Allegheny Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name: Explained In Allegheny, Pennsylvania, a subrogation agreement is a legal contract that allows an insurance company to bring legal action on behalf of an insured party, commonly referred to as the insured's name. Subrogation is a legal principle that grants the insurer the right to pursue a claim against a third party who is responsible for the insured's damages or losses. This agreement empowers the insurer to act on behalf of the insured, seeking compensation for losses incurred under the insurance policy. There are several types of Allegheny Pennsylvania Subrogation Agreements Authorizing Insurer to Bring Action in Insured's Name. Let's explore some of them: 1. Property Insurance Subrogation Agreement: This type of agreement is commonly used when a property or its contents are damaged or destroyed due to the negligence or fault of a third party. In such cases, the insurer steps into the shoes of the insured and pursues legal action against the responsible party to recover the cost of repairs or replacement. 2. Auto Insurance Subrogation Agreement: This agreement comes into play when there is an accident involving a vehicle insured under an auto insurance policy. If the insured is not at fault, the insurance company can initiate a subrogation claim against the party responsible for the accident. This allows the insurer to seek reimbursement for the damages paid out to the insured. 3. Workers' Compensation Subrogation Agreement: In cases where an insured individual is injured at their workplace due to the negligence of a third party, the insurer providing workers' compensation coverage can pursue subrogation. This enables the insurance company to recover the amount paid in benefits from the responsible party. 4. Health Insurance Subrogation Agreement: In situations where a person sustains injuries or requires medical treatment due to someone else's actions, but has health insurance coverage, the insurer can establish a subrogation agreement. This allows the company to bring an action against the at-fault party to recover the medical costs paid on behalf of the insured. By entering into a subrogation agreement, Allegheny, Pennsylvania insurance companies ensure that they can act swiftly on behalf of their policyholders. This legal mechanism not only protects the rights of the insured but also safeguards the insurance company's financial interests. It enables insurers to seek reimbursement from responsible parties, minimizing financial burdens on the insured and maintaining the integrity of the insurance system. It is important for both insurers and insured individuals in Allegheny, Pennsylvania to understand the implications and potential benefits of a subrogation agreement. By familiarizing themselves with the different types of subrogation agreements that can be authorized in the insured's name, parties involved can protect their rights and ensure fair compensation for damages and losses.

Allegheny Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Allegheny Pennsylvania Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

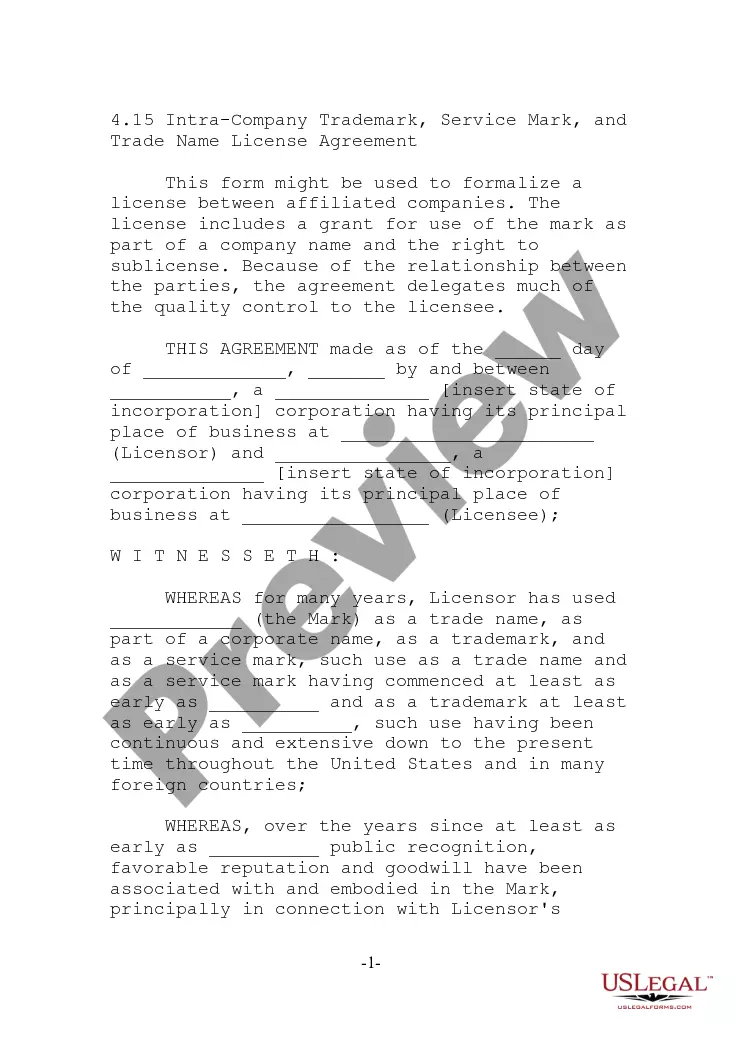

Preparing papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Allegheny Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name without professional help.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Allegheny Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Allegheny Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

What's an Example of Subrogation? An example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

An example of subrogation is when a car insurance company pays out a claim to a policyholder before fault is determined and then attempts to recover their costs from the other driver. Subrogation is the legal process by which insurers receive compensation from an at-fault party.

A subrogation claim allows the innocent paying party, also known as a "collateral source," to stand in the shoes of the injured party. The collateral source asserting a subrogation claim will not be entitled to greater legal rights than those possessed by the person who was entitled to receive the initial benefits.

