Nassau New York Loan Agreement for Business is a legally binding contract that outlines the terms and conditions of a loan arrangement between a lender and a borrower situated in Nassau, New York. This agreement serves as a crucial document that protects the rights and interests of both parties involved in the transaction. Here, we will delve into the key aspects of this agreement and touch upon the various types it can entail. The Nassau New York Loan Agreement for Business typically begins with an introductory section where the parties involved are identified. This includes providing the legal names and addresses of the lender and borrower. It is essential to note that the lender may be an individual, a financial institution, or even a government agency. Following the introductory section, the agreement details the specific loan terms. This section outlines the loan amount, interest rate, repayment schedule, and any additional charges or penalties that might be applicable. Moreover, it may mention the purpose of the loan, such as for business expansion, working capital, equipment purchase, or real estate investment. Another crucial aspect of the Nassau New York Loan Agreement for Business is collateral. The agreement typically specifies whether the loan is secured or unsecured. A secured loan involves collateral, which can be any valuable asset that the borrower pledges to hand over to the lender in the case of default. Unsecured loans, on the other hand, do not require collateral but often involve higher interest rates to mitigate the risk. Additionally, the agreement may contain provisions related to default and remedies available in such a scenario. It lays out the consequences of non-payment or breach of the agreed-upon terms and conditions, which could include penalties, legal actions, or the acceleration of the loan, leading to immediate payment obligation. If the Nassau New York Loan Agreement for Business is specifically tailored to a particular industry or purpose, it may be categorized accordingly. Examples of such specialized loan agreements could include construction loans, equipment financing loans, working capital loans, or debt consolidation loans. It is crucial to note that every loan agreement should be carefully reviewed by legal professionals to ensure compliance with state and federal laws and to address any specific requirements or circumstances unique to the borrower or lender. In summary, the Nassau New York Loan Agreement for Business is an essential legal document that outlines the terms and conditions of a loan between a lender and a borrower located in Nassau, New York. It covers critical aspects such as loan terms, collateral, default provisions, and remedies. Different types of this agreement can exist, depending on the specific industry or purpose of the loan. Legal guidance is crucial to ensure the agreement's accuracy, compliance, and protection of the rights of both parties involved.

Nassau New York Loan Agreement for Business

Description

How to fill out Nassau New York Loan Agreement For Business?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

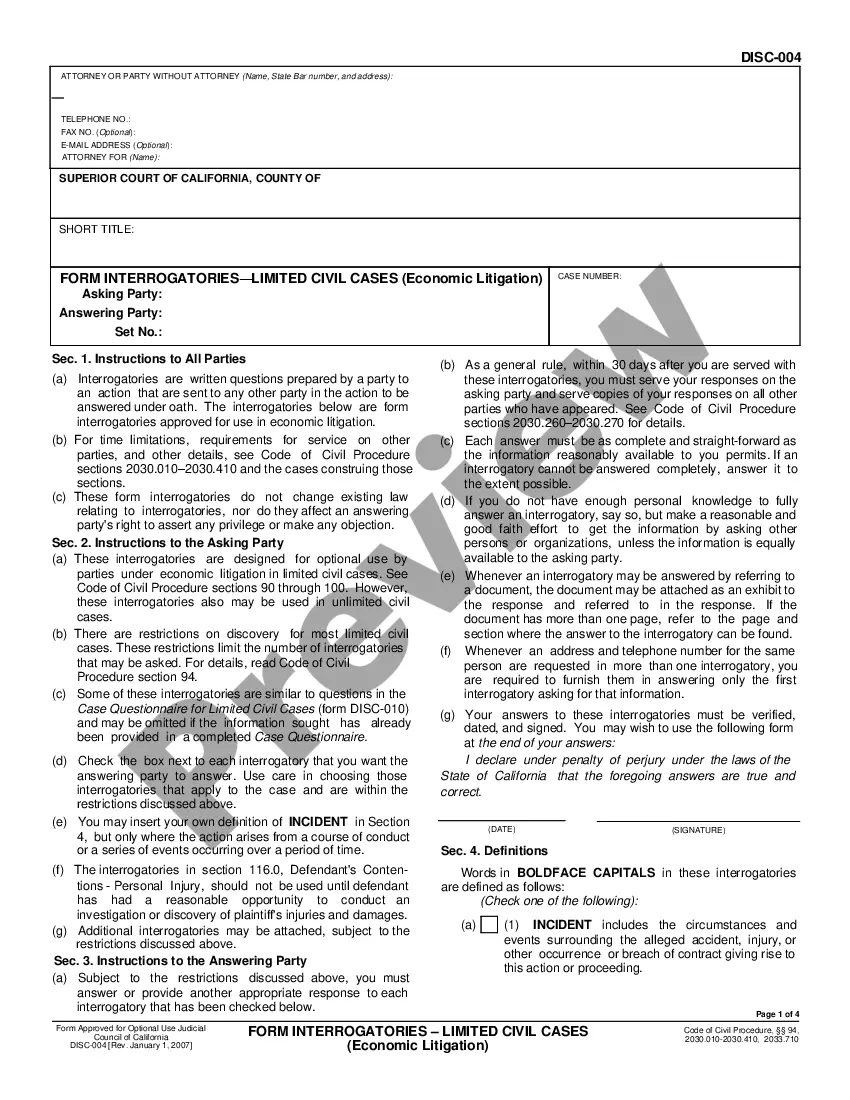

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Nassau Loan Agreement for Business.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Nassau Loan Agreement for Business will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Nassau Loan Agreement for Business:

- Make sure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Nassau Loan Agreement for Business on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Generally, people consult loans lawyers to draft loan contracts. However, you can write your own loan contract using free templates and guidance. It is still advisable to consult a lawyer who understands the national, state and local laws that would apply.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to Write a Loan Agreement Step 1 Loan Amount, Borrower, and Lender.Step 2 Payment.Step 3 Interest.Step 4 Expenses.Step 5 Governing Law.Step 6 Signing.

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause:#2: 'Default' Definition Clause:#3: Security Cover Clause:#4: Disbursement Clause:#5: Force Majeure Clause:#6: Reset Clause:#7: Prepayment Clause:#8: Other Balances Set Off Clause:

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A business loan agreement typically includes a promissory note stating the amount you agree to borrow, and the term and interest rate at which you must pay the money back. The promissory note is essentially your promise to pay back the funds you borrow.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

The Borrower hereto, requiring money, has requested the Lender to give her a with interest loan of Rs.The said loan is required by the Borrower for a period of one year, commencing from (Starting date) and terminating on (End date). The Borrower hereby agrees and undertakes to return the loan of Rs.