San Diego is a vibrant city located on the southern coast of California, known for its beautiful beaches, warm climate, and diverse cultural scene. With its stunning coastline, bustling downtown area, and numerous attractions, it is a popular destination for tourists and locals alike. A Receipt for Payment of Loss for Subrogation is a legal document that acknowledges the payment made by an insurance company to an individual or entity who has suffered a loss and subsequently transferred their rights to claim reimbursement to the insurance company. This type of receipt is commonly utilized in situations where an individual has incurred a loss or damage, such as in an automobile accident or property damage, and their insurance company steps in to financially compensate them for their loss. In San Diego, there are different types of Receipts for Payment of Loss for Subrogation that may be encountered in various circumstances. These include: 1. Auto Insurance Subrogation Receipt: This receipt is commonly used when an individual's vehicle has been damaged in an accident, and their insurance company pays for the repairs or provides them with the monetary value of the damaged vehicle. 2. Property Insurance Subrogation Receipt: This type of receipt comes into play when damage occurs to an insured property, such as a home or business, and the insurance company compensates the policyholder for the loss or provides financial assistance for repairs or rebuilding. 3. Liability Insurance Subrogation Receipt: In situations where an individual is held responsible for causing harm or damage to another person or their property, liability insurance can step in to cover the incurred loss. This receipt acknowledges the payment made by the insurance company on behalf of the liable party. It is important to note that Receipts for Payment of Loss for Subrogation serve as essential documentation, providing proof of payment and ensuring that the transfer of rights to pursue reimbursement has occurred. In conclusion, San Diego, California, is a vibrant coastal city known for its stunning beaches, warm climate, and diverse cultural scene. A Receipt for Payment of Loss for Subrogation is a legal document frequently encountered in various situations involving insurance claims, such as auto accidents or property damage. Different types of these receipts, such as Auto Insurance Subrogation Receipts, Property Insurance Subrogation Receipts, and Liability Insurance Subrogation Receipts, exist in order to acknowledge the payment made by insurance companies to individuals or entities who have suffered a loss and then transferred their rights to claim reimbursement.

San Diego California Receipt for Payment of Loss for Subrogation

Description

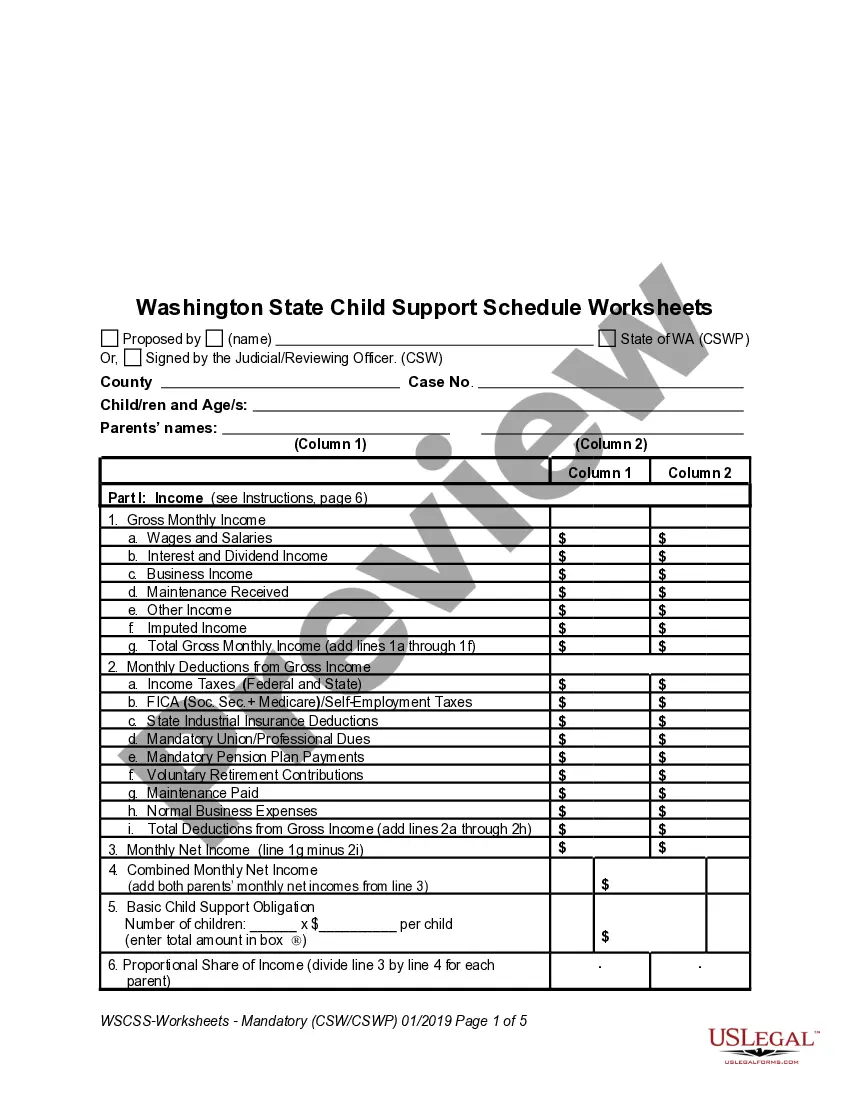

How to fill out San Diego California Receipt For Payment Of Loss For Subrogation?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the San Diego Receipt for Payment of Loss for Subrogation, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Diego Receipt for Payment of Loss for Subrogation from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the San Diego Receipt for Payment of Loss for Subrogation:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!