Franklin Ohio Receipt for Payment of Loss for Subrogation is a legal document issued to acknowledge the settlement of a claim or loss by an insurance company on behalf of its insured. This comprehensive receipt serves as proof of payment and outlines the terms and conditions of the subrogation process. It contains essential information regarding the parties involved, the nature of the loss, the amount paid, and the date of payment. Keywords: Franklin Ohio, receipt for payment, subrogation, loss, settle claim, insurance company, insured, proof of payment, terms and conditions. Different Types of Franklin Ohio Receipt for Payment of Loss for Subrogation: 1. Personal Injury Subrogation Receipt: This type of receipt is issued by the insurance company when settling a claim related to personal injury. It includes details about medical expenses, compensation for pain and suffering, and any other relevant costs. 2. Property Damage Subrogation Receipt: When an insured individual experiences property damage, such as a car accident or fire, the insurance company issues a property damage subrogation receipt. It highlights the amount paid for repair or replacement of the damaged property. 3. Workers' Compensation Subrogation Receipt: In cases where an employee gets injured on the job, the employer's insurance company may issue a workers' compensation subrogation receipt. It documents the compensation provided to the injured worker for medical expenses, lost wages, and rehabilitation. 4. Liability Subrogation Receipt: Liability subrogation receipt is issued when the insurance company pays on behalf of the insured for any damage caused to a third party due to the insured's actions or negligence. It may cover medical expenses, property damage, or legal settlements. 5. Medical Subrogation Receipt: In situations where an insured individual's medical expenses are covered by their insurance company and a subrogation claim is made against a liable third party, a medical subrogation receipt is issued. It specifies the amount paid by the insurance company towards medical treatments and the subrogation amount recovered. By properly documenting and categorizing these various types of subrogation receipts, insurance companies and policyholders can ensure transparency and accuracy in the settlement process. These receipts are essential not only for record-keeping but also for facilitating future reimbursement and legal proceedings, if necessary.

Franklin Ohio Receipt for Payment of Loss for Subrogation

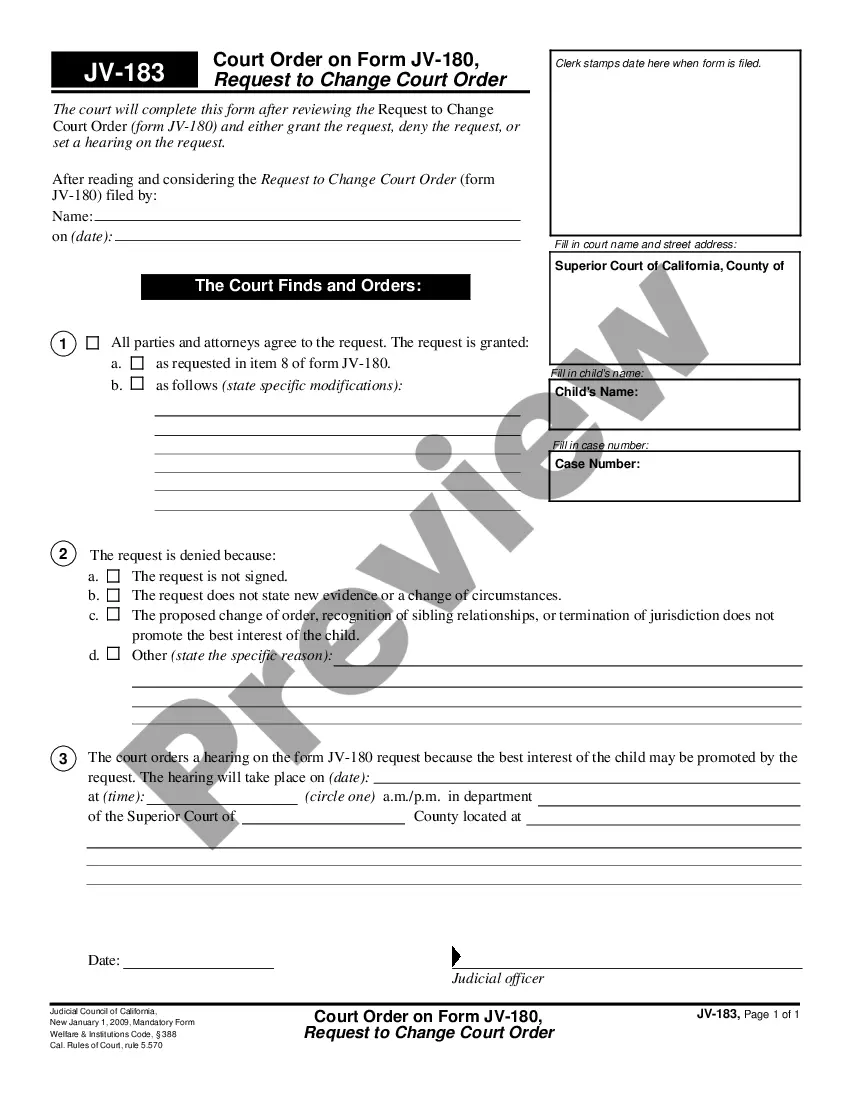

Description

How to fill out Franklin Ohio Receipt For Payment Of Loss For Subrogation?

Drafting papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Franklin Receipt for Payment of Loss for Subrogation without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Franklin Receipt for Payment of Loss for Subrogation on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Franklin Receipt for Payment of Loss for Subrogation:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

The doctrine of subrogation provides that if an insurer pays a loss to its insured due to the wrongful act of another, the insurer is subrogated to the rights of the insured and may prosecute a suit against the wrongdoer for recovery of its outlay.

Subrogation by contract commonly arises in contracts of insurance. The doctrine of subrogation confers upon the insurer the right to receive the benefit of such rights and remedies as the assured has against third parties in regard to the loss to the extent that the insurer has indemnified the loss and made it good.

A subrogation receipt is signed by the insured upon payment of a claim, and assigns the insurer to the right to recovery for the loss.

An example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

A waiver of subrogation is a contractual provision whereby an insured waives the right of their insurance carrier to seek redress or seek compensation for losses from a negligent third party.

Definition of subrogation : the act of subrogating specifically : the assumption by a third party (such as a second creditor or an insurance company) of another's legal right to collect a debt or damages.

A waiver of subrogation clause is placed in a contract to minimize lawsuits and claims among the parties. The result is that the risk of loss is agreed among the parties to lie with the insurers, and the cost of the insurance coverage is contractually allocated among the parties as they may agree.