Kings New York Loan Agreement for Business is a comprehensive financial document designed to formalize the terms and conditions of lending for businesses in New York. This agreement outlines the necessary details for both lenders and borrowers to ensure a transparent and legally binding transaction. In the realm of business loans, Kings New York offers various types of loan agreements tailored to meet specific financial needs. These agreements include: 1. Business Term Loan Agreement: This agreement establishes the terms and conditions for a fixed-term loan, where the borrower receives a lump sum of money and repays it over a specified period. The interest rate, repayment schedule, and any additional fees are outlined in this agreement. 2. Line of Credit Agreement: This type of loan agreement grants the borrower continuous access to a predetermined credit limit. This agreement specifies the terms of the revolving credit arrangement, including interest rates, repayment terms, and any collateral requirements. 3. Equipment Financing Agreement: Kings New York offers this agreement for businesses seeking to acquire equipment or machinery. The agreement specifies the loan amount, interest rate, repayment structure, and any associated collateral. 4. Small Business Administration (SBA) Loan Agreement: As an approved lender for SBA loans, Kings New York extends this agreement to facilitate financing eligible businesses under the SBA program. This agreement outlines the terms, rates, and criteria set by the Small Business Administration. Kings New York Loan Agreement for Business covers crucial aspects, including loan amount, interest rates, repayment terms, collateral requirements, default consequences, and any additional fees. It also defines the rights and responsibilities of both the lender and the borrower, ensuring a fair and transparent lending relationship. The loan agreement serves as a legally binding contract, protecting the interests of all parties involved. It provides a framework for the lender to recover the loan if the borrower defaults, including foreclosure or other legal actions. Additionally, it safeguards the borrower by ensuring clear terms and protection against any potential lender misconduct. It is important for both lenders and borrowers to carefully review and understand the terms outlined in Kings New York Loan Agreement for Business before signing. Seeking legal counsel is advisable to ensure compliance with New York state laws and regulations, as well as to negotiate favorable terms. In summary, Kings New York Loan Agreement for Business offers a range of loan agreements designed to meet the diverse financial needs of businesses. Whether it's a term loan, line of credit, equipment financing, or an SBA loan, these agreements provide a clear framework for lenders and borrowers to engage in a secure and mutually beneficial lending relationship.

Kings New York Loan Agreement for Business

Description

How to fill out Kings New York Loan Agreement For Business?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Kings Loan Agreement for Business, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Kings Loan Agreement for Business from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Kings Loan Agreement for Business:

