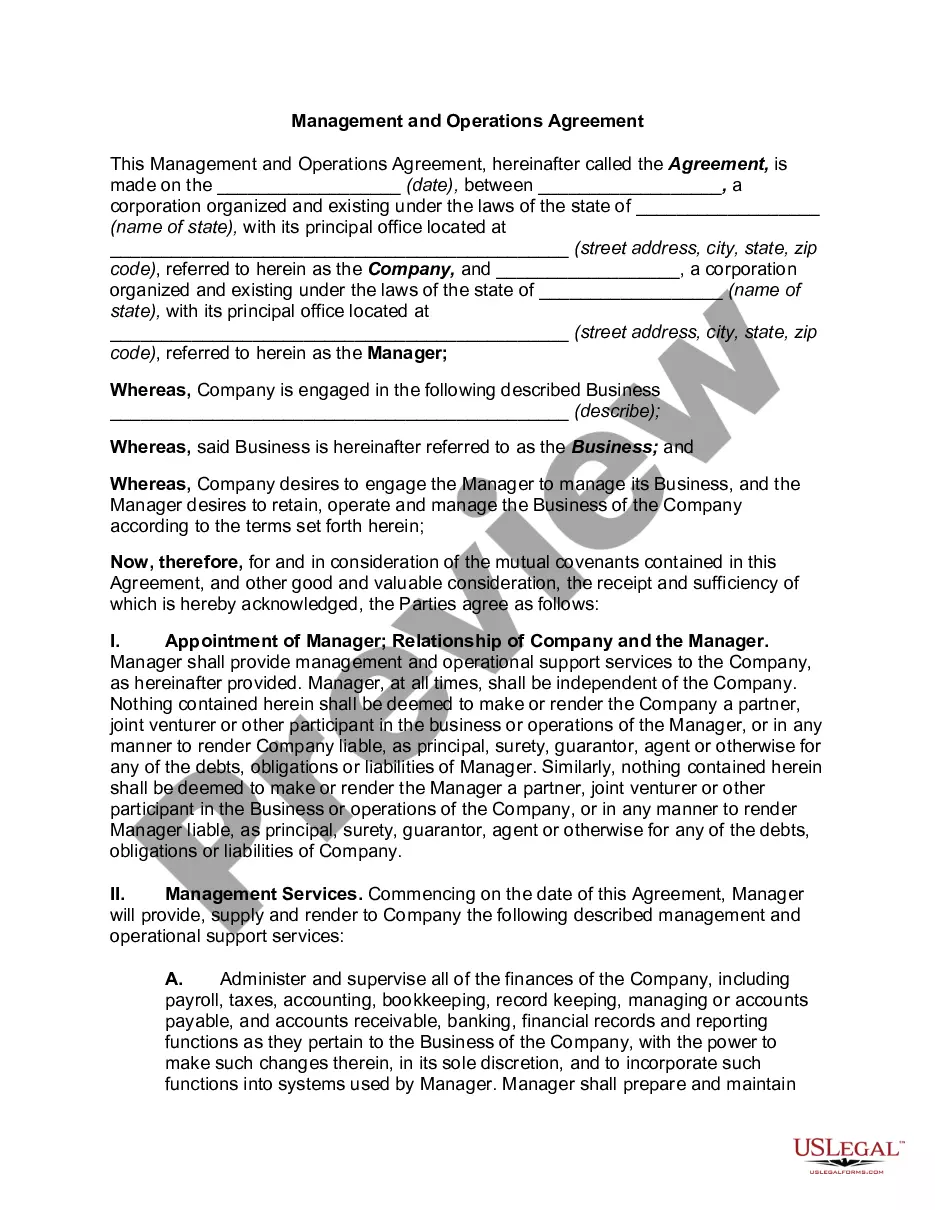

Tarrant Texas Gift Agreement with Institution is a legal document that outlines the terms and conditions regarding a gift given to an institution located in Tarrant, Texas. This agreement establishes the rights, obligations, and responsibilities of both the donor and the institution in relation to the gift. The Tarrant Texas Gift Agreement with Institution encompasses various types of gifts, depending on the donor's intentions and the institution's needs. Some different types of gift agreements commonly encountered include: 1. Cash Gifts Agreement: This agreement involves the donation of monetary funds to the institution. The document specifies the amount of the gift, how the funds will be allocated, and any conditions or restrictions imposed by the donor. 2. Endowment Gifts Agreement: An endowment gift is a donation where the principal amount is invested, and the institution utilizes the generated income for specific purposes, such as scholarships, research, or facility maintenance. The agreement defines the terms of the endowment, including investment guidelines, disbursement policies, and naming opportunities if applicable. 3. Restricted Gifts Agreement: A restricted gift refers to a donation with specific requirements or limitations imposed by the donor. This agreement outlines how the funds will be used, ensuring that the institution complies with the donor's wishes and restrictions. 4. In-Kind Gifts Agreement: In-kind gifts involve the donation of tangible assets or services rather than monetary funds. This agreement specifies the nature, value, and purpose of the donated assets, as well as any conditions or restrictions associated with their use. Regardless of the specific type of gift, the Tarrant Texas Gift Agreement with Institution typically covers significant elements such as the purpose of the gift, acknowledgement and tax-related information, duration of the agreement, provisions for termination or amendment, confidentiality clauses, and any dispute resolution mechanisms. It is crucial for both the donor and the institution to have a well-defined gift agreement in order to ensure transparency, accountability, and legal compliance. This document protects the rights and interests of all parties involved, fostering a mutually beneficial relationship and ensuring that the gift fulfills its intended purpose.

Tarrant Texas Gift Agreement with Institution

Description

How to fill out Tarrant Texas Gift Agreement With Institution?

Creating paperwork, like Tarrant Gift Agreement with Institution, to manage your legal affairs is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for different scenarios and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Tarrant Gift Agreement with Institution form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before downloading Tarrant Gift Agreement with Institution:

- Make sure that your document is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Tarrant Gift Agreement with Institution isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our website and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!