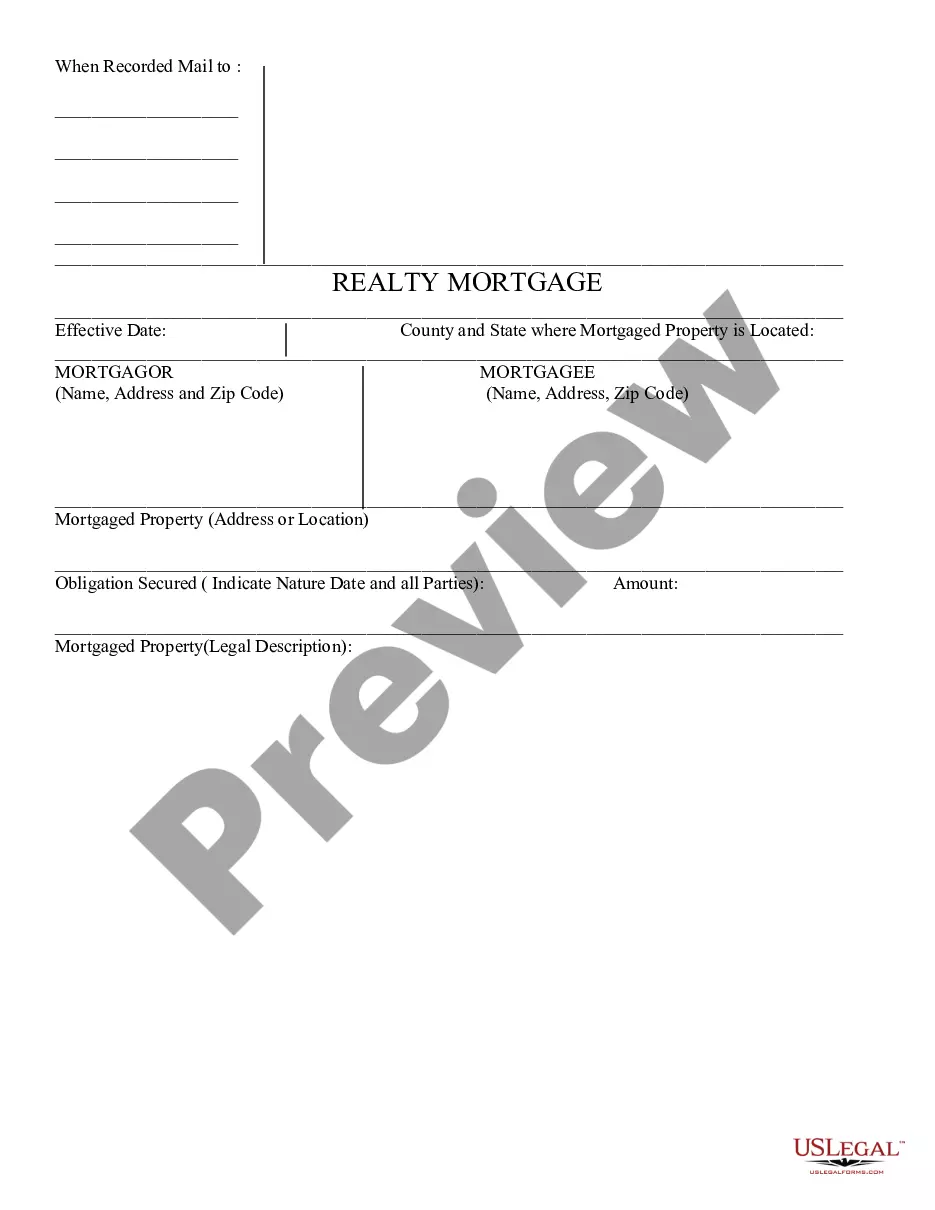

Maricopa, Arizona Loan Agreement: A Comprehensive Overview with Relevant Keywords Introduction: A Maricopa, Arizona Loan Agreement is a legally binding contract between a lender and a borrower within the Maricopa area, specifying the terms and conditions associated with a loan. This agreement outlines the details of the loan, such as the amount borrowed, interest rates, repayment schedule, and any collateral involved. Maricopa, Arizona, being a prominent city within Pinal County, has various types of loan agreements catered to meet different financial needs. Let's delve deeper into some of these loan agreements: 1. Personal Loan Agreement: A personal loan agreement in Maricopa, Arizona, is an arrangement wherein an individual obtains funds from a lender to fulfill personal financial requirements. It is often an unsecured loan, meaning it does not require collateral. This type of loan agreement is typically used for debt consolidation, medical expenses, or other personal expenses. 2. Mortgage Loan Agreement: A mortgage loan agreement is designed specifically for individuals in Maricopa, Arizona, who intend to finance the purchase of real estate properties. This agreement outlines the terms and conditions, including the loan amount, interest rate, repayment schedule, and the rights and responsibilities of both the borrower and the lender. Mortgages are secured loans, often using the property as collateral. 3. Auto Loan Agreement: An auto loan agreement is applicable for Maricopa, Arizona residents seeking financing to purchase a vehicle. This agreement specifies the loan amount, interest rate, repayment plan, and any other relevant conditions. The vehicle itself serves as collateral until the loan is fully repaid. 