Nassau New York Lease of Commercial Building is a legally binding agreement between a landlord and a tenant for the rental of a commercial property in Nassau County, New York. This lease outlines the terms and conditions under which the tenant can occupy and use the commercial building for business purposes. The lease agreement typically includes essential details such as the term of the lease, which can range from a few months to several years, as well as the amount of rent to be paid and the frequency of payments. It also outlines the responsibilities of the tenant and the landlord, including maintenance and repair obligations, insurance requirements, and any restrictions or limitations on the use of the commercial space. There are various types of Nassau New York Lease of Commercial Building, including: 1. Full-Service Lease: This type of lease commonly includes all the operating expenses, such as property taxes, insurance, maintenance costs, and utility bills, within the rent payment. It is convenient for tenants as it simplifies the cost structure and provides predictability. 2. Triple Net (NNN) Lease: In this type of lease, the tenant is responsible for paying the property taxes, building insurance, and maintenance costs in addition to the base rent. It shifts more financial obligations onto the tenant, but typically offers lower base rents. 3. Percentage Lease: This lease structure is mainly applicable for retail businesses where the tenant pays a base rent plus a percentage of their gross sales to the landlord. It is commonly used in shopping centers or malls. 4. Gross Lease: In a gross lease, the tenant pays a fixed rent amount that includes most, if not all, of the property expenses. The landlord is responsible for the operating costs. This type of lease is often used for smaller commercial spaces. 5. Short-Term Lease: These leases are typically for a few months or up to a year, making them suitable for temporary or seasonal businesses. They may offer flexibility but often come at a higher rent per month. When signing a Nassau New York Lease of Commercial Building, it is crucial for both the landlord and the tenant to thoroughly review and understand all the terms and conditions mentioned in the agreement. Seeking legal advice and negotiating specific clauses can ensure that the lease protects the interests of both parties involved and creates a mutually beneficial rental arrangement.

Nassau New York Lease of Commercial Building

Description

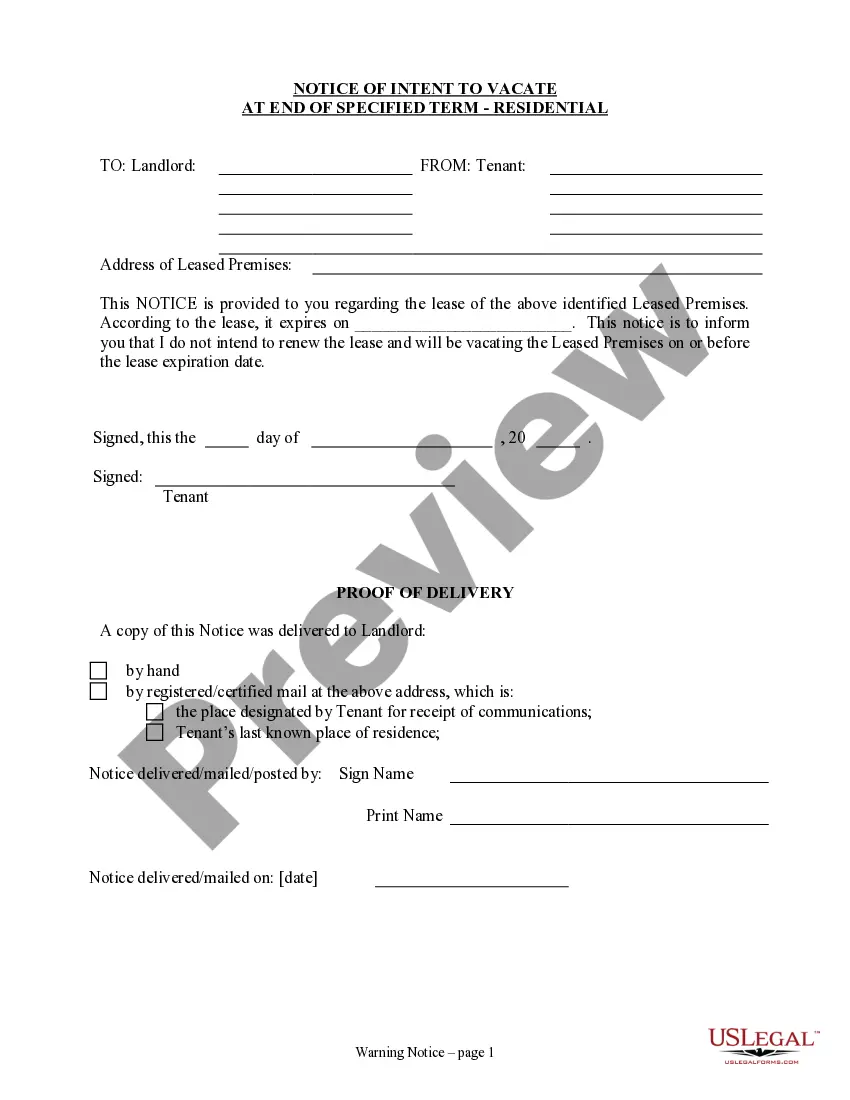

How to fill out Nassau New York Lease Of Commercial Building?

Creating documents, like Nassau Lease of Commercial Building, to manage your legal affairs is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for a variety of scenarios and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Nassau Lease of Commercial Building template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Nassau Lease of Commercial Building:

- Make sure that your document is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Nassau Lease of Commercial Building isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our website and get the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!