A Houston Texas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name is a legal document that grants the insurance company the right to pursue a legal claim or lawsuit on behalf of the insured party. This agreement allows the insurer to "stand in the shoes" of the insured and seek reimbursement or compensation from a third party who may have caused damage or harm to the insured. The purpose of this agreement is to protect the interests of the insurance company while ensuring the insured receives proper compensation. There are various types of Houston Texas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name, including: 1. Property Damage: This type of agreement is typically utilized in cases where an insured party's property has been damaged due to the negligence or actions of a third party. The insurer may pursue legal action to recover the costs of repairing or replacing the damaged property. 2. Personal Injury: In cases involving bodily injury or harm to an insured party, such as in car accidents or slip and fall incidents, the insurance company may enter into a subrogation agreement to take legal action against the responsible party. This allows the insurer to seek reimbursement for medical expenses, lost wages, and other associated damages. 3. Workers' Compensation: When an employee is injured on the job, the insurance company providing workers' compensation coverage may need to recover the costs of medical treatment, disability benefits, or other compensation paid to the injured worker. A subrogation agreement enables the insurer to pursue legal action against third parties whose actions may have caused the workplace injury. 4. Health Insurance: Subrogation agreements are also common in health insurance claims. If an insured party sustains injuries due to the fault of another party, such as in a car accident or medical malpractice incident, the health insurance company may seek reimbursement for the medical expenses they have covered. The Houston Texas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name is a crucial legal tool that allows insurance companies to protect their financial interests while enabling the insured party to receive proper compensation. It is important for both insurers and insured individuals to understand the terms and conditions of such an agreement and seek professional legal advice before entering into one.

Houston Texas Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Houston Texas Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

Drafting paperwork for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Houston Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Houston Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Houston Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name:

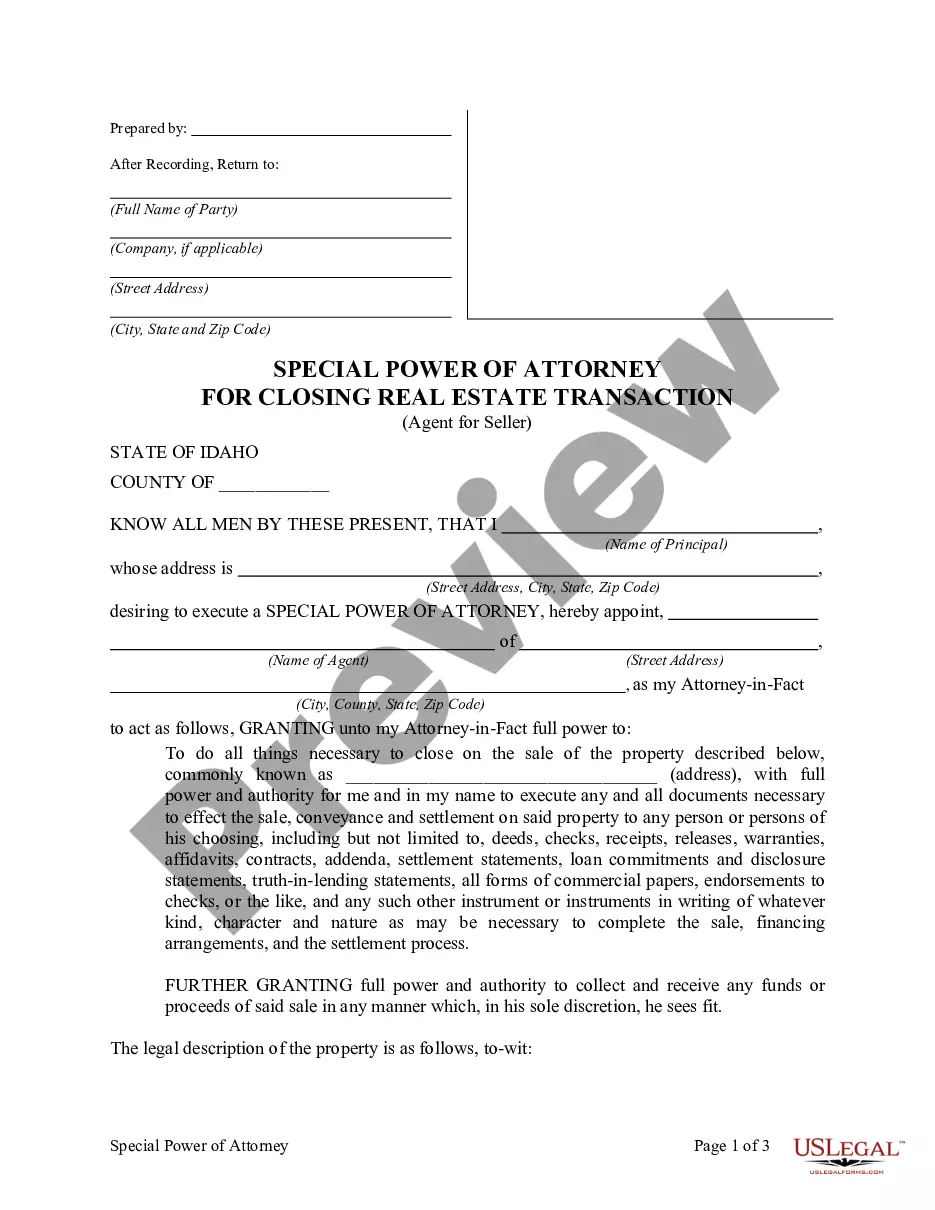

- Examine the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!