A Kings New York Credit support agreement is a legally binding contract that outlines the terms and conditions under which one party provides credit support to another party. This agreement serves as a risk mitigation tool and ensures the fulfillment of financial obligations. The Kings New York Credit support agreement is applicable in various situations where credit support is necessary, such as loans, derivative transactions, and other financial arrangements. It provides assurance to the receiving party that a certain form of collateral or support will be available in the event of default or insolvency. There are different types of Kings New York Credit support agreements, each designed to cater to specific requirements and circumstances. Some common types include: 1. Guarantees: This agreement involves a guarantee provided by a third party, known as the guarantor, to ensure repayment of the loan or meet other financial obligations. The guarantor pledges to fulfill these obligations if the borrower defaults. 2. Letters of credit: In this agreement, a financial institution agrees to pay a specified amount to the beneficiary on behalf of the applicant, ensuring that the financial obligations will be fulfilled. 3. Surety bonds: This type of agreement involves a third party, typically an insurance company or a surety, providing a guarantee to the obliged that the principal will fulfill their obligations. These bonds are commonly used in construction projects and other contractual agreements. 4. Collateral agreements: This agreement involves the provision of specific assets or property as collateral to secure a loan or other financial arrangement. If the borrower defaults, the lender can seize and sell the collateral to recoup their losses. 5. Repurchase agreements: Also known as repos, these agreements involve the sale of securities along with a simultaneous agreement to buy them back at a later date. This serves as a short-term borrowing mechanism and ensures credit support through collateralized assets. It is crucial for parties entering into a Kings New York Credit support agreement to clearly outline the terms, obligations, and responsibilities of each party involved. These agreements help mitigate risks and provide financial security, thereby fostering trust and confidence in business relationships.

Kings New York Credit support agreement

Description

How to fill out Kings New York Credit Support Agreement?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Kings Credit support agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Kings Credit support agreement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Kings Credit support agreement:

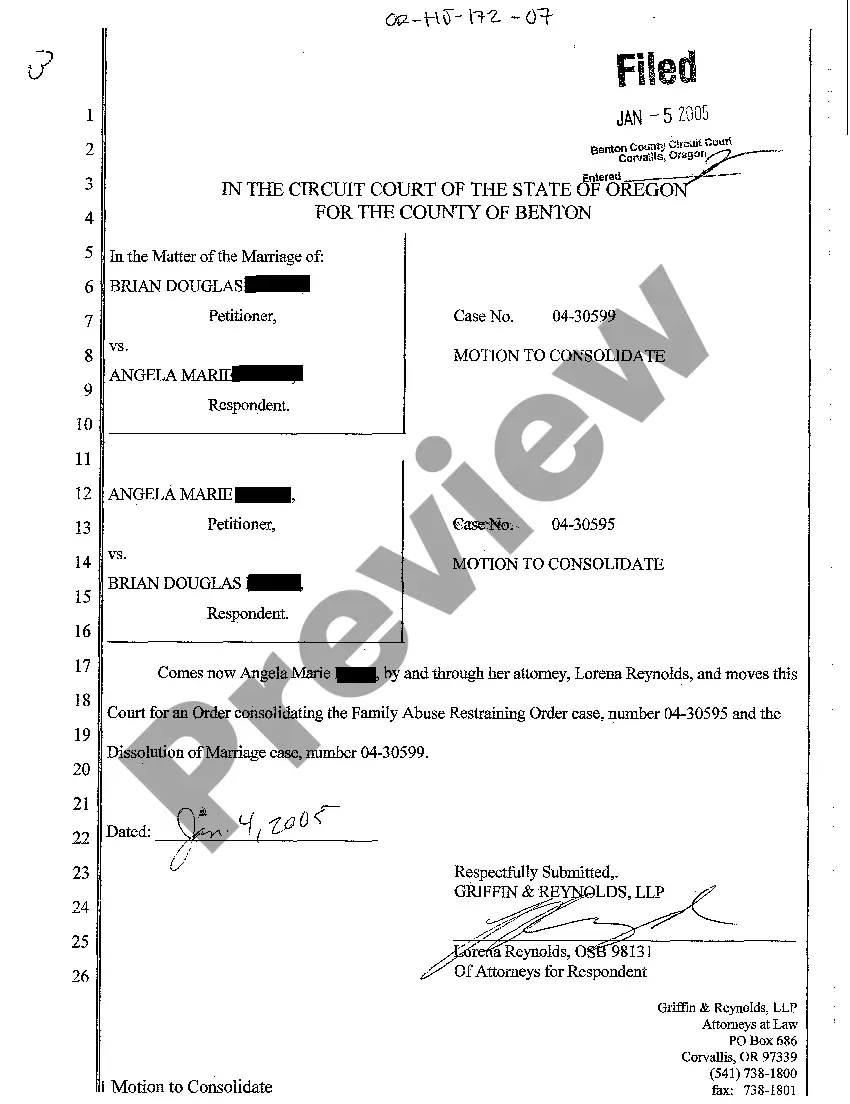

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!