Oakland County, Michigan, is a vibrant region located in the southeastern part of the state. It is home to various cities and townships, including but not limited to Waterford, Troy, Rochester, and Birmingham. Known for its dynamic blend of urban centers, suburban neighborhoods, and natural landscapes, Oakland County offers a high quality of life for its residents. When it comes to the insurance industry, a subrogation agreement between an insurer and insured in Oakland County, Michigan, is a legal contract that outlines the rights and responsibilities of both parties in case of a claim or loss. Subrogation refers to the process where an insurance provider steps into the shoes of the policyholder to recover costs or damages from a third party responsible for the loss. Keywords: Oakland County, Michigan, subrogation agreement, insurer, insured, insurance industry, legal contract, claim, loss, rights, responsibilities, recovery, costs, damages, third party. There may be different types of subrogation agreements based on the specific insurance policies, such as: 1. Auto Insurance Subrogation Agreement: This agreement is designed to handle subrogation claims related to automobile accidents. It allows the insurer to pursue reimbursement from the at-fault party or their insurance company for the costs incurred in repairing the insured vehicle or compensating for injuries. 2. Property Insurance Subrogation Agreement: This type of agreement is utilized in cases involving property damage, such as fire, theft, or natural disasters. It outlines the insurer's right to recover the paid-out claim amount from responsible third parties, such as negligent contractors or manufacturers. 3. Health Insurance Subrogation Agreement: Health insurance providers often enter into subrogation agreements with their insured individuals. In situations where the insured person sustains injuries due to someone else's negligence, the agreement allows the insurer to surrogate or recover costs from the liable party's insurance or settlement. 4. Workers' Compensation Subrogation Agreement: When an employee is injured on the job due to a third party's negligence, the insurer responsible for workers' compensation benefits may establish a subrogation agreement. It enables the insurer to seek reimbursement from the third party responsible for the injury. 5. Subrogation Agreement in Commercial Insurance: This type of subrogation agreement applies to various insurance policies that protect businesses, such as general liability, professional liability, or product liability. It allows the insurer to recover costs from responsible parties in case of a covered loss. In summary, a subrogation agreement between an insurer and insured in Oakland County, Michigan, is a legally binding document that details the rights and responsibilities of both parties when it comes to claims and losses. Different types of subrogation agreements include auto insurance, property insurance, health insurance, workers' compensation, and commercial insurance.

Oakland Michigan Subrogation Agreement between Insurer and Insured

Description

How to fill out Oakland Michigan Subrogation Agreement Between Insurer And Insured?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Oakland Subrogation Agreement between Insurer and Insured, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks related to paperwork execution straightforward.

Here's how to locate and download Oakland Subrogation Agreement between Insurer and Insured.

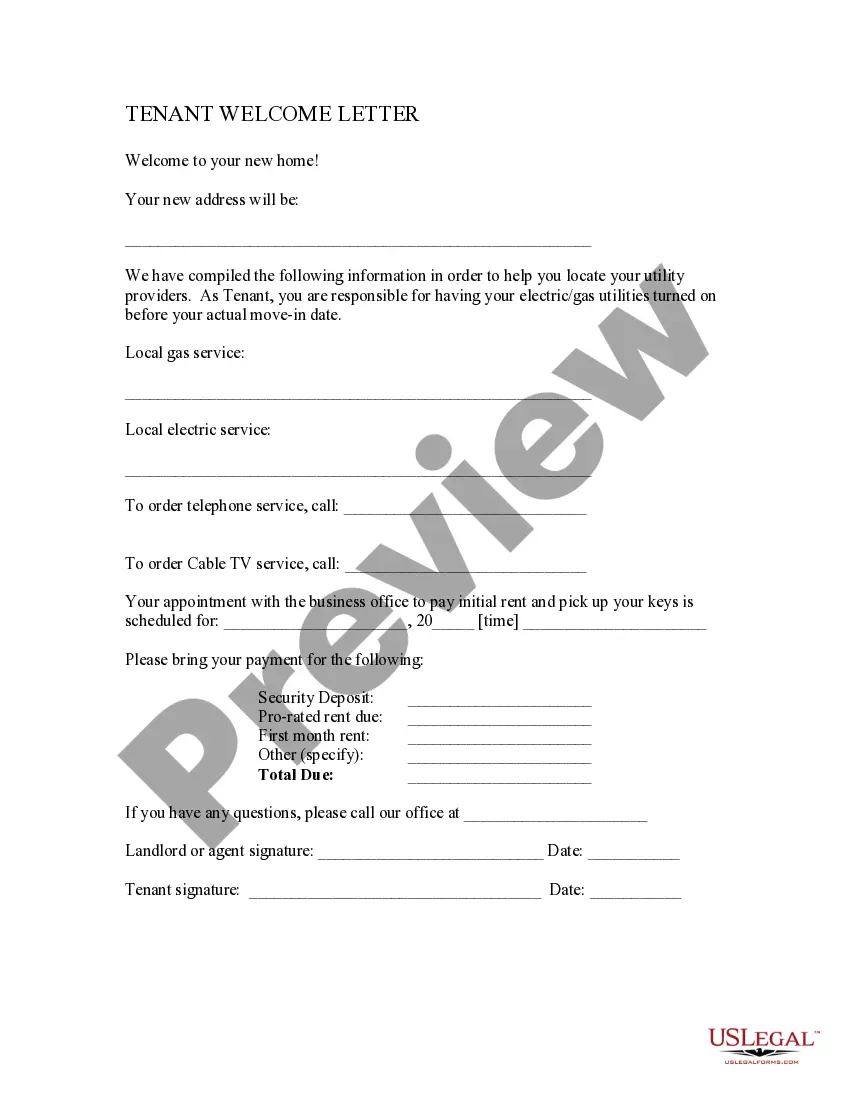

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the related document templates or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Oakland Subrogation Agreement between Insurer and Insured.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Oakland Subrogation Agreement between Insurer and Insured, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you have to cope with an extremely difficult situation, we recommend using the services of a lawyer to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!