Title: Understanding the Phoenix Arizona Assignment of LLC Company Interest to Living Trust Introduction: The Phoenix Arizona Assignment of LLC Company Interest to Living Trust is an important legal process that allows individuals to transfer their membership interest in a limited liability company (LLC) to their living trust. This assignment is particularly significant for estate planning purposes as it helps in the seamless transfer of ownership and management of the LLC. Types of Phoenix Arizona Assignment of LLC Company Interest to Living Trust: 1. Traditional Phoenix Arizona Assignment of LLC Company Interest to Living Trust: This type of assignment involves transferring the ownership interest in an LLC to a living trust, ensuring a smooth ownership transition as part of overall estate planning strategies. 2. Partial Phoenix Arizona Assignment of LLC Company Interest to Living Trust: In certain cases, an individual may opt to transfer only a portion of their LLC ownership interest to a living trust. This could be done to achieve specific financial or estate planning goals while retaining control over a part of the LLC interest. 3. Irrevocable Phoenix Arizona Assignment of LLC Company Interest to Living Trust: An irrevocable assignment is binding and cannot be changed or revoked by the LLC member once the transfer to the living trust has taken place. This type of assignment ensures long-term asset protection and may have implications for tax planning purposes. 4. Revocable Phoenix Arizona Assignment of LLC Company Interest to Living Trust: Unlike an irrevocable assignment, a revocable assignment provides flexibility for the LLC member to amend or undo the assignment after it has been made. This allows for adjustments to the estate plan based on changing circumstances, although it may have different tax and legal consequences. Key Elements of Phoenix Arizona Assignment of LLC Company Interest to Living Trust: 1. Assignment Agreement: This is a formal legal document that outlines the terms and conditions of the assignment. It includes details of the LLC, the assignor (the LLC member initiating the assignment), the assignee (the living trust), the transfer of ownership, and any ancillary provisions. 2. LLC Operating Agreement: The existing LLC operating agreement may need to be modified or amended to accommodate the assignment to the living trust. It is important to ensure compliance with the provisions of the operating agreement during the assignment process. 3. Consenting Co-Members: If the LLC has multiple members, the assignment of company interest should be done with the consent of other co-members as per the operating agreement. Their agreement and acknowledgment may be required for a valid assignment. 4. Record keeping and Filing: To complete the assignment, certain filings with the Arizona Corporation Commission may be necessary. Additionally, maintaining proper documentation and record keeping is essential to ensure the legal validity of the assignment and make the transition smooth. Conclusion: The Phoenix Arizona Assignment of LLC Company Interest to Living Trust provides LLC members with a variety of options for transferring their membership interests to a living trust. These assignments, whether traditional, partial, irrevocable, or revocable, help individuals in effective estate planning and asset protection. Engaging legal professionals familiar with Arizona-specific laws can ensure a proper understanding and execution of the assignment process.

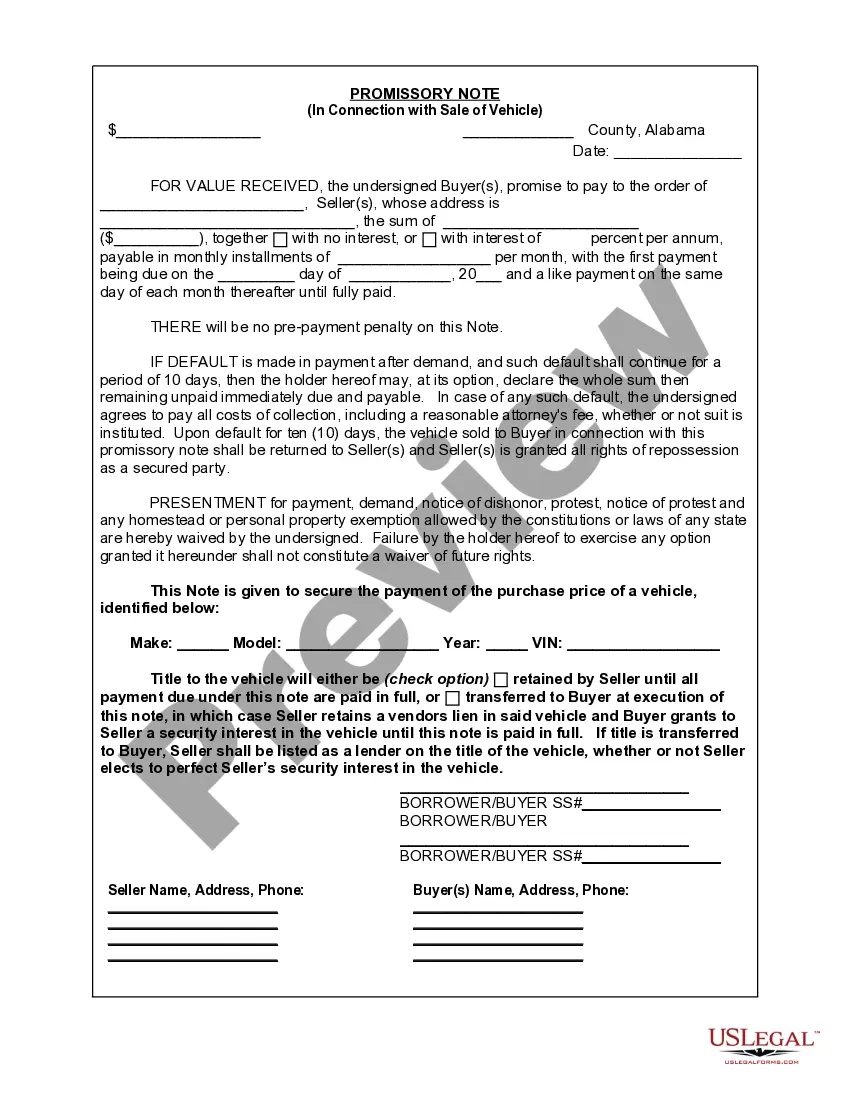

Phoenix Arizona Assignment of LLC Company Interest to Living Trust

Description

How to fill out Phoenix Arizona Assignment Of LLC Company Interest To Living Trust?

Are you looking to quickly create a legally-binding Phoenix Assignment of LLC Company Interest to Living Trust or maybe any other form to manage your own or business matters? You can go with two options: contact a professional to write a legal document for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant form templates, including Phoenix Assignment of LLC Company Interest to Living Trust and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Phoenix Assignment of LLC Company Interest to Living Trust is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Phoenix Assignment of LLC Company Interest to Living Trust template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the documents we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!