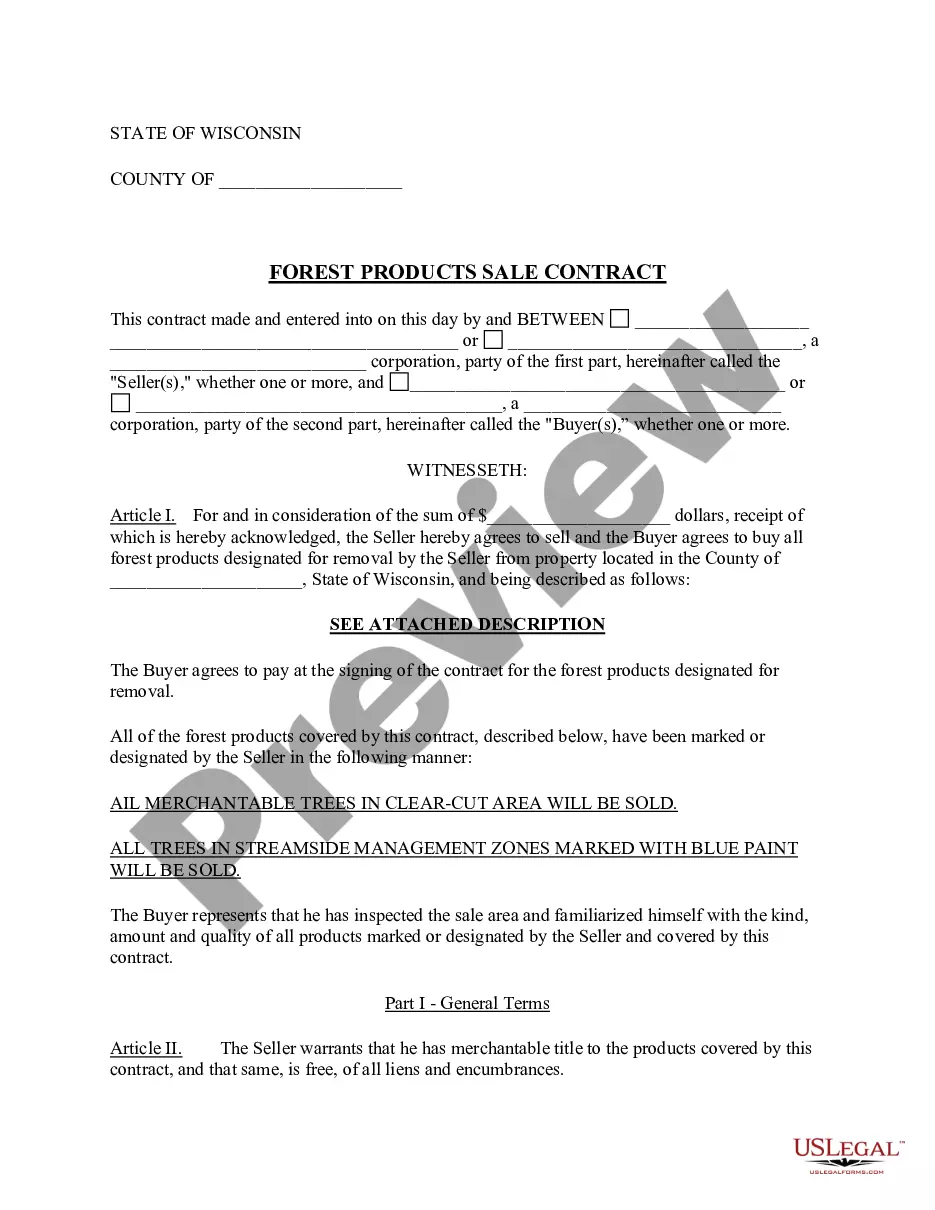

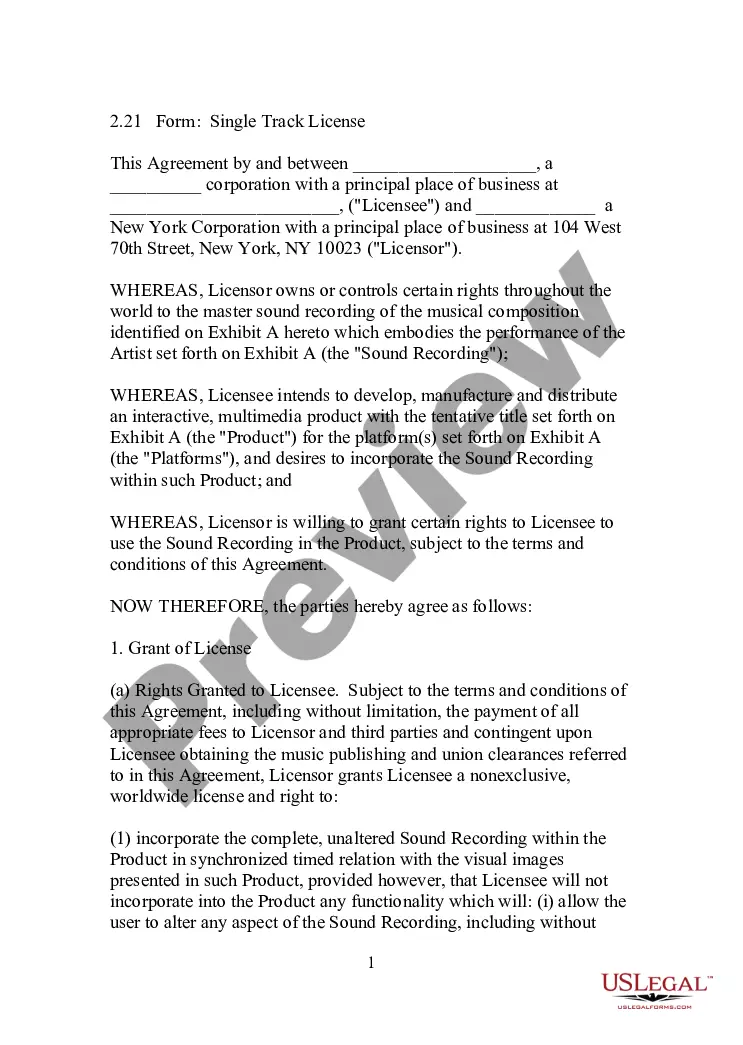

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!