Clark Nevada Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

How to fill out Clark Nevada Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Clark Notice of Private Sale of Collateral (Non-consumer Goods) on Default, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Clark Notice of Private Sale of Collateral (Non-consumer Goods) on Default from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Clark Notice of Private Sale of Collateral (Non-consumer Goods) on Default:

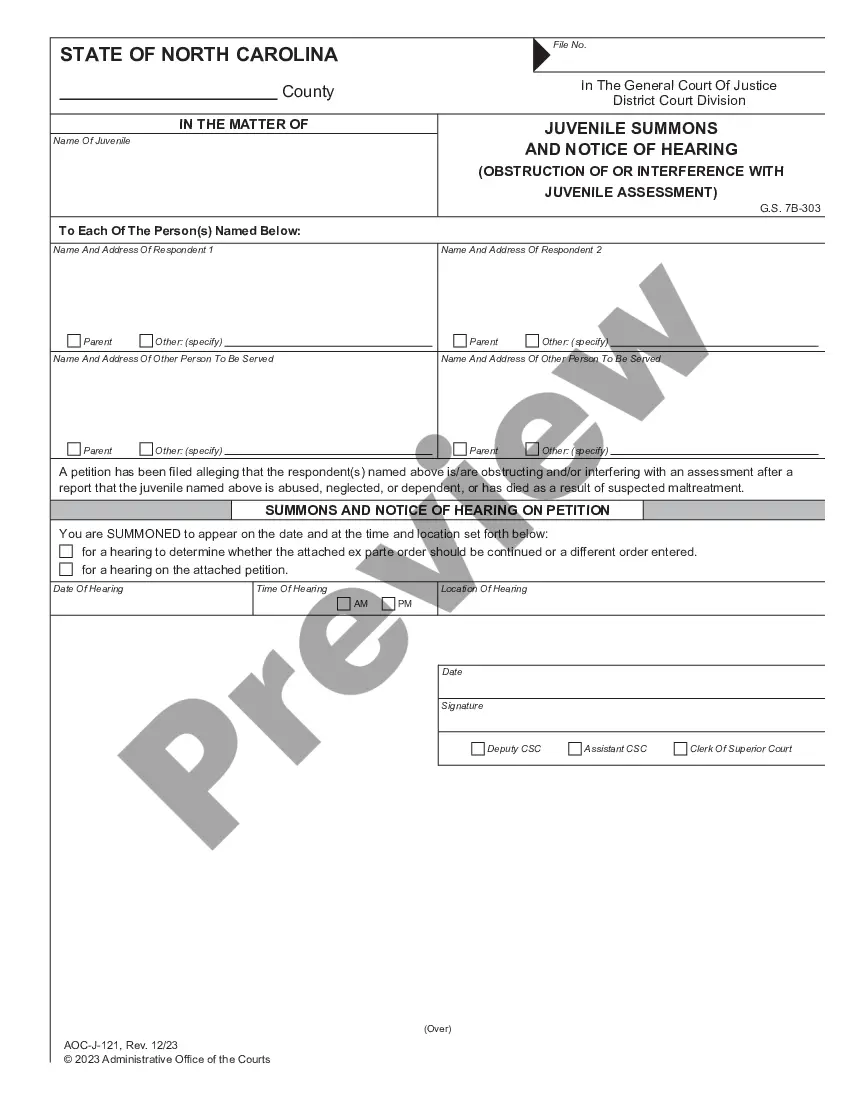

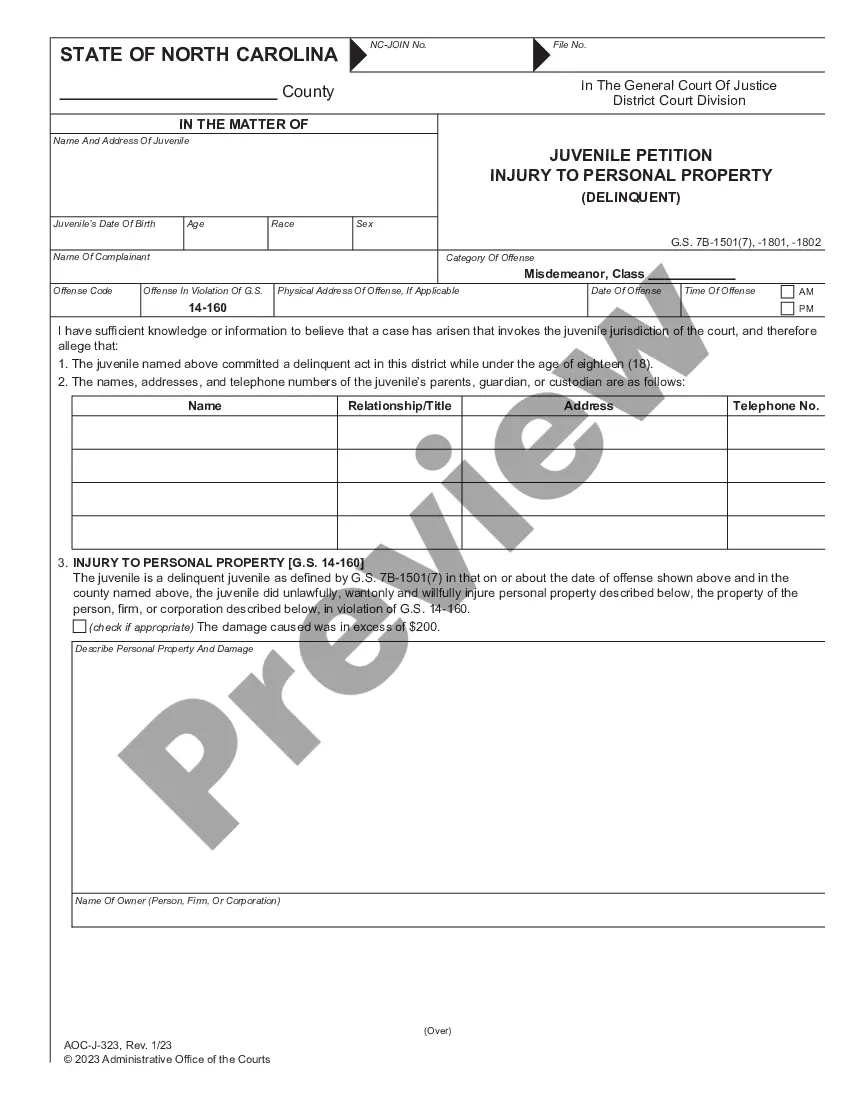

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Secured Party (a/k/a Secured Creditor): A lender, seller, or any other person who is a beneficiary of a security interest, including a person to whom accounts or chattel paper has been sold.

Under §9-622, a proposal to accept collateral in full satisfaction of the debt that is consented to by the debtor discharges the obligation not just the consenting debtor's liability for that obligation.

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

If the debtor defaults and does not repay the loan, generally the secured party can foreclose and recover the collateral. A person who has an ownership or other interest in the collateral and owes payment of a secured obligation Revised UCC 9-102(a)(28).

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

§ 9-623. RIGHT TO REDEEM COLLATERAL. (a) Persons that may redeem. A debtor, any secondary obligor, or any other secured party or lienholder may redeem collateral.

RIGHTS AND DUTIES OF SECURED PARTY HAVING POSSESSION OR CONTROL OF COLLATERAL. (a) Duty of care when secured party in possession. Except as otherwise provided in subsection (d), a secured party shall use reasonable care in the custody and preservation of collateral in the secured party's possession.

(a) After default, a secured party may (1) take possession of the collateral; and (2) without removal, may render equipment unusable and dispose of collateral on a debtor's premises.

Upon default, a secured party can either take possession of the collateral or render collateral such as equipment unusable, or dispute of collateral on a debtor's premises under Section 9-1610.

(a) After default, a secured party may do both of the following: (1) Take possession of the collateral. (2) Without removal, render equipment unusable and dispose of collateral on a debtor's premises under Section 9610.