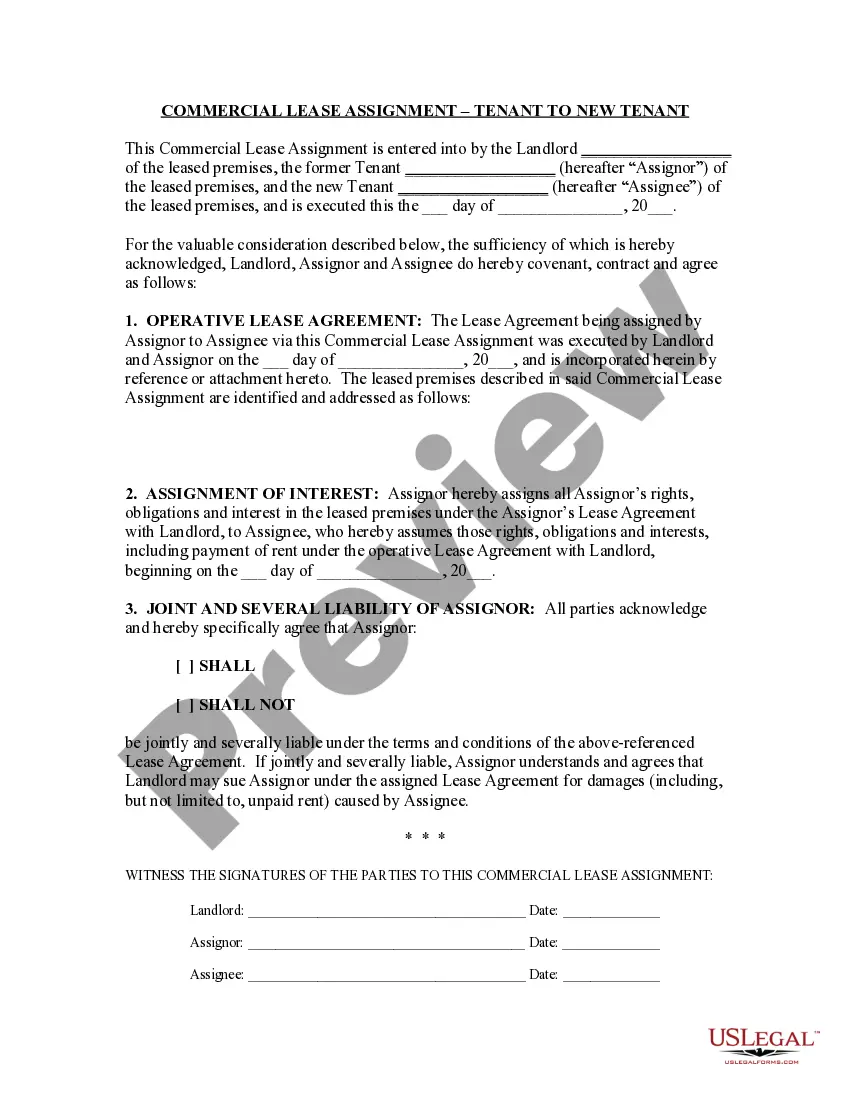

The Nassau New York Agreement is a legal document that establishes a pledge of stock and collateral for a loan made in Nassau County, New York. This agreement outlines the terms and conditions under which the borrower pledges specific stocks and collateral as security for the loan. The pledge of stock and collateral serves as a guarantee for the lender that if the borrower is unable to repay the loan according to the agreed-upon terms, the lender has the right to seize the pledged stocks and collateral to recoup the outstanding loan amount. The Nassau New York Agreement Pledge of Stock and Collateral for Loan is a comprehensive contract that covers various aspects, including the identification of the pledged stocks and collateral, their valuation, and the conditions under which the lender can exercise their rights to seize and sell the assets. Furthermore, the agreement specifies the details of the loan, such as the loan amount, interest rate, repayment schedule, and any additional fees or penalties associated with late or defaulted payments. There might be different types of Nassau New York Agreement Pledge of Stock and Collateral for Loan, depending on the specific circumstances and requirements of the parties involved. Some potential variations may include: 1. Corporate Loan Agreement: This type of agreement is tailored for corporations or businesses seeking a loan, where the stocks of the company and its collateral assets are pledged as security. 2. Individual Loan Agreement: This agreement is created for individuals who want to pledge their personal stocks and collateral against a loan, typically for personal expenses or investments. 3. Real Estate Loan Agreement: In cases where real estate properties serve as collateral, this agreement includes additional clauses specific to the mortgage or lien on the property, ensuring the lender has a legally enforceable claim. 4. Secured Business Loan Agreement: This version of the agreement is designed for small businesses or startups looking to secure financing by pledging business assets as collateral, including stocks and other valuable holdings. It is crucial to consult legal professionals and experts in finance and lending when preparing and executing a Nassau New York Agreement Pledge of Stock and Collateral for Loan to ensure compliance with local regulations and to protect the interests of both the borrower and the lender.

Nassau New York Agreement Pledge of Stock and Collateral for Loan

Description

How to fill out Nassau New York Agreement Pledge Of Stock And Collateral For Loan?

Draftwing paperwork, like Nassau Agreement Pledge of Stock and Collateral for Loan, to manage your legal matters is a challenging and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for various cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Nassau Agreement Pledge of Stock and Collateral for Loan form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before downloading Nassau Agreement Pledge of Stock and Collateral for Loan:

- Make sure that your document is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Nassau Agreement Pledge of Stock and Collateral for Loan isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!