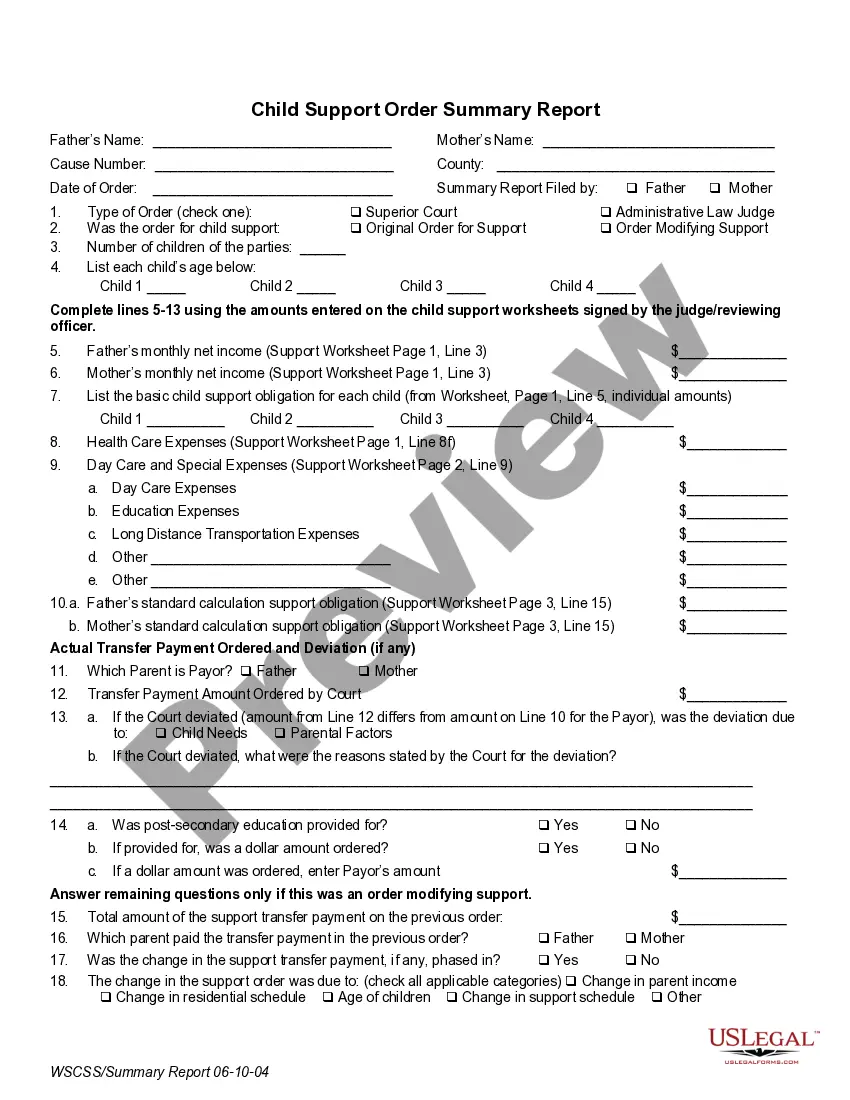

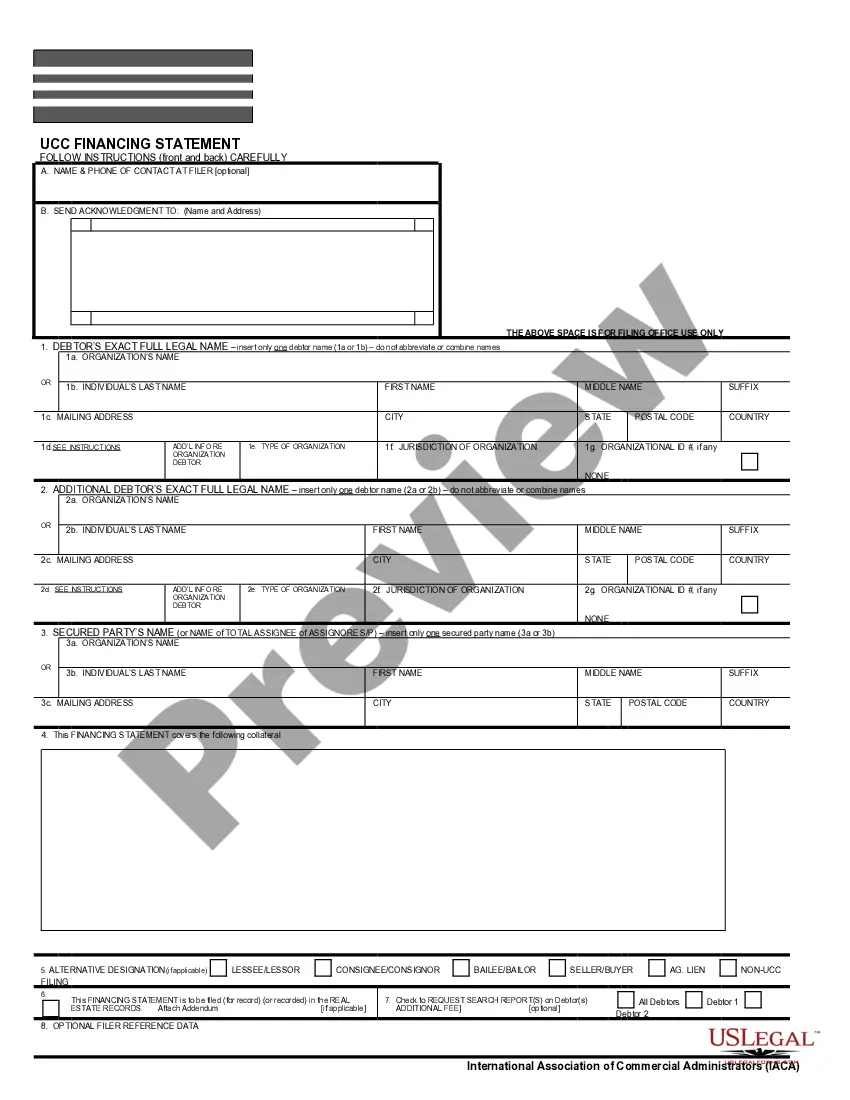

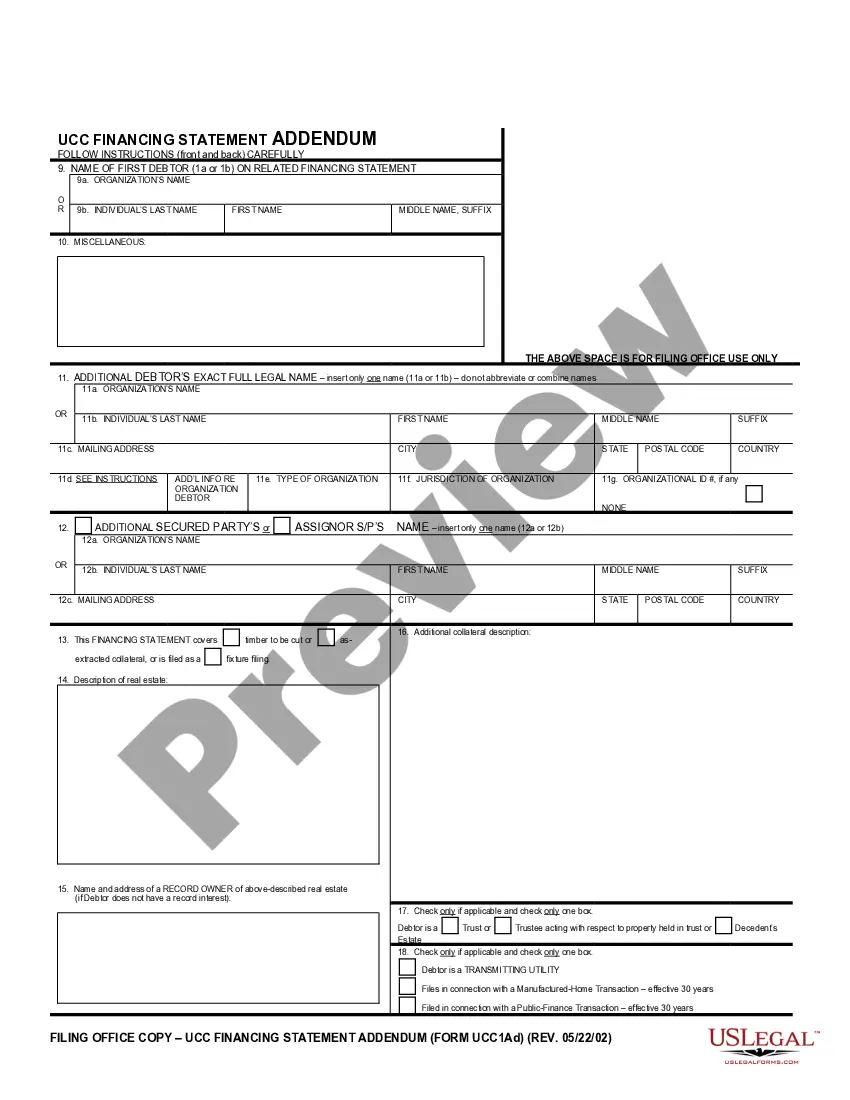

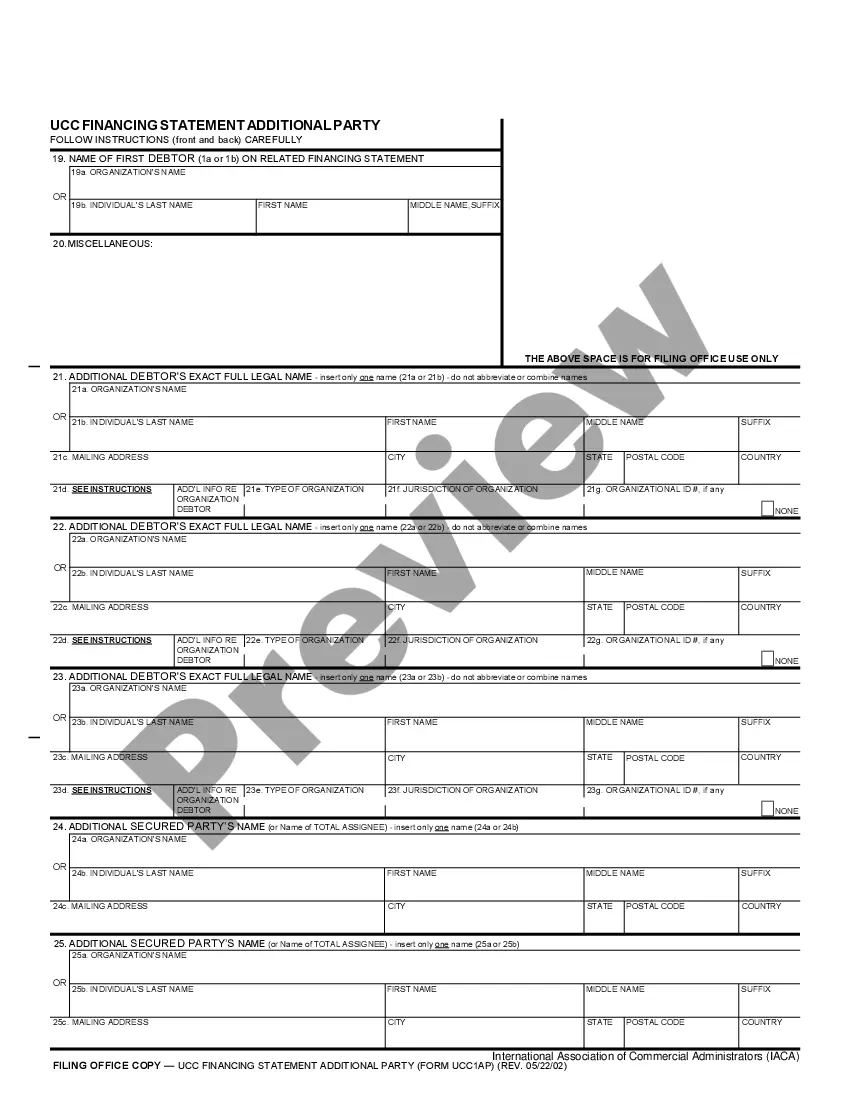

San Diego, California Loan Agreement for Property is a legally binding contract that outlines the terms and conditions between a lender and a borrower when obtaining a loan specifically for property-related purposes within the vibrant city of San Diego. This agreement is designed to protect the rights and interests of both parties involved in the loan transaction. Keywords: San Diego, California, loan agreement, property, terms and conditions, legally binding, lender, borrower, loan transaction. There are several types of Loan Agreements for Property in San Diego, California, each tailored to different property-related financial needs. Here are a few of the most common types: 1. Residential Property Loan Agreement: This type of loan agreement is used when an individual or family