Nassau New York Gift Agreement with Institution — A Comprehensive Overview Introduction: The Nassau New York Gift Agreement with Institution refers to a legally binding contract entered into by individuals, organizations, or businesses wishing to donate a gift to an institution located in Nassau County, New York. This agreement outlines the terms and conditions agreed upon by both the donor and the institution, ensuring a transparent and mutually beneficial arrangement. Description: 1. Purpose: The Nassau New York Gift Agreement with Institution serves as a formal agreement between the donor and the recipient institution, formally documenting the intention behind the gift and ensuring that it is used for its intended purpose. This agreement provides a structure for the allocation, management, and utilization of the gift, including any restrictions or specific conditions that must be adhered to. 2. Gift Types: a) Monetary Gifts: Monetary gifts are the most common type of donation received under the Nassau New York Gift Agreement with Institution. These gifts can be made in the form of checks, wire transfers, or online donations, and are typically used to support various initiatives, programs, scholarships, or infrastructure development within the recipient institution. b) In-Kind Gifts: In-Kind gifts involve the donation of tangible assets, such as artwork, real estate, equipment, or any other non-monetary asset with significant value. These gifts may require additional appraisal and documentation to ascertain their fair market value and appropriate usage within the institution. c) Endowment Gifts: Endowment gifts are long-term investments entrusted to the institution, where the principal amount is invested, and the generated income is used to support specific programs or scholarships in perpetuity. Donors can establish an endowment fund and establish conditions on how its income should be allocated. 3. Key Components of the Agreement: a) Identification of Parties: The agreement should clearly identify both the donor and recipient institution, including their legal names, addresses, and contact information. b) Gift Description: A detailed description of the gift, including its nature, value (if applicable), and any specific restrictions or conditions associated with its use, must be outlined. c) Purpose and Intended Use: The agreement should clearly define the purpose for which the gift is being made and how the institution will utilize it to meet its objectives, whether for scholarships, research, facility enhancement, or any other designated purposes. d) Gift Administration: This section provides guidelines on the management, administration, and stewardship of the gift, including the responsibilities of both parties and any reporting requirements. e) Donor Recognition: The agreement may include provisions regarding public acknowledgment or naming opportunities, either for the donor or in honor of a specific individual or group. f) Termination Clauses: If applicable, the agreement may outline the circumstances under which the agreement can be terminated or modified, ensuring flexibility and adaptability to changing circumstances. Conclusion: The Nassau New York Gift Agreement with Institution outlines the terms and conditions governing the donation of gifts to institutions in Nassau County, New York. It ensures transparency, accountability, and adherence to the donor's intentions, while also facilitating the institution's ability to utilize the gift effectively. By entering into this agreement, both parties can establish a mutually beneficial relationship that supports the advancement of education, research, and community development within Nassau County.

Nassau New York Gift Agreement with Institution

Description

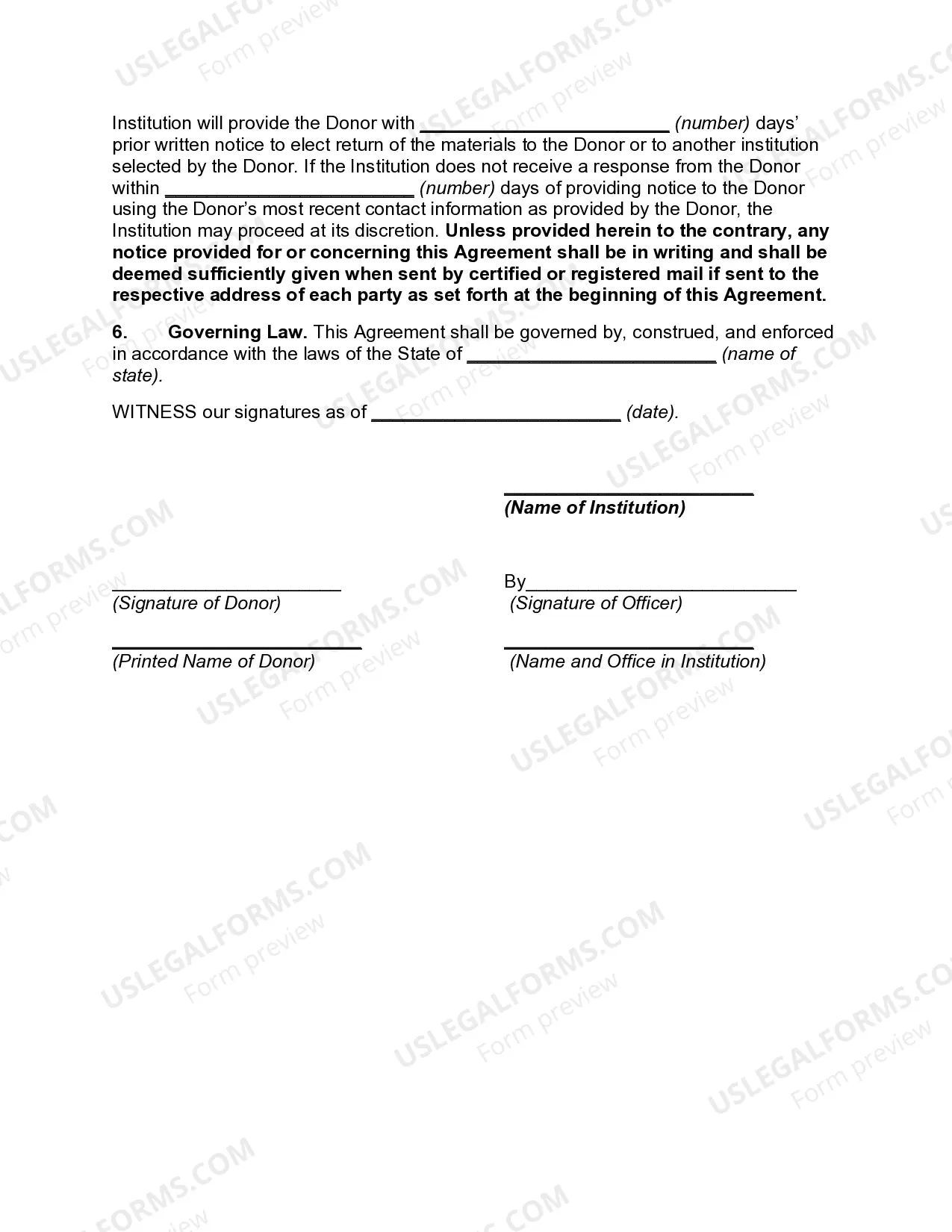

How to fill out Nassau New York Gift Agreement With Institution?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Nassau Gift Agreement with Institution suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the Nassau Gift Agreement with Institution, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Nassau Gift Agreement with Institution:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Nassau Gift Agreement with Institution.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!