4. Business Loan Agreement: Maricopa, Arizona also offers a business loan agreement designed for entrepreneurs, startups, or established businesses in need of financial support. This loan agreement defines the terms under which funds will be provided, repayment conditions, interest rates, and any necessary collateral requirements. Business loan agreements may be secured or unsecured, depending on the lender's policies. 5. Student Loan Agreement: As in any other region, Maricopa, Arizona facilitates a student loan agreement, allowing individuals to finance their education expenses. This agreement encompasses the loan amount, interest rate, repayment schedule, and various other terms and conditions. Student loan agreements are often deferred until after the borrower completes their education or reaches a certain income threshold. Conclusion: In Maricopa, Arizona, loan agreements play a vital role in facilitating financial transactions by establishing clear terms and conditions between lenders and borrowers. Whether it's a personal loan, mortgage loan, auto loan, business loan, or student loan, the relevant loan agreements provide essential documentation and protection for all parties involved. Understanding these loan agreement options can help potential borrowers make informed decisions when seeking financial assistance in Maricopa, Arizona.

Maricopa Arizona Loan Agreement

Description

How to fill out Maricopa Arizona Loan Agreement?

Preparing papers for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Maricopa Loan Agreement without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Maricopa Loan Agreement by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Maricopa Loan Agreement:

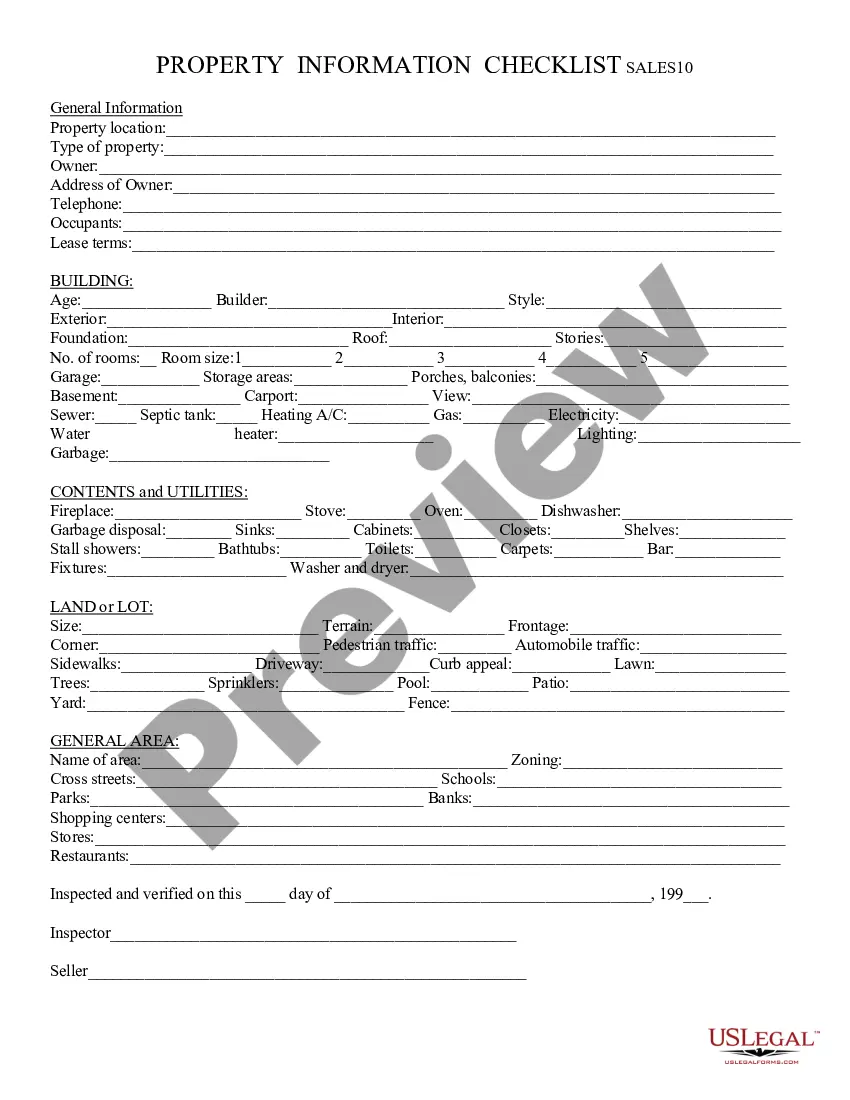

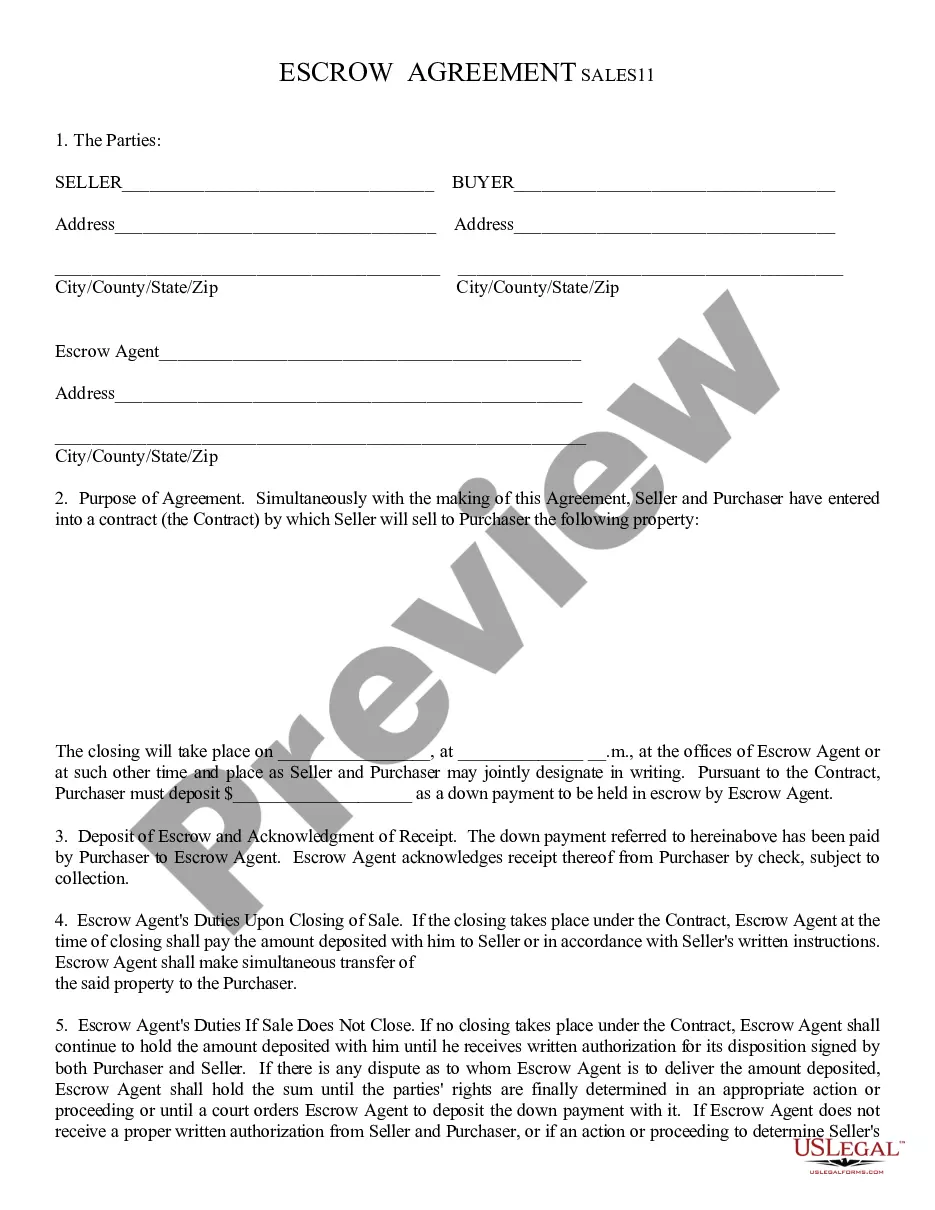