seeks financial assistance for purchasing a residential property in San Diego. It lays out the terms of the loan, including loan amount, interest rate, repayment terms, and any additional clauses specific to residential property loans. 2. Commercial Property Loan Agreement: Designed for businesses or individuals looking to acquire commercial real estate in San Diego, this agreement outlines the terms and conditions regarding the financing of commercial properties, such as office buildings, retail spaces, or warehouses. It includes information on the loan amount, interest rate, repayment terms, and any provisions specific to commercial property loans. 3. Construction Loan Agreement: When individuals or businesses plan to construct a property in San Diego, they may require a construction loan to finance the project. This agreement details the terms regarding the disbursement of funds at different stages of construction, along with provisions that ensure the quality and timely completion of the project. 4. Refinance Loan Agreement: San Diego homeowners may choose to refinance their existing property loan to take advantage of better interest rates or to access additional funds. This agreement specifies the terms of the new loan, including the loan amount, refinancing terms, and any other relevant provisions specific to refinancing a property in San Diego. 5. Bridge Loan Agreement: A bridge loan is a temporary financing option used by property owners in San Diego who are in between selling a property and buying a new one. This agreement establishes the terms for the short-term loan, including the amount, interest rate, repayment period, and any specific conditions relating to bridge loans in San Diego. Each Loan Agreement for Property in San Diego, California aims to protect both lenders and borrowers by clearly defining the rights and responsibilities of each party involved. It is recommended that legal advice be sought during the creation or review of these agreements to ensure compliance with relevant state and federal laws.

