Harris Texas Loan Agreement for Business is a legally binding document that outlines the terms and conditions between a lender and a borrower for a business loan in Harris County, Texas. It serves as a written contract to protect both parties involved in the loan transaction. The agreement typically covers important details such as loan amount, interest rate, repayment terms, and any additional terms or conditions. The Harris Texas Loan Agreement for Business is designed to provide clarity and ensure that both the lender and borrower are on the same page regarding the loan terms. It helps establish a framework for the loan transaction, minimizing potential misunderstandings or disputes. There are various types of Harris Texas Loan Agreements for Business, including: 1. Term Loan Agreement: This type of agreement specifies a fixed amount of money that the borrower must repay over a predetermined period, typically with regular payments of principal and interest. 2. Revolving Line of Credit Agreement: Unlike a term loan, a revolving line of credit agreement allows the borrower to access a specific credit limit as needed, repay it, and then borrow again within that limit. This agreement provides flexibility for businesses that require ongoing funding. 3. Secured Loan Agreement: In this type of agreement, the borrower provides collateral, such as real estate or equipment, as security for the loan. If the borrower defaults on the loan, the lender can seize the collateral to recover the outstanding balance. 4. Unsecured Loan Agreement: Unlike a secured loan agreement, an unsecured loan does not require collateral. This type of agreement relies primarily on the borrower's creditworthiness and may have higher interest rates to compensate for the increased risk for the lender. It is important for both lenders and borrowers to carefully review and understand the terms before signing a Harris Texas Loan Agreement for Business. Seeking legal advice is advisable to ensure compliance with local laws and regulations and to protect the interests of both parties involved.

