Middlesex Massachusetts Loan Agreement is a legally binding contract that outlines the terms and conditions between a lender and a borrower in Middlesex County, Massachusetts. This agreement is crucial in protecting the rights and obligations of both parties involved in a loan transaction. The Middlesex Massachusetts Loan Agreement typically includes various key elements such as the loan amount, interest rate, repayment schedule, late payment penalties, collateral, and any additional fees or charges. It clearly defines the responsibilities of the lender and borrower and reduces the chances of any misunderstandings or disputes arising during the loan period. There are different types of Middlesex Massachusetts Loan Agreements, each catering to specific lending scenarios. Some of these loan agreements include: 1. Personal Loan Agreement: This type of agreement is entered into when an individual borrows money from a lender for personal purposes, such as debt consolidation, home renovations, education, or other personal expenses. 2. Business Loan Agreement: This involves a loan provided by a lender to a business entity for various purposes, including starting a new business, expanding operations, purchasing assets, or meeting short-term financial needs. 3. Mortgage Loan Agreement: This agreement is specific to real estate transactions, where the borrower seeks financial assistance from the lender to acquire a property. The property itself serves as collateral, allowing the lender to foreclose on the property in case of default. 4. Student Loan Agreement: Primarily aimed at students pursuing higher education, this agreement enables them to finance their tuition fees, books, accommodation, and other educational expenses. Regardless of the loan type, Middlesex Massachusetts Loan Agreement ensures a transparent and fair relationship between the lender and the borrower. It protects the rights and interests of both parties involved, making it essential to carefully review and understand all the terms and conditions before signing the agreement. Professional legal advice is recommended to ensure compliance with state and federal laws and to avoid potential legal complications in the future.

Middlesex Massachusetts Loan Agreement

Description

How to fill out Middlesex Massachusetts Loan Agreement?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Middlesex Loan Agreement.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Middlesex Loan Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Middlesex Loan Agreement:

- Ensure you have opened the correct page with your regional form.

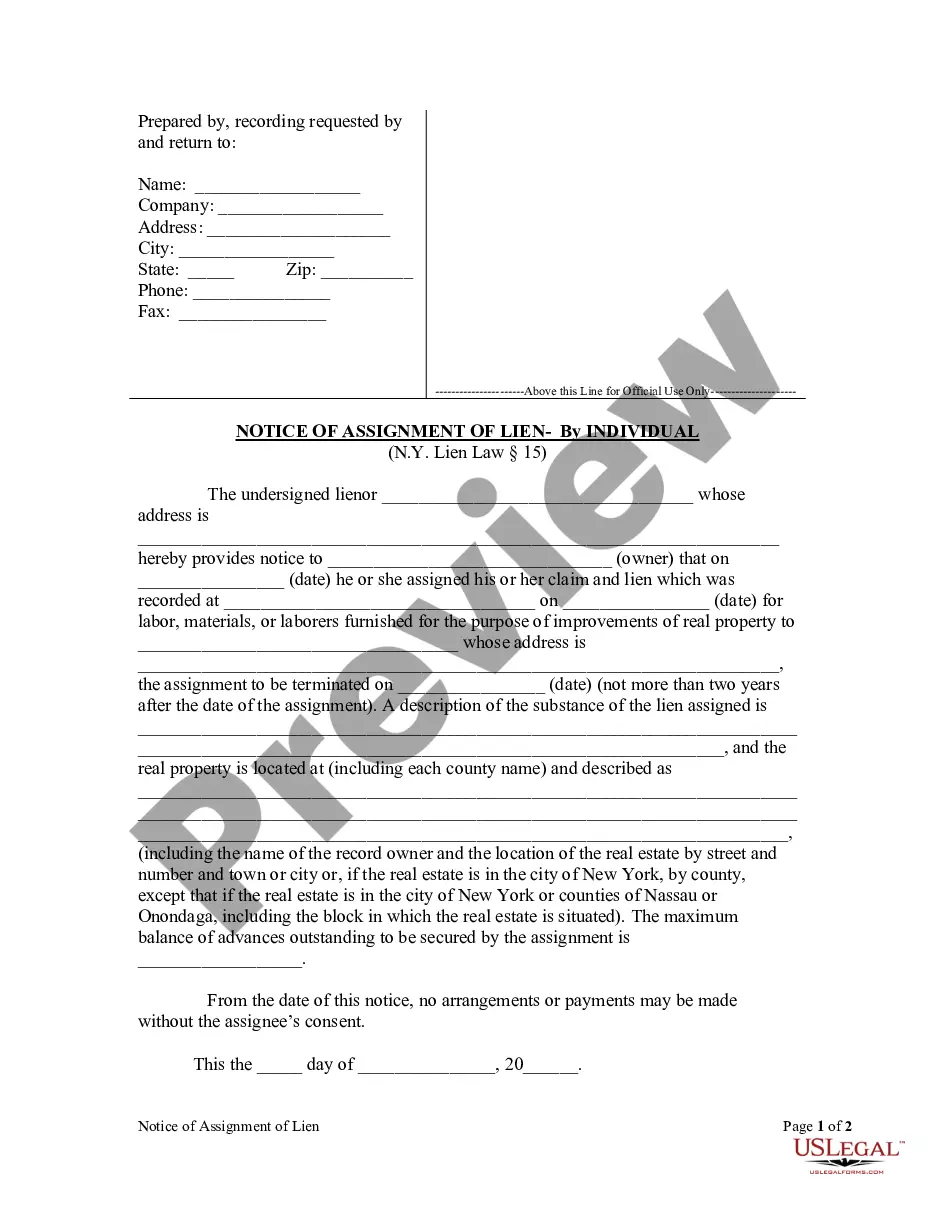

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Middlesex Loan Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!