Philadelphia, Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name: A Detailed Description In Philadelphia, Pennsylvania, a subrogation agreement is a legally binding document that grants an insurer the authority to pursue legal action in the name of the insured. This arrangement is commonly used in insurance claims to recover damages or losses sustained by insured parties. The subrogation agreement ensures that the insurer has the right to stand in the shoes of the insured and seek compensation from responsible third parties. Keywords: Philadelphia, Pennsylvania, subrogation agreement, insurer, insured, legal action, damages, losses, insurance claims, compensation, responsible third parties. Types of Philadelphia, Pennsylvania Subrogation Agreements: 1. Property Insurance Subrogation Agreement: This type of subrogation agreement is typically related to property insurance claims. It allows the insurer to seek reimbursement from liable parties for damages caused to insured property, such as houses, commercial buildings, or personal belongings. The agreement ensures that the insured is compensated for the loss, while the insurer recovers the claim amount. Keywords: property insurance, reimbursement, damages, insured property, liable parties, loss, claim amount. 2. Auto Insurance Subrogation Agreement: In cases of vehicular accidents or damage to insured vehicles, an auto insurance subrogation agreement is crucial. This agreement permits the insurer to initiate legal proceedings in the name of the insured against negligent parties responsible for the accident or damage. It enables the insured to receive compensation for repairs or replacement costs while allowing the insurer to recover the claim amount. Keywords: auto insurance, vehicular accidents, damage, insured vehicles, legal proceedings, negligent parties, compensation, repairs, replacement costs. 3. Workers' Compensation Subrogation Agreement: When employees sustain injuries or experience work-related accidents, workers' compensation insurance comes into play. A subrogation agreement for workers' compensation allows the insurer to recover the paid benefits by bringing legal action against responsible parties, such as employers or third parties involved in the incident. This agreement ensures that the insurer can recoup the compensation paid to the insured worker while protecting the worker's rights. Keywords: workers' compensation, injuries, work-related accidents, benefits, legal action, responsible parties, employers, third parties, compensation. Philadelphia, Pennsylvania subrogation agreements are essential tools for insurers to protect their financial interests while ensuring that insured parties receive proper compensation for their losses or damages. These agreements empower insurers to pursue legal action in the insured's name, seeking reimbursement from those responsible. By utilizing subrogation agreements, insurers can efficiently recover claim amounts, safeguarding their financial stability and delivering justice to the insured individuals. Keywords: Philadelphia, Pennsylvania, subrogation agreements, insurers, financial interests, compensation, losses, damages, legal action, reimbursement, responsible parties, claim amounts, financial stability, justice.

Philadelphia Pennsylvania Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Philadelphia Pennsylvania Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Philadelphia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Philadelphia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Philadelphia Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name:

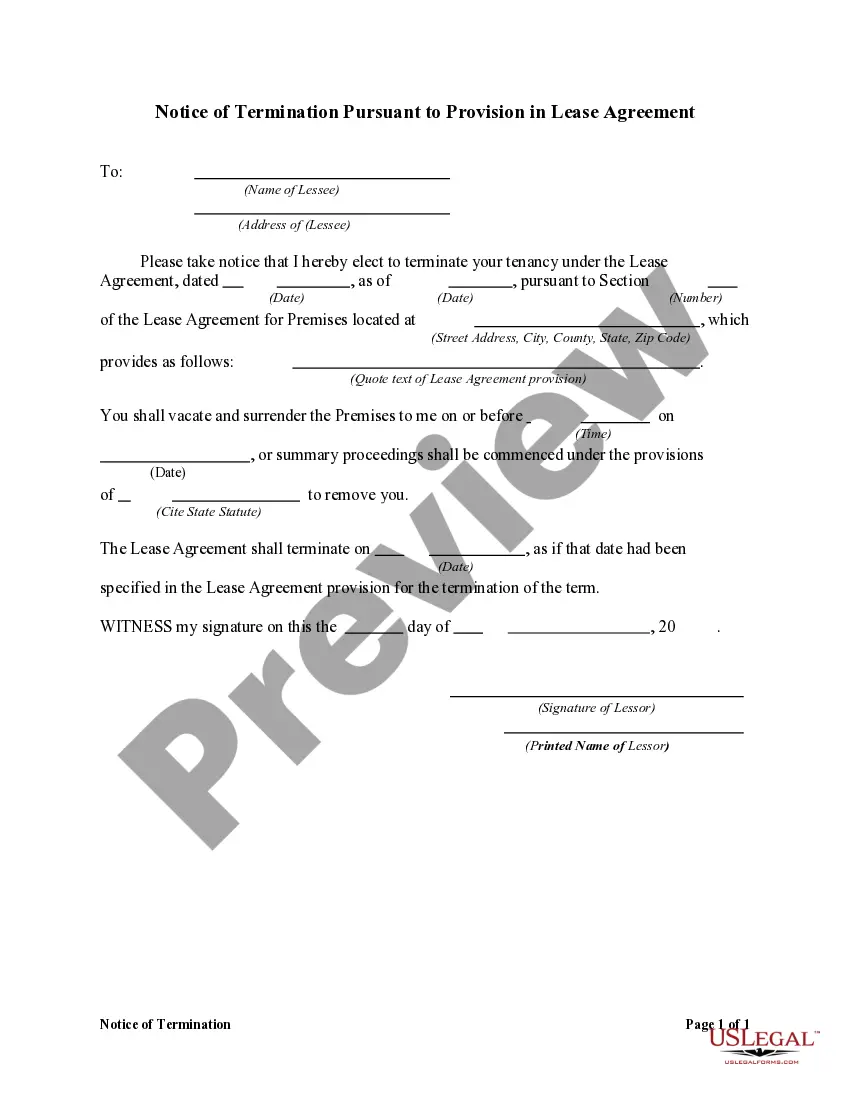

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!