Nassau County, located in the state of New York, handles various legal documents, including Release of Security Interest — Termination Statements. This legal document is crucial for both lenders and borrowers as it signifies the release and termination of an existing security interest on a particular property or asset. Keywords related to Nassau New York Release of Security Interest — Termination Statement: Nassau County, New York, security interest, termination, lenders, borrowers, legal document, property, asset. There are different types of Nassau New York Release of Security Interest — Termination Statements, depending on the nature of the transaction and the specific property or asset involved. These types may include: 1. Real Estate Release of Security Interest — Termination Statement: This type of termination statement is used when a security interest, such as a mortgage or lien, is released from a property. It is commonly used when a property loan has been fully paid off, and the lender no longer holds any claim on the property. 2. Vehicle Release of Security Interest — Termination Statement: This type of termination statement is utilized when a security interest, such as a car loan, is terminated, releasing the lender's claim on the vehicle. It is typically filed with the appropriate authorities, such as the Department of Motor Vehicles, to ensure the vehicle's title is updated and transferred to the borrower without any encumbrances. 3. Personal Property Release of Security Interest — Termination Statement: This type of termination statement applies to personal property, such as machinery, equipment, or other assets used for business purposes. The statement relieves the borrower from any outstanding obligations and removes the lender's security interest in the specified personal property. Regardless of the specific type, a Nassau New York Release of Security Interest — Termination Statement must be filed with the appropriate authorities, such as the Nassau County Clerk's Office or relevant state agencies, to ensure it is legally recognized and recorded. It typically requires the completion of specific legal forms, including the accurate identification of the property or asset, details of the original security agreement, and the borrower's and lender's information. Overall, a Nassau New York Release of Security Interest — Termination Statement serves as a critical document to legally release and terminate a security interest, providing clarity and assurance to both borrowers and lenders in Nassau County, New York.

Nassau New York Release of Security Interest - Termination Statement

Description

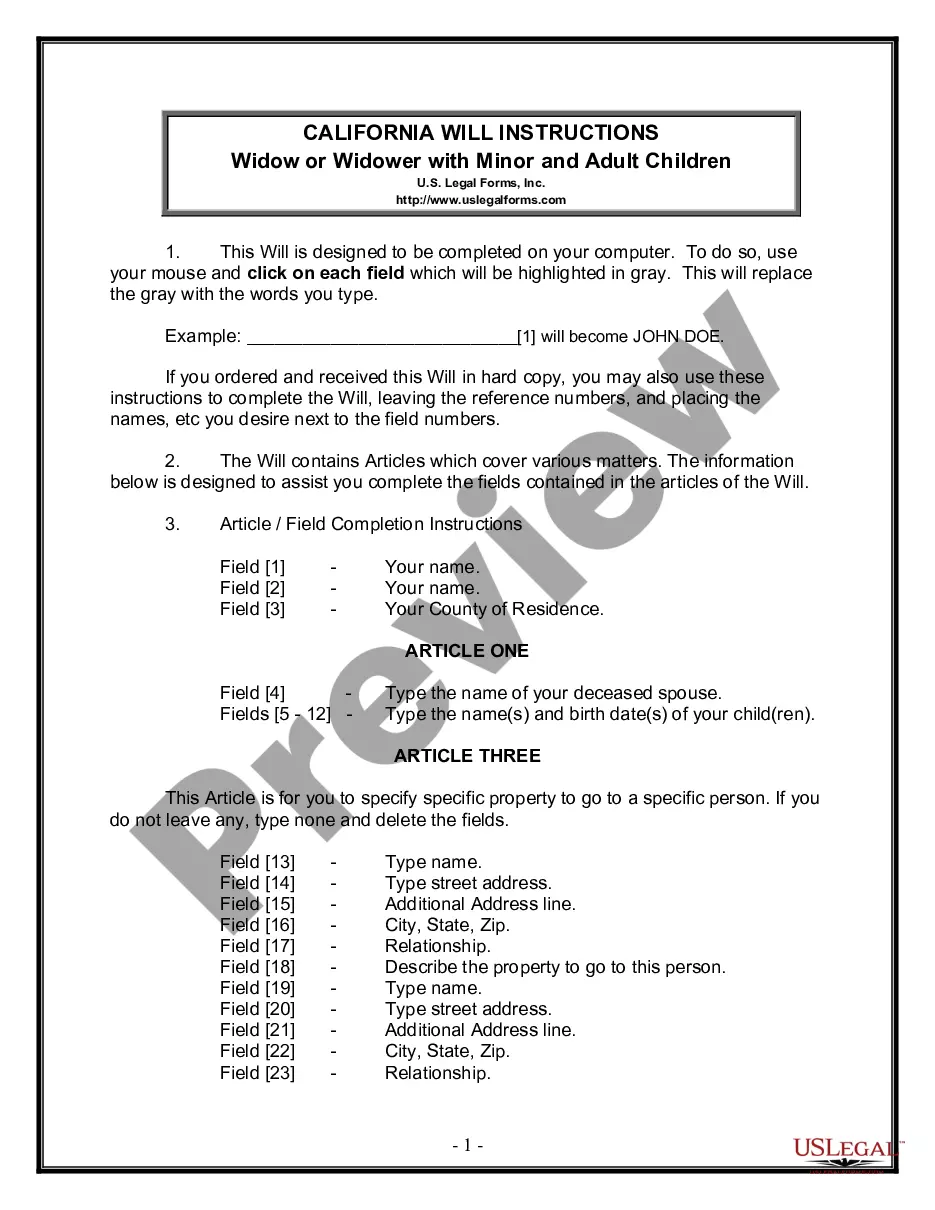

How to fill out Nassau New York Release Of Security Interest - Termination Statement?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Nassau Release of Security Interest - Termination Statement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Release of Security Interest - Termination Statement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Nassau Release of Security Interest - Termination Statement:

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

Visit your secretary of state's office. To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

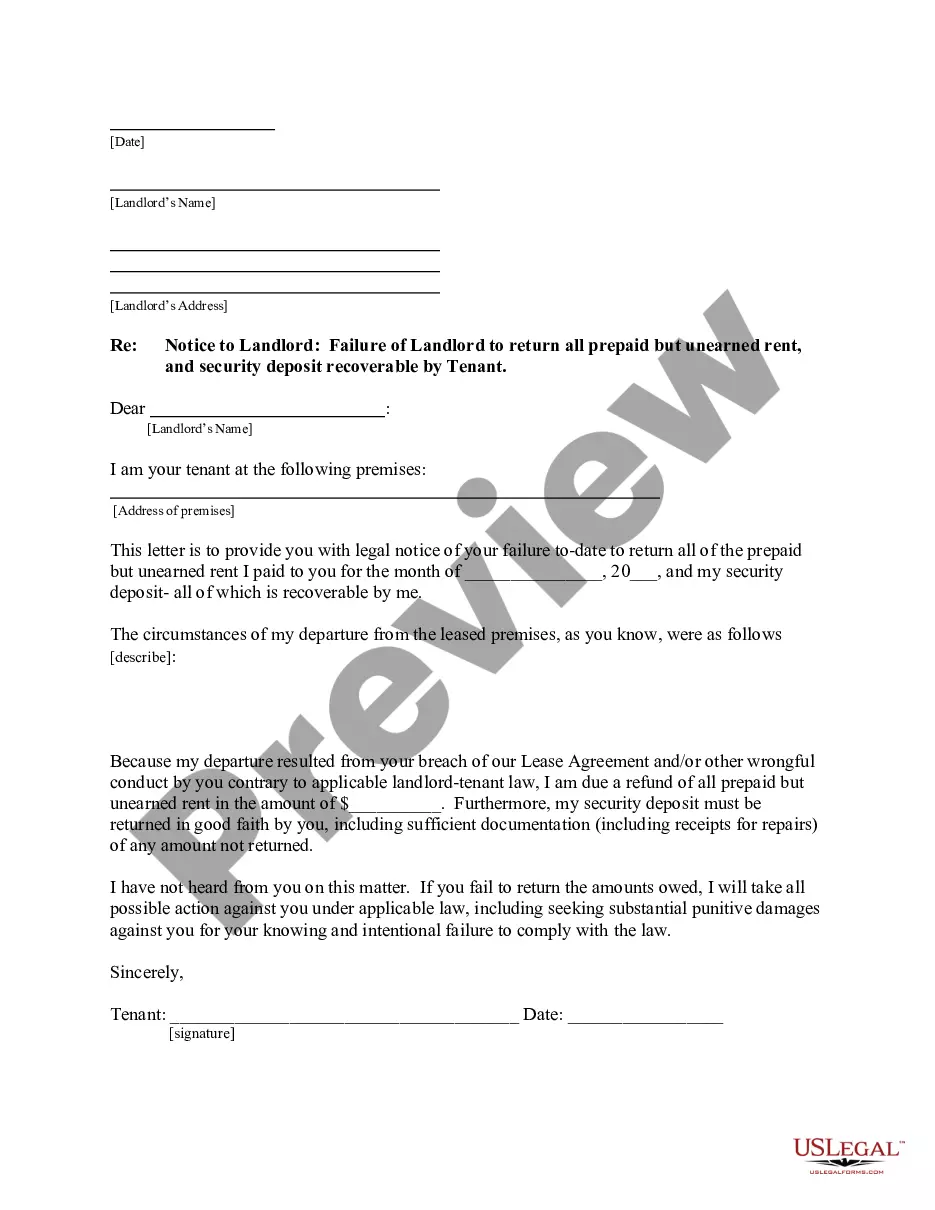

A termination statement is a document issued by a lending institution, which establishes that a particular secured loan has been fully repaid. They are commonly used in association with home mortgages, once the mortgage has been paid off.

File a UCC-3 termination statement if you are releasing the entire security interest. File a UCC-3 amendment statement to either amend the collateral description or release certain collateral if only part of the security interest in collateral is being released.

Request a UCC-3 Financial Statement Amendment (Termination): You should request the lender to file a UCC-3 termination, since lenders typically don't file these unless requested. You should always get confirmation from the lender that the UCC-3 was filed. This termination statement can remove the UCC lien if processed.

3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.

Related Definitions UCC Termination Statements means completed UCC Financing Statement Amendments, in form and substance acceptable to Buyer, to delete the Assets as collateral under, or to terminate, as the case may be, the UCC financing statements listed on Exhibit Q.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC1 filing. A Termination for personal property is accomplished by completing and filing form UCC3 with the Secretary of State's office in the appropriate state.