Harris Texas Loan Agreement for Business

Description

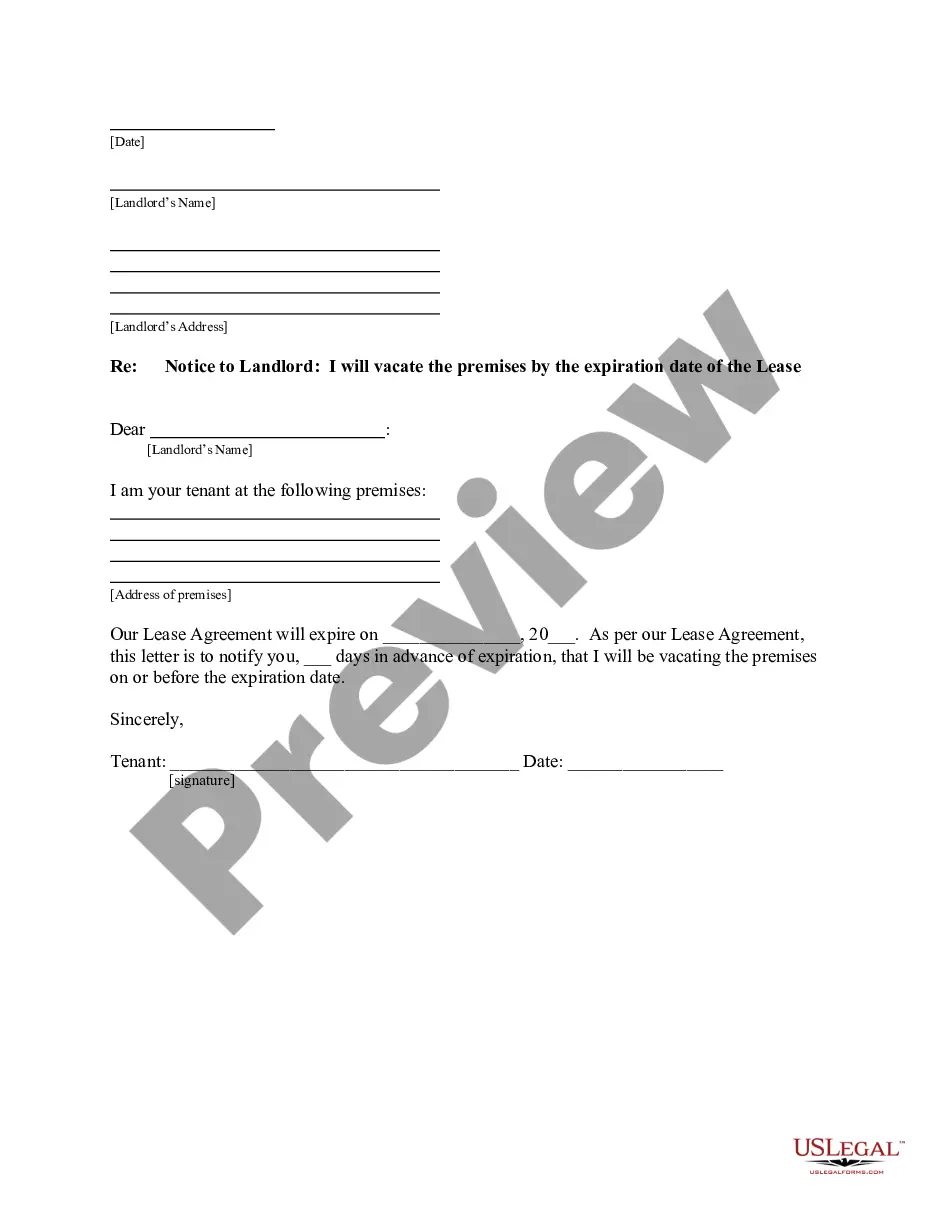

How to fill out Loan Agreement For Business?

Laws and guidelines in each area vary from one state to another.

If you aren't an attorney, it's simple to become confused by the numerous regulations regarding the creation of legal documents.

To evade costly legal help while drafting the Harris Loan Agreement for Business, you require a verified template applicable in your region.

That's the easiest and most cost-effective way to access current templates for any legal requirements. Discover everything effortlessly and maintain your documentation organized with US Legal Forms!

- That's where the US Legal Forms platform proves to be advantageous.

- US Legal Forms is a reliable online repository with over 85,000 state-specific legal templates, trusted by millions.

- It's an ideal option for both professionals and individuals looking for do-it-yourself templates for diverse life and business situations.

- All forms can be reused: when you purchase a document, it remains accessible in your account for future use.

- Thus, if you possess an account with an active subscription, you can simply Log In and re-download the Harris Loan Agreement for Business from the My documents section.

- For new users, several additional steps are necessary to acquire the Harris Loan Agreement for Business.

- Review the page content to confirm you have located the correct document.

- Utilize the Preview feature or check the form description if available.

Form popularity

FAQ

Bank of Montreal. U.S. Holding Company. BMO Financial Corp. President and Chief Executive Officer. BMO Harris Bank N.A.

Their current valuation is $298.80B. BMO Harris Bank's brand is ranked #- in the list of Global Top 1000 Brands, as rated by customers of BMO Harris Bank. Their current market cap is $51.94B....Bank of America vs BMO Harris Bank. 41%Promoters44%Detractors1 more row

BMO Harris Bank N.A. BMO Harris Bank N.A. is part of BMO Financial Group. BMO Financial Group was ranked the 9th largest financial institution in North America based on market capitalization as of June 27, 2011.

BMO Harris Bank has 900 branches in the Midwest....BMO Harris Bank vs Bank of America. BMO Harris BankBank of AmericaBMO Harris BankBank of America40,000+ BMO Harris and Allpoint ATMsApproximately 17,000 ATMsIRA CD41 more rows

BMO acquires Harris Bank, Chicago.

BMO Harris Bank Facts fact titlefact detailParent CompanyBank of MontrealU.S. Holding CompanyBMO Financial Corp.President and Chief Executive Officer BMO Harris Bank N.A.David CasperHeadquarters111 W. Monroe St. Chicago, Illinois 606038 more rows

BMO Harris Bank N.A. is part of BMO Financial Group. BMO Financial Group was ranked the 9th largest financial institution in North America based on market capitalization as of June 27, 2011.

BMO Harris Bank FormerlyN.W. Harris & Co. (18821907) M&I Marshall & Ilsley Bank (18472012) Harris Trust and Savings Bank (19071972) Harris Bank, N.A. (19722005) (Harris Bank name then retired in 2005)OwnerHarris Bankcorp, Inc. (1972-1984) Bank of Montreal (through BMO Financial Group) (1984-present)11 more rows

Start by sign in to BMO Online Banking and: Click Payments & Transfers. Select Make a Transfer. Choose the From and To accounts, and enter the amount, and currency you'd like to transfer.Review the transaction details, and then click Verify Transfer. Click Complete Transfer.

Interesting Questions

More info

Please follow all the instructions on the form and call us as soon as possible to verify. This document is designed to help you access your funding, or you may contact the Houston-Galveston Area Council and Harris County for more information. Borrowers are encouraged to complete a separate Business Credit Request Form. Agency Funding — Agency funding is a type of loan, which can only be received with a Business Application Form Agency Funding has a minimum of a 50,000 maximum loan amounts for a business program. Creditors/Lender Borrowers are not allowed to list a Creditor of their own. The Creditor must be a non-profit 501(c)(3). Lenders will only consider a business application with a Creditor. In order to be considered as business loan recipient, Lenders will require this information from the loan application.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.