A waiver of subrogation clause is placed in a contract to minimize lawsuits and claims among the parties. The result is that the risk of loss is agreed among the parties to lie with the insurers, and the cost of the insurance coverage is contractually allocated among the parties as they may agree.

As a general rule, an insurer does not have a right of subrogation or indemnification against its own insured. More specifically, an insurer has no right of subrogation against its own insured for claims arising from the very risk for which the insured was covered.

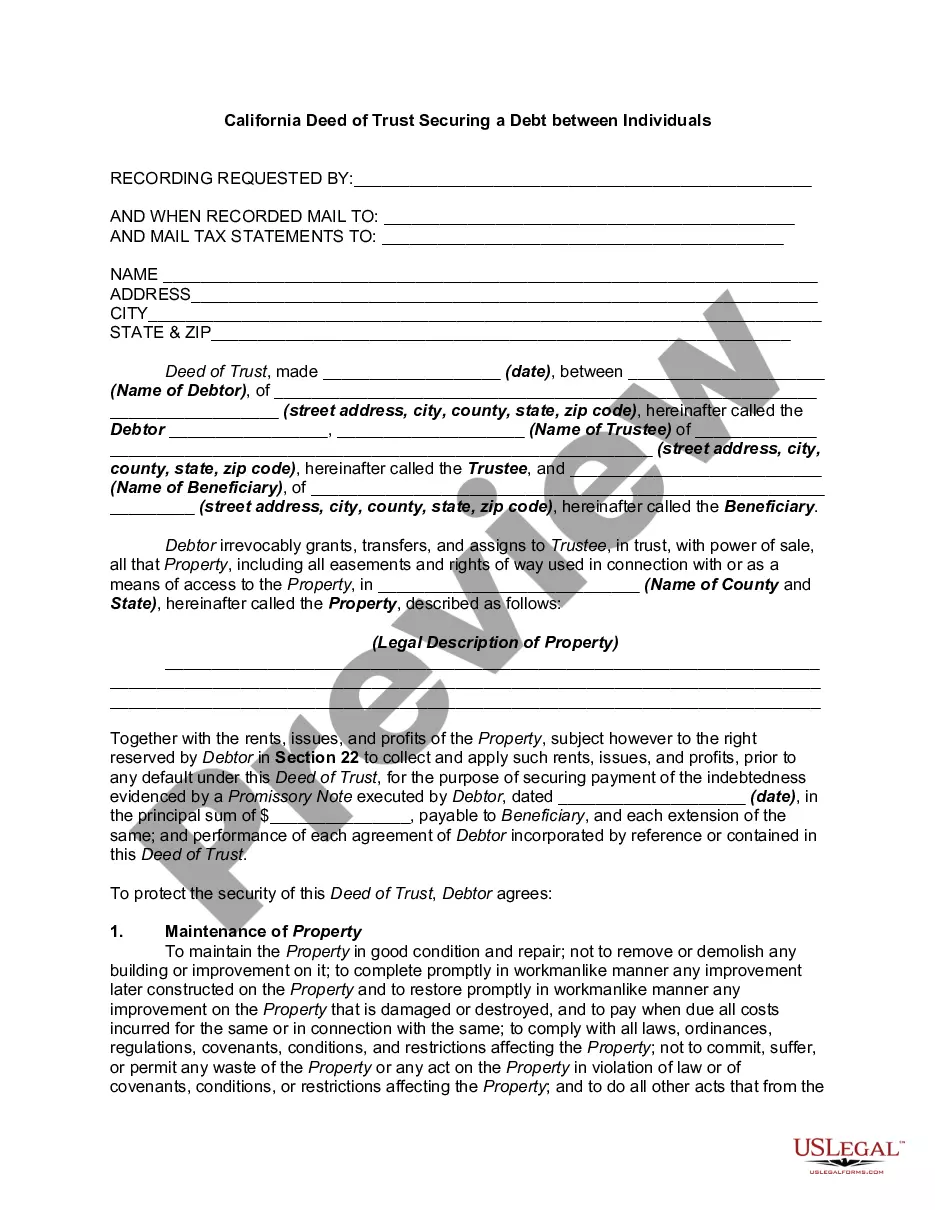

Subrogation Clause Defined Subrogation clauses are used in the real estate industry and insurance industry and allows insurance companies to follow a lawful claim against a third party that caused damages to the insured. They fall under the common law legal system if a dispute over indemnity or enforceability occurs.

An example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

When one party takes on the legal rights of another, especially substituting one creditor for another. Subrogation can also occur when one party takes over another's right to sue.

The doctrine of subrogation provides that if an insurer pays a loss to its insured due to the wrongful act of another, the insurer is subrogated to the rights of the insured and may prosecute a suit against the wrongdoer for recovery of its outlay.

Interesting Questions

More info

In federal court for the Southern District of New York. To enforce a contract provision in an arbitration agreement. In an arbitration agreement or an employment contract that is enforceable as a non-monetary remedy. In federal court for the Middle District of Pennsylvania. In state court or in a federal court where the non-monetary remedy in a federal court case cannot be obtained. To remedy a non-monetary breach of a contract. In state court or in federal court. 1920.14 — Unlawful Assumption of Authority. Unlawful assumption of authority applies only in situations where the employer's decision to accept or reject a qualified employee is based on a non-monetary remedy not available through arbitration. See Example 210(a). Action: To recover money lost due to an employer's decision that a qualified employee isn't suitable. In federal court. To obtain relief for an arbitration agreement, an arbitration procedure, or non-monetary relief.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.