San Jose California Assignment of LLC Company Interest to Living Trust: A Comprehensive Guide Keywords: San Jose California, Assignment of LLC Company Interest, Living Trust, Trustee, LLC membership, Estate Planning Introduction: In San Jose, California, the Assignment of LLC Company Interest to Living Trust is an essential element of estate planning for individuals who own or want to ensure smooth distribution of their LLC membership interest upon their incapacity or demise. This detailed description will provide an in-depth understanding of what this legal process entails and its significance in protecting one's assets and ensuring their effective transfer to the chosen beneficiaries or trustees. 1. San Jose California Assignment of LLC Company Interest to Living Trust — Overview: The Assignment of LLC Company Interest to Living Trust is a legal document that transfers the ownership of an individual's interest in a Limited Liability Company (LLC) to their living trust. A living trust is a common estate planning tool that allows individuals to manage and distribute their assets during their lifetime and after their passing, without the need for probate court proceedings. 2. Types of Assignment of LLC Company Interest to Living Trust in San Jose California: a. Irrevocable Assignment: An irrevocable assignment refers to a transfer of an LLC company interest to a living trust that cannot be altered, amended, or revoked by the LLC member or granter. This type of assignment provides greater asset protection and potential tax benefits but comes with the restriction of losing control over the transferred interest. b. Revocable Assignment: A revocable assignment, on the other hand, allows LLC members or granters to retain control over the transferred interest. They have the option to modify or revoke the assignment during their lifetime. However, upon their demise or incapacity, the assignment becomes irrevocable, ensuring seamless distribution of the LLC company interest to the designated beneficiaries or trustees. 3. Importance of San Jose California Assignment of LLC Company Interest to Living Trust: a. Probate Avoidance: By assigning LLC company interest to a living trust, individuals can bypass probate, the legal process through which the court validates a will and oversees the distribution of assets. Avoiding probate helps save time, money, and maintains privacy as the transfer of interests within the trust remains confidential. b. Smooth Distribution and Asset Protection: Assigning LLC company interest to a living trust ensures a seamless transfer of ownership to the designated beneficiaries or trustees upon the LLC member's incapacity or death. This prevents disruption in the LLC's operations while safeguarding the company's assets from potential claims by creditors or unwanted beneficiaries. c. Flexibility in Managing Interests: With an irrevocable assignment, individuals can take advantage of favorable tax planning strategies, protect assets from potential lawsuits, and establish an effective succession plan. Revocable assignments provide flexibility, allowing the LLC member to make changes as their circumstances evolve. Conclusion: The Assignment of LLC Company Interest to Living Trust is a crucial aspect of estate planning in San Jose, California. By utilizing this legal mechanism, individuals can ensure the smooth transition of their LLC membership interest to their chosen beneficiaries or trustees while avoiding probate, protecting assets, and maintaining control over their interests. Whether opting for an irrevocable or revocable assignment, consulting with an experienced attorney is highly recommended navigating the complexities of this process and tailor it to individual needs.

San Jose California Assignment of LLC Company Interest to Living Trust

Description

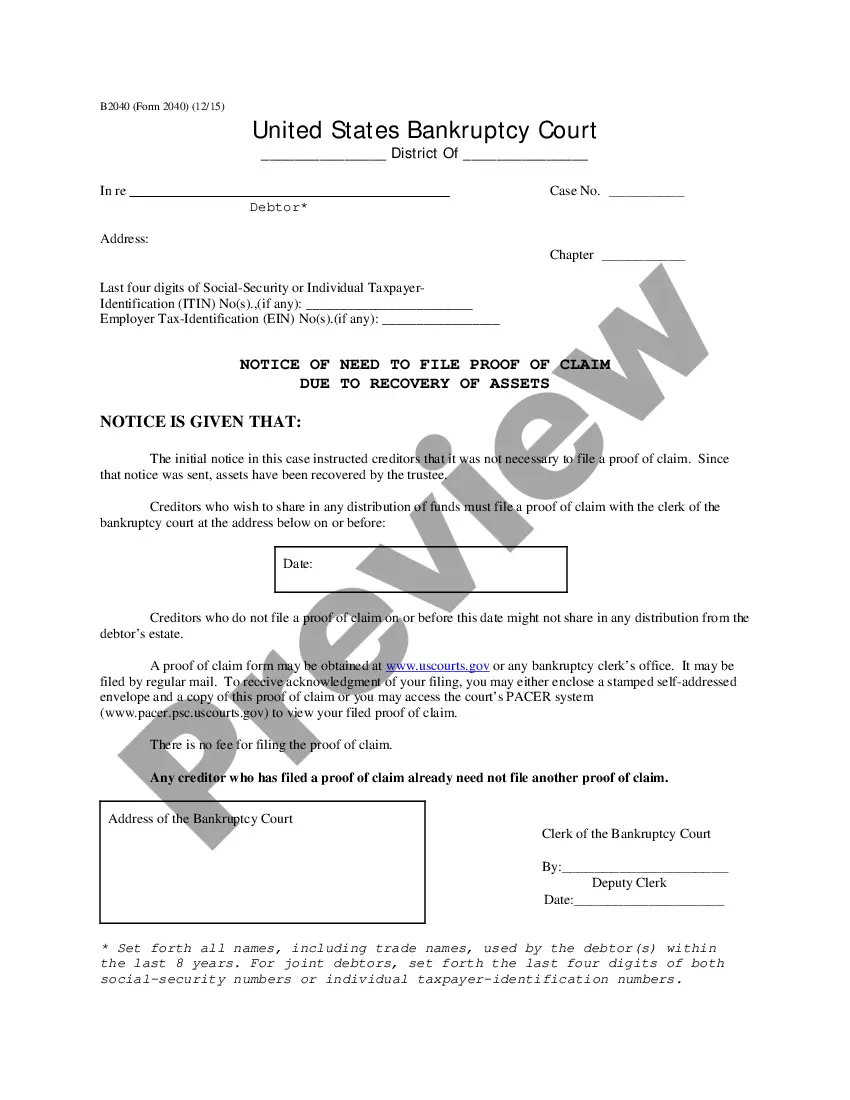

How to fill out San Jose California Assignment Of LLC Company Interest To Living Trust?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Jose Assignment of LLC Company Interest to Living Trust, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the recent version of the San Jose Assignment of LLC Company Interest to Living Trust, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Jose Assignment of LLC Company Interest to Living Trust:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your San Jose Assignment of LLC Company Interest to Living Trust and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!