A Dallas Texas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name is a legal document that outlines the terms and conditions under which an insurance company can bring legal action in the name of the insured party to recover damages or losses. This agreement enables the insurer to seek compensation from a third party who may be responsible for causing the insured's damages. In Dallas, Texas, there are several types of Subrogation Agreements Authorizing Insurer to Bring Action in Insured's Name, including: 1. Property Subrogation Agreement: This type of agreement is commonly used in cases where an individual's property has been damaged due to the actions or negligence of a third party. The insurer, on behalf of the insured, can file a lawsuit to recover the costs of repairs or replacement. 2. Personal Injury Subrogation Agreement: In situations where an insured person suffers bodily injury due to someone else's fault, the insurer can pursue legal action in the insured's name to seek compensation for medical expenses, pain and suffering, and lost wages. 3. Automobile Subrogation Agreement: When an insured individual's vehicle is involved in an accident caused by another driver, the insurer can bring legal action against the at-fault driver to recover the costs associated with repair, medical bills, and any other damages incurred by the insured. These different types of Subrogation Agreements allow insurance companies to protect their financial interests by ensuring that any losses they cover on behalf of their insured are recovered from the party responsible. By enabling insurers to bring legal action in the insured's name, these agreements simplify the process and help streamline the recovery of funds. In conclusion, a Dallas Texas Subrogation Agreement Authorizing Insurer to Bring Action in the Insured's Name is a crucial legal document that allows insurance companies to seek compensation on behalf of their insured parties. The agreement varies depending on the type of damage or loss being claimed, such as property damage, personal injury, or automobile accidents. These agreements serve as powerful tools for insurance companies to recoup the expenses they have paid out and protect their clients' interests.

Dallas Texas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Dallas Texas Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

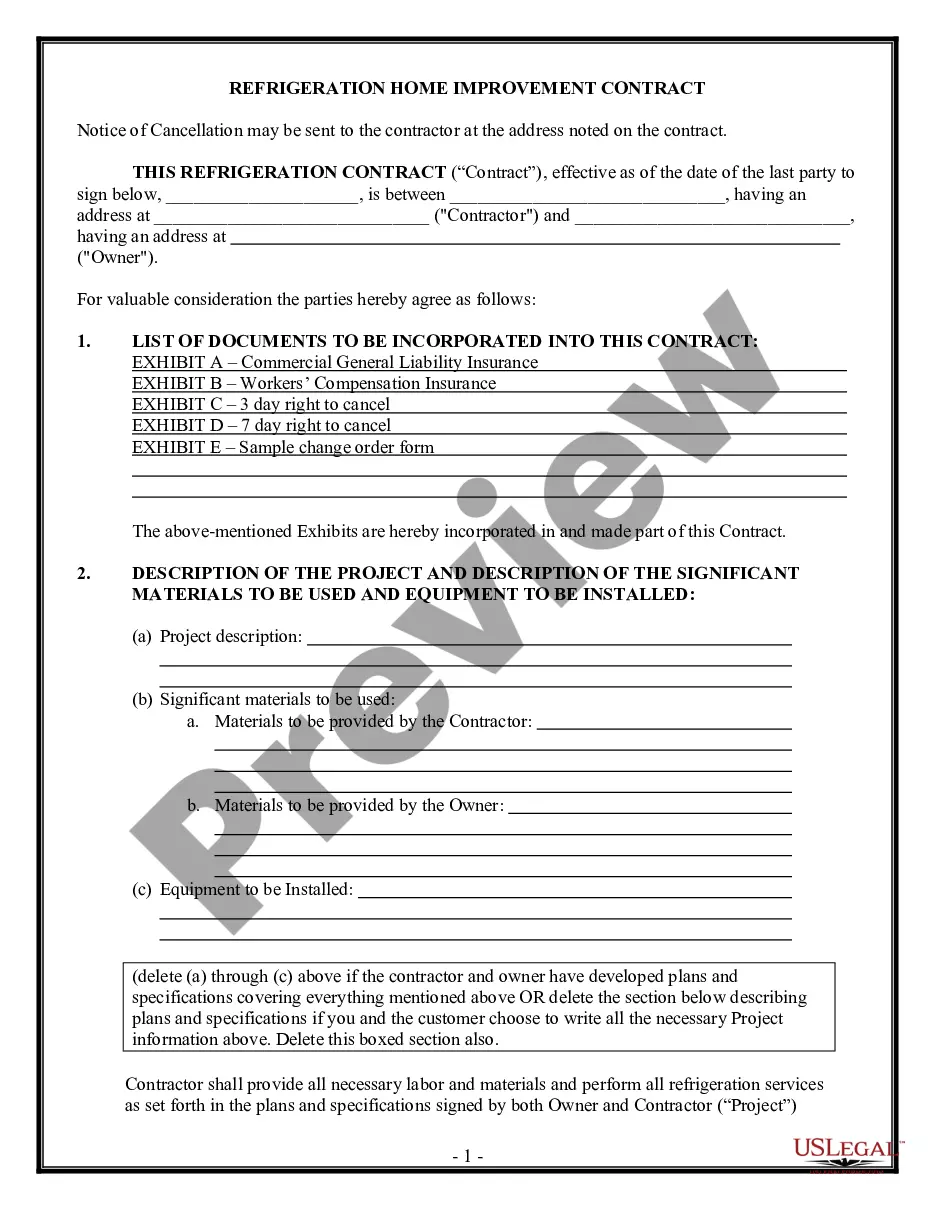

Are you looking to quickly draft a legally-binding Dallas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name or probably any other form to take control of your personal or corporate matters? You can select one of the two options: hire a professional to draft a valid paper for you or draft it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Dallas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, carefully verify if the Dallas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name is tailored to your state's or county's laws.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were looking for by using the search bar in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Dallas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the documents we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!