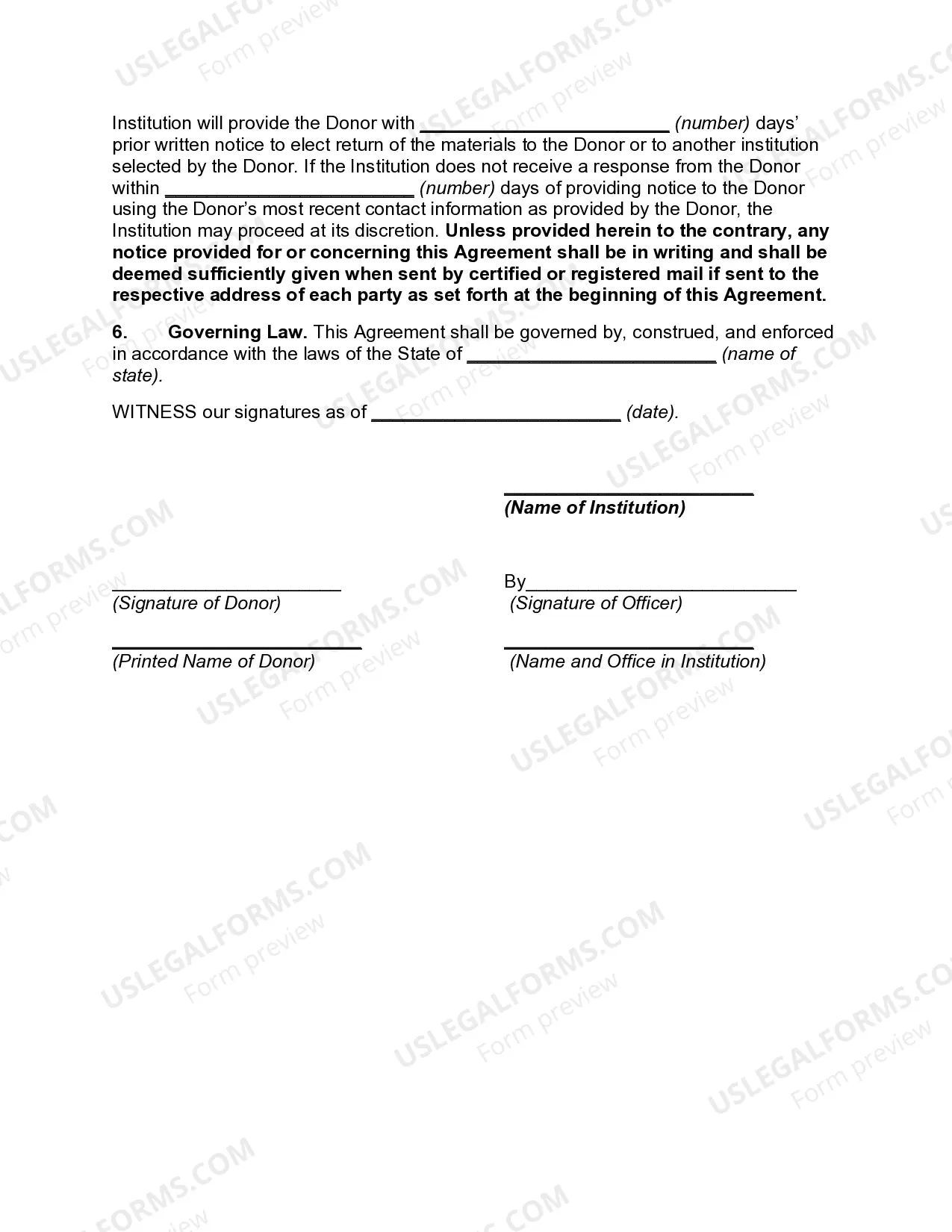

Harris Texas Gift Agreement with Institution is a legally binding agreement that governs the terms and conditions of gifting certain assets to a nonprofit institution or organization located in Harris County, Texas. This agreement outlines the responsibilities, obligations, and rights of both the donor and the recipient institution. The Harris Texas Gift Agreement with Institution typically includes the following key elements: 1. Donor Information: This section includes detailed information about the donor, such as their full name, contact address, and any relevant identification details. It may also include the donor's legal capacity to make a gift. 2. Recipient Institution Information: This section provides comprehensive details about the nonprofit institution or organization that will be receiving the gift. This includes the name of the institution, its contact information, and its legal status. 3. Description of the Gift: The agreement specifies the nature, extent, and condition of the gift being given. This may include various types of assets such as cash, securities, real estate, artwork, or other personal property. 4. Conditions and Restrictions: In certain cases, the donor may impose conditions or restrictions on the use of the gift. These conditions can range from designating the gift for a specific purpose within the institution, to requiring the institution to meet certain guidelines or obligations. 5. Delivery of the Gift: This section outlines the logistics of transferring the gift from the donor to the recipient institution. It may specify the mode of transfer, the timing, and any associated costs or fees. 6. Tax and Legal Considerations: Harris Texas Gift Agreements with Institutions may include provisions addressing the tax and legal implications of the gift. This may include information regarding the donor's tax deduction eligibility or any applicable state or federal regulations. 7. Termination and Amendment: The agreement may specify the circumstances under which the gift agreement can be terminated or amended. This includes provisions for situations like non-compliance with the terms of the agreement or changes in the circumstances of either the donor or the recipient institution. Different types of Harris Texas Gift Agreements with Institutions may vary based on factors such as the type and value of the gift, any specific restrictions imposed by the donor, or the nature of the recipient institution. For example, there may be separate agreements for cash gifts, real estate gifts, or ongoing donations. It is crucial for both the donor and the recipient institution to have a clear and well-defined Harris Texas Gift Agreement to protect the interests of both parties involved. Consulting with legal professionals experienced in nonprofit and estate planning law is highly recommended when drafting or entering into such agreements.

Harris Texas Gift Agreement with Institution

Description

How to fill out Harris Texas Gift Agreement With Institution?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Harris Gift Agreement with Institution, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the recent version of the Harris Gift Agreement with Institution, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Harris Gift Agreement with Institution:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Harris Gift Agreement with Institution and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!