Kings New York Subrogation Agreement between Insurer and Insured is a legal contract that outlines the rights and responsibilities of both parties in the event of an insurance claim. This agreement is crucial in cases where the insured party has suffered a loss or damage and seeks to recover the losses incurred from a third party responsible for the incident. The primary purpose of the Kings New York Subrogation Agreement is to grant the insurer the right to initiate legal action and pursue reimbursement from the responsible party on behalf of the insured. By signing this agreement, the insured transfers their rights of recovery to the insurer, allowing them to act as the insured's legal representative in any subrogation claims. This agreement includes various important provisions and clauses such as the scope and limitations of subrogation, procedures for filing claims, identification and notification of potential responsible parties, and the allocation of recovered amounts between the insurer and insured. These provisions ensure that both parties understand their rights and obligations throughout the claims process, minimizing any potential disputes or confusion. There can be different types of Kings New York Subrogation Agreements between an insurer and an insured, depending on the specific circumstances and insurance policies involved. Some common types of subrogation agreements include: 1. Property Subrogation Agreement: This type of agreement is applicable when there is damage or loss to property covered under an insurance policy. It allows the insurer to recover the costs incurred in repairing or replacing the damaged property from the responsible party. 2. Auto Subrogation Agreement: In cases of auto insurance, this subrogation agreement applies when the insured's vehicle is damaged due to the negligence of another driver. The insurer may seek reimbursement for the costs of repairs or the vehicle's total value from the responsible driver or their insurance company. 3. Workers' Compensation Subrogation Agreement: This agreement is related to workers' compensation insurance claims. If an employee is injured while working, and a third party is liable for the accident, the insurer can pursue subrogation to recover the compensation paid to the insured worker. In conclusion, the Kings New York Subrogation Agreement between Insurer and Insured is a vital legal tool that allows insurers to protect their interests while assisting insured parties in recovering losses. It serves to establish clear guidelines and procedures for subrogation claims and ensures both parties are aware of their rights and obligations in the event of an insurance claim.

Kings New York Subrogation Agreement between Insurer and Insured

Description

How to fill out Kings New York Subrogation Agreement Between Insurer And Insured?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Kings Subrogation Agreement between Insurer and Insured, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Kings Subrogation Agreement between Insurer and Insured, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Kings Subrogation Agreement between Insurer and Insured:

- Look through the page and verify there is a sample for your area.

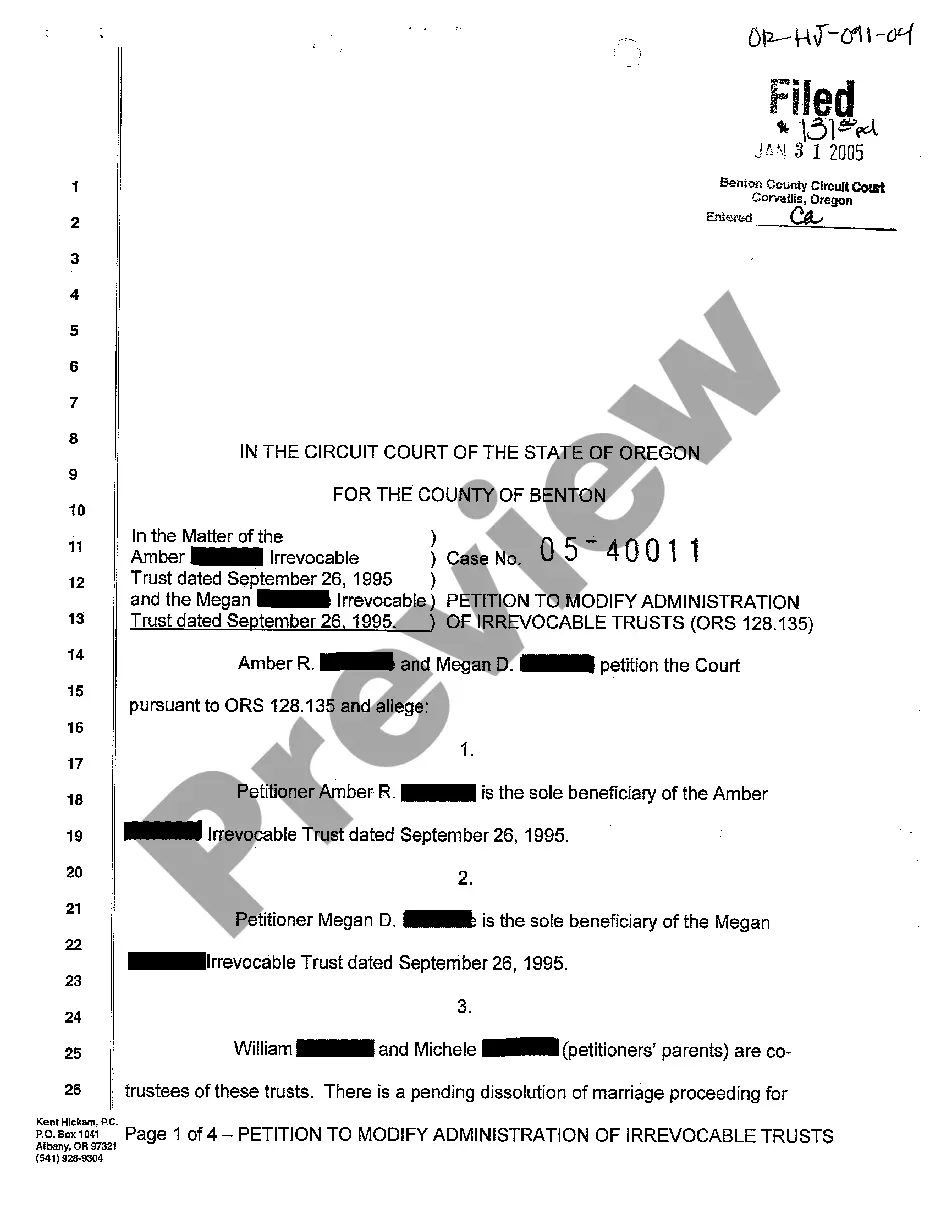

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Kings Subrogation Agreement between Insurer and Insured and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!