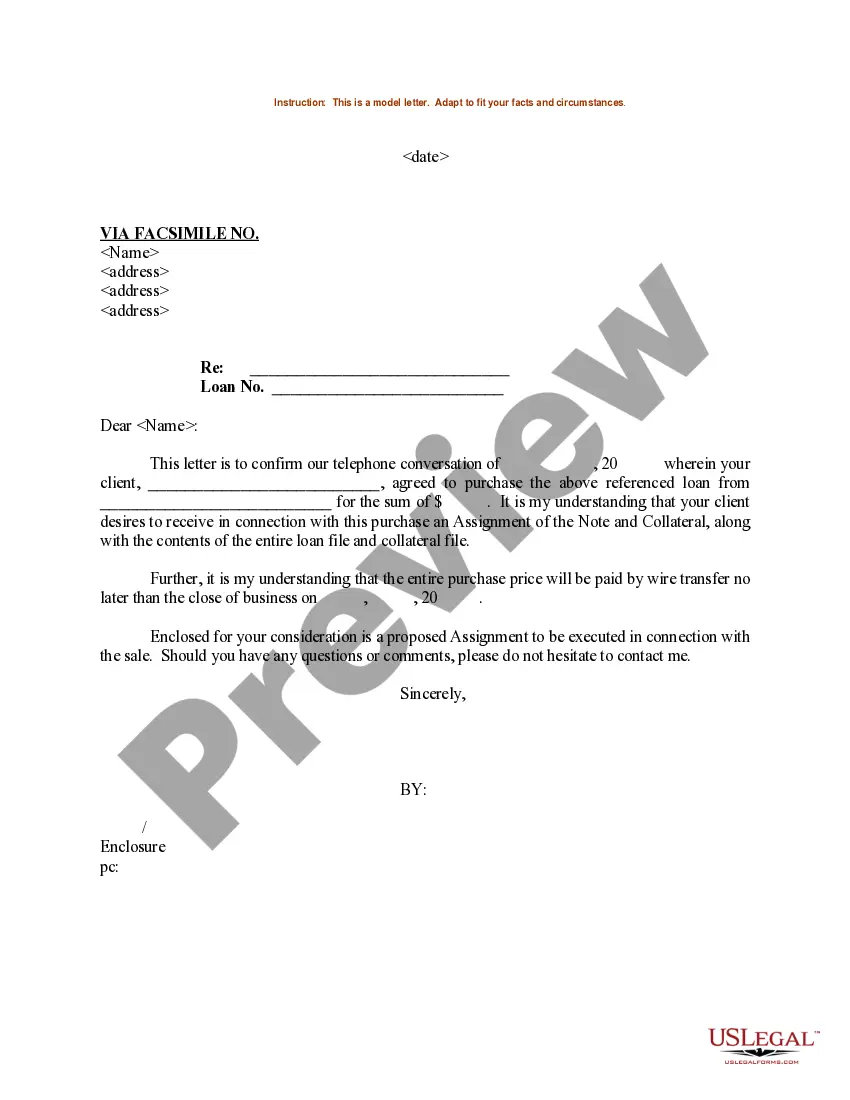

The Wake North Carolina Loan Agreement is a legally-binding contract between a lender and a borrower, specifically relevant to residents, businesses, or organizations in the Wake County area of North Carolina. This agreement outlines the terms and conditions under which a loan is extended, borrowed, and repaid. It is an essential document that ensures clarity and protects the interests of both parties involved. Keywords: Wake North Carolina, Loan Agreement, legally-binding, lender, borrower, residents, businesses, organizations, terms and conditions, extended, borrowed, repaid, clarity, protects, interests There can be various types of Wake North Carolina Loan Agreements, depending on the specific requirements and purposes. Some of these loan agreements are: 1. Personal Loan Agreement: This type of loan agreement is typically used by individuals who need financial assistance for personal reasons such as education, medical expenses, debt consolidation, or home renovations. 2. Business Loan Agreement: Designed specifically for business owners, this type of loan agreement helps entrepreneurs secure funding for business-related purposes, such as expansion, inventory purchase, or operational expenses. 3. Mortgage Loan Agreement: This agreement is prevalent for individuals or families seeking financing to purchase a property in the Wake North Carolina area. It outlines the terms of the loan, including interest rates, repayment schedule, and collateral information. 4. Student Loan Agreement: This type of loan agreement is aimed at students seeking financial assistance to fund their education. It specifies the terms of the loan, including interest rates, repayment options, and any applicable grace periods. 5. Vehicle Loan Agreement: This agreement is commonly used when an individual or business intends to purchase a vehicle. It includes details about the loan amount, interest rates, repayment terms, and conditions related to vehicle ownership. 6. Small Business Administration (SBA) Loan Agreement: This loan agreement is facilitated by government-backed SBA programs to support small businesses in Wake North Carolina. It outlines the terms and conditions for the loan, such as loan amount, interest rates, and repayment schedule. Keywords: Personal Loan Agreement, Business Loan Agreement, Mortgage Loan Agreement, Student Loan Agreement, Vehicle Loan Agreement, Small Business Administration Loan Agreement, government-backed, SBA programs, loan amount, interest rates, repayment schedule.

Wake North Carolina Loan Agreement

Description

How to fill out Wake North Carolina Loan Agreement?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Wake Loan Agreement meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Wake Loan Agreement, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Wake Loan Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wake Loan Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

You must notify your lender in writing that you are cancelling the loan contract and exercising your right to rescind. You may use the form provided to you by your lender or a letter. You can't rescind just by calling or visiting the lender.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Loan agreements are beneficial for borrowers and lenders for many reasons. Namely, this legally binding agreement protects both of their interests if one party fails to honor the agreement. Aside from that, a loan agreement helps a lender because it: Legally enforces a borrower's promise to pay back the money owed.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

Call the lender and explain that you would like to cancel the loan contract, disown the item it financed (car or house) and be relieved of any future obligations. Give your reasons and see if the lender is willing to work with you.

Breach or Default If a loan contract is paid off late, the loan is considered in default. The borrower can be liable for a myriad of potential legal damages to compensate the lender for any losses suffered.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Writing a Friend or Family Personal Loan Agreement: What You Need to Know Step 1: Beginning the Document. The first step is the easiest, but it's one that you can't forget.Step 2: Write the Terms of the Loan.Step 3: Date the Document.Step 4: Statement of Agreement.Step 5: Signatures.Step 6: Record the Document.

Loan agreements are beneficial for borrowers and lenders for many reasons. Namely, this legally binding agreement protects both of their interests if one party fails to honor the agreement. Aside from that, a loan agreement helps a lender because it: Legally enforces a borrower's promise to pay back the money owed.

A loan agreement does not require a notary signature. The purpose of a notary seal is to provide evidence that the signature is genuinely the signature of the person signing.