Phoenix Arizona Notice of Private Sale of Collateral (Non-consumer Goods) on Default: A Comprehensive Guide Introduction: In Phoenix, Arizona, when a borrower defaults on a loan, the lender has the right to initiate the Private Sale of Collateral (Non-consumer Goods) to recover their losses. This legal process allows lenders to sell the assets pledged as collateral, such as machinery, equipment, inventory, or other non-consumer goods, to satisfy the outstanding debt. A Notice of Private Sale is a crucial step in this process, as it informs all interested parties about the upcoming sale and ensures transparency in the proceedings. Types of Phoenix Arizona Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. Machinery and Equipment Sale: When a borrower defaults on a loan secured by machinery and equipment, the lender can release a Notice of Private Sale specifically tailored to these assets. This notice provides detailed information about the machinery and equipment being sold, including their make, model, condition, and any other relevant specifications. 2. Inventory Sale: If a borrower defaults on a loan with inventory pledged as collateral, the lender can issue a Notice of Private Sale of Collateral specifically for inventory. This notice outlines the specifics of the inventory being sold, such as the type of goods, quantity, quality, and other relevant details. 3. Vehicle Sale: When a borrower defaults on a loan secured by vehicles, such as cars, trucks, or commercial vehicles, the lender can initiate a Notice of Private Sale exclusively for these assets. This notice describes the vehicles being sold, including their make, model, year, mileage, condition, and other pertinent information. 4. Real Estate Sale: In some cases, the collateral for a defaulted loan may involve real estate properties. In such instances, the lender can issue a Notice of Private Sale of Collateral (Non-consumer Goods) on Default, specifically tailored to real estate assets. This notice provides essential details about the property being sold, such as location, size, zoning information, and any relevant terms or conditions. Key Components of a Notice of Private Sale of Collateral (Non-consumer Goods) on Default: 1. Identification of Parties: The notice should include the names of the lender, borrower, and any other relevant parties involved in the loan agreement. 2. Description of Collateral: A detailed and accurate description of the collateral being sold, including its type, quantity, condition, specifications (if applicable), and any distinguishing features. 3. Sale Information: The notice must provide information on the date, time, and location of the private sale. It may also specify any additional terms or conditions related to the sale process. 4. Right of Redemption: The notice may include information regarding the borrower's right of redemption, which allows them to reclaim the collateral by paying off the outstanding debt plus any additional costs incurred. 5. Proceeds Distribution: Details regarding the distribution of proceeds from the sale, including the order of priority for payment, such as covering outstanding debt, fees, and other expenses related to the sale. Conclusion: When handling a default situation in Phoenix, Arizona, issuing a Notice of Private Sale of Collateral (Non-consumer Goods) on Default is a critical step for lenders to recover their losses. By specifying the type of collateral being sold, such as machinery, equipment, inventory, vehicles, or real estate, lenders can ensure compliance with legal procedures and maintain transparency throughout the process.

