Hillsborough Florida Notice of Assignment of Security Interest is a legal document that signifies the transfer of rights and interests in a secured asset from one party to another within the jurisdiction of Hillsborough County, Florida. This document is typically executed when a borrower pledges collateral, such as a vehicle or property, to secure a loan or credit agreement. The Notice of Assignment of Security Interest provides official notice to all parties involved that the original secured party, who held the security interest in the collateral, has assigned or transferred their rights to a new party (the assignee). The assignee becomes the new legal owner of the security interest and gains the rights to collect payments, enforce the terms of the security agreement, and obtain possession of the collateral if the debtor defaults on the loan. Keywords: 1. Hillsborough Florida: Refers to the specific geographical area where the Notice of Assignment of Security Interest is applicable, namely Hillsborough County, Florida. 2. Notice of Assignment: Emphasizes the purpose of the document, which serves as formal notice that the security interest has been assigned to another party. 3. Security Interest: Refers to the legal right granted to a lender or creditor to secure repayment of a debt using pledged collateral. 4. Assignment: Highlights the transfer of the security interest from the original secured party to the assignee, indicating a change of ownership and rights. 5. Collateral: Indicates the pledged asset that serves as security for the loan or credit agreement. 6. Debtor: The individual or entity who owes the debt and pledges the collateral. 7. Secured Party: The original lender or creditor who holds the security interest. 8. Assignee: The new party to whom the security interest has been assigned or transferred. 9. Loan Agreement: The contract or agreement that outlines the terms and conditions of the loan, including the security interest. 10. Default: The failure of the debtor to fulfill their obligations outlined in the loan agreement. Types of Hillsborough Florida Notice of Assignment of Security Interest may include: 1. Vehicle Assignment of Security Interest: Relates specifically to the assignment of security interest in a motor vehicle (car, truck, motorcycle, etc.) in Hillsborough County, Florida. 2. Real Estate Assignment of Security Interest: Pertains to the assignment of security interest in real property or properties located within Hillsborough County, Florida. 3. Personal Property Assignment of Security Interest: Involves the assignment of security interest in personal property, excluding motor vehicles, within Hillsborough County, Florida. 4. Business Asset Assignment of Security Interest: Relates to the assignment of security interest in business assets, such as equipment, machinery, inventory, etc., located within Hillsborough County, Florida. It is important to note that the specific types of Notice of Assignment of Security Interest might vary based on the jurisdiction and the nature of the collateral involved.

Hillsborough Florida Notice of Assignment of Security Interest

Description

How to fill out Hillsborough Florida Notice Of Assignment Of Security Interest?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Hillsborough Notice of Assignment of Security Interest, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the latest version of the Hillsborough Notice of Assignment of Security Interest, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Hillsborough Notice of Assignment of Security Interest:

- Look through the page and verify there is a sample for your area.

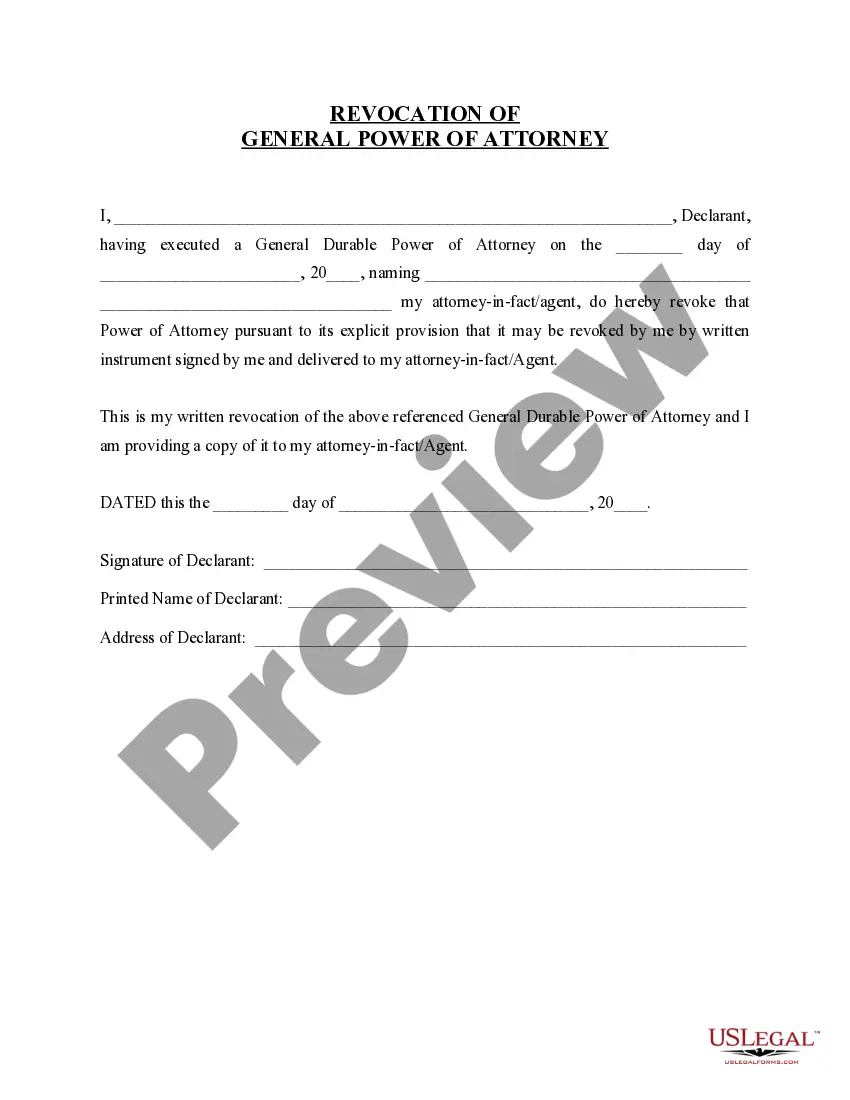

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Hillsborough Notice of Assignment of Security Interest and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!