San Diego California Loan Agreement for Property

Description

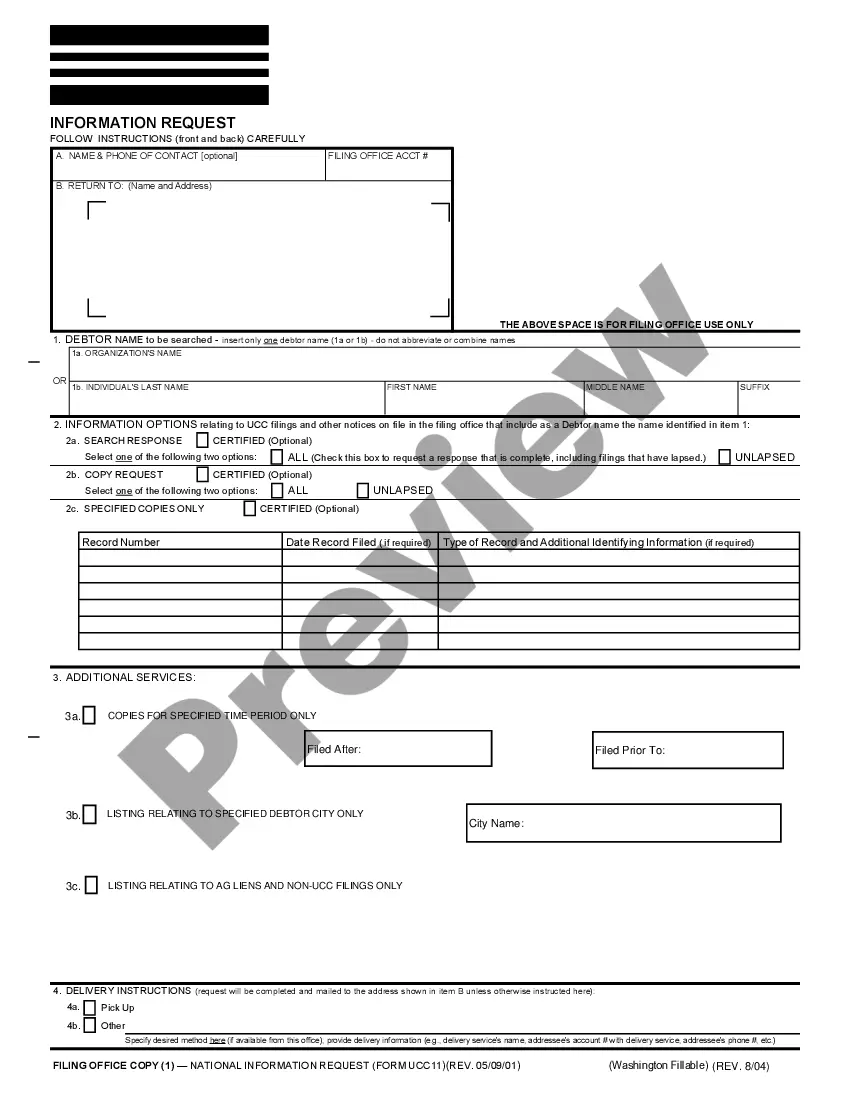

How to fill out San Diego California Loan Agreement For Property?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including San Diego Loan Agreement for Property, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download San Diego Loan Agreement for Property.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Check the related document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase San Diego Loan Agreement for Property.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Loan Agreement for Property, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to deal with an extremely complicated situation, we advise using the services of an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!