Phoenix Arizona Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

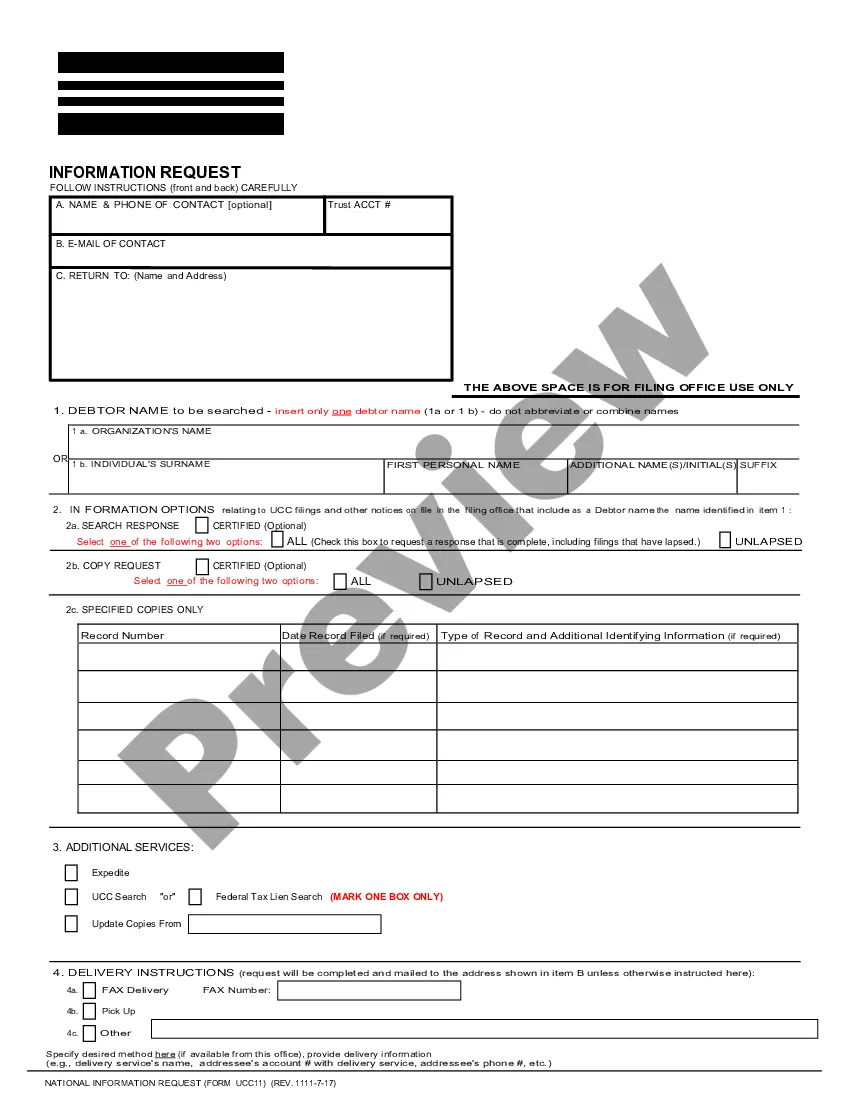

How to fill out Phoenix Arizona Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

