fill out Mecklenburg North Carolina Loan Agreement For Property?

Are you looking to quickly draft a legally-binding Mecklenburg Loan Agreement for Property or maybe any other form to handle your own or corporate matters? You can select one of the two options: contact a professional to draft a valid paper for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Mecklenburg Loan Agreement for Property and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, carefully verify if the Mecklenburg Loan Agreement for Property is adapted to your state's or county's laws.

- If the document has a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Mecklenburg Loan Agreement for Property template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!