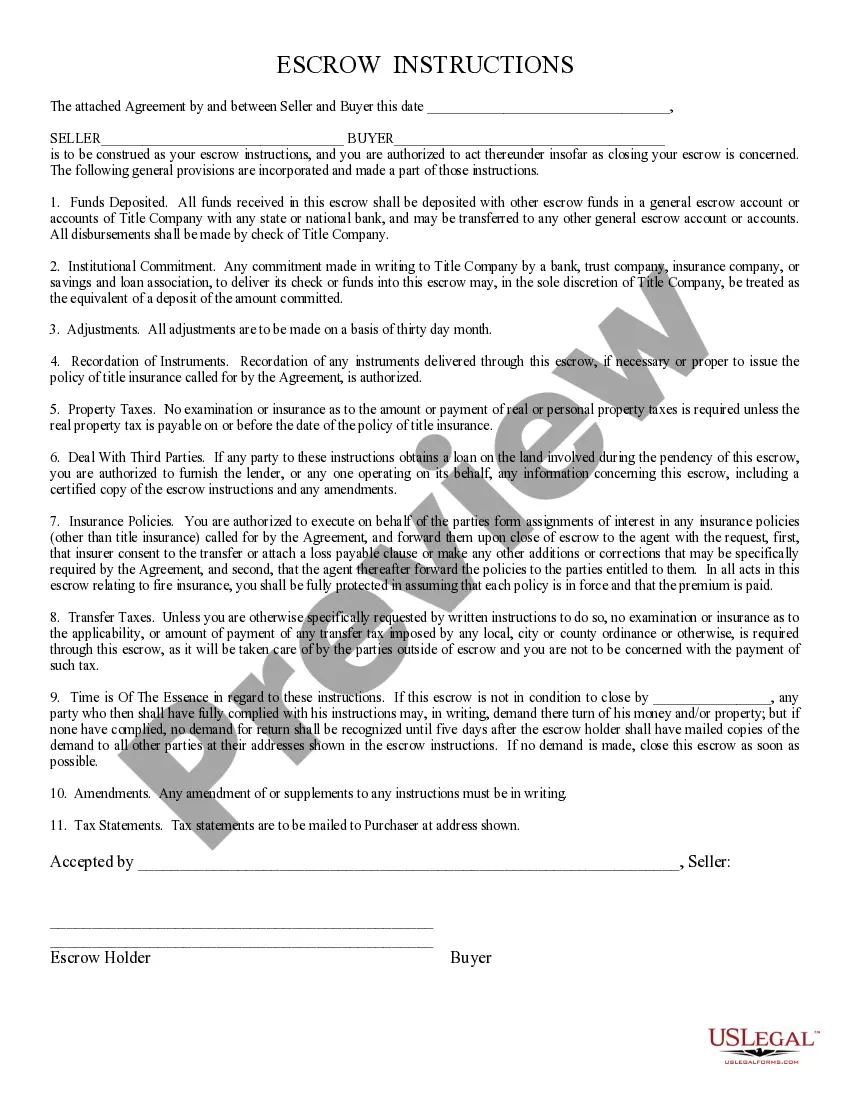

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!