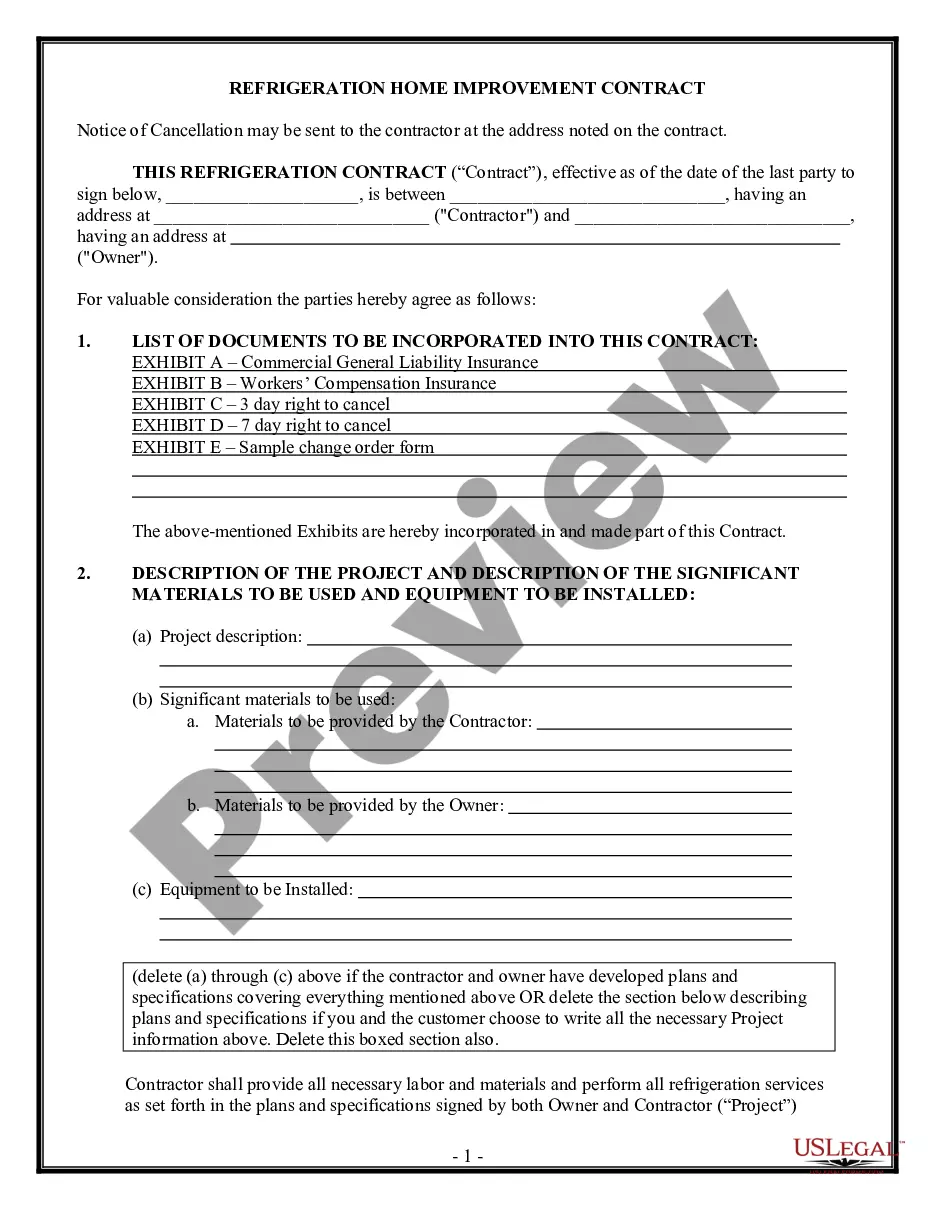

If you need to get a reliable legal form provider to find the Phoenix Notice of Private Sale of Collateral (Non-consumer Goods) on Default, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it simple to locate and complete various documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to search or browse Phoenix Notice of Private Sale of Collateral (Non-consumer Goods) on Default, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Phoenix Notice of Private Sale of Collateral (Non-consumer Goods) on Default template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Phoenix Notice of Private Sale of Collateral (Non-consumer Goods) on Default - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Section 9-610 of the UCC permits the secured creditor to ?sell, lease, license, or otherwise dispose of any or all of the collateral in its present condition or following any commercially reasonable preparation or processing.? The collateral may be sold as a whole or in parcels, at one time or at different times.

Perfection by Possession: A secured creditor can perfect his or her security interest by taking possession of the collateral until the debtor has paid the debt for which the collateral was pledged. For example, stocks, bonds, jewelry.

If the debtor defaults under its obligation, the secured creditor may proceed to sell the assets representing the collateral under the secured party's Credit Agreement.

Is it true that a debtor can sell collateral without the lender's consent? Yes, under the Bankruptcy Code it can be done ? even if the collateral is sold for less than the amount of outstanding debt. So, a secured creditor must be proactive if a distressed borrower tries to sell the collateral in a bankruptcy.

Each Grantor hereby waives notice of the time and place of any public sale or the time after which any private sale or other disposition of all or any part of the Collateral may be made.

Under Article 9 of the UCC, a secured creditor's remedies include a sale of its collateral. As with a sale under section 363 of the Bankruptcy Code, the secured lender may choose to credit bid in connection with a sale of its collateral and thereby become the owner of the collateral.

If you don't pay a debt secured by personal property, the creditor has the right to take the property pledged as collateral for the loan. The creditor can't just walk into your house and take your couch, however. The creditor must have a court order or permission from someone in your household to enter your home.

Perfection by Possession: A secured creditor can perfect his or her security interest by taking possession of the collateral until the debtor has paid the debt for which the collateral was pledged.