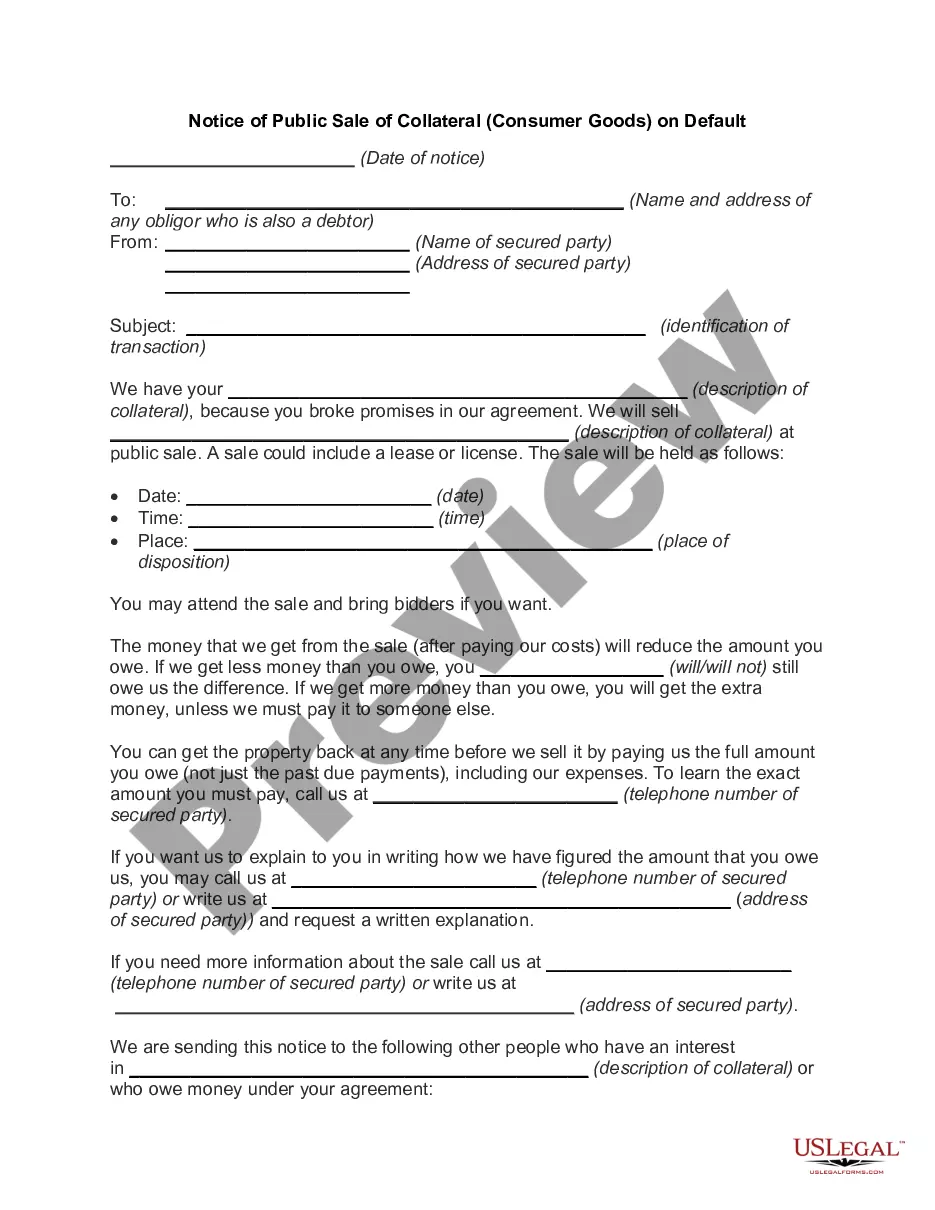

Title: Understanding Palm Beach, Florida's Notice of Public Sale of Collateral (Consumer Goods) on Default — Everything You Need to Know Introduction: Palm Beach, Florida, renowned for its beautiful beaches and luxurious lifestyle, occasionally sees instances where individuals default on their loans or financial obligations, leading to the issuance of a Notice of Public Sale of Collateral (Consumer Goods) on Default. In this article, we will provide you with a detailed description of what this notice entails, shed light on its significance, and outline any potential variations or types related to Palm Beach. Keywords: Palm Beach, Florida, Notice of Public Sale of Collateral, Consumer Goods, Default. 1. Essential Components of a Palm Beach, Florida Notice of Public Sale of Collateral: When an individual defaults on a loan secured by consumer goods in Palm Beach, Florida, a Notice of Public Sale of Collateral is issued. This notice serves several purposes and contains crucial information, such as: — Identity of the defaulting party (borrower) — Description of the collateral being sold — Date, time, and location of the public sale — Terms and conditionpalatalal— - Contact details of the party issuing the notice — Any additional legal obligations imposed on the borrower 2. Significance of Notice of Public Sale of Collateral (Consumer Goods) on Default: This notice is significant as it fulfills legal requirements, provides transparency to all parties involved, and safeguards the rights of the debtor and creditor. By publicly announcing the sale, interested parties have an opportunity to participate, potentially recover their debts, or ensure a fair valuation of the consumer goods. 3. Types of Palm Beach, Florida Notice of Public Sale of Collateral: While the core components of the notice remain relatively consistent, different variations may arise depending on the nature of the default and type of consumer goods involved. Listed below are a few possible types: — Automotive Collateral: In cases where the default is related to an auto loan, a specific Notice of Public Sale of Automotive Collateral on Default may be issued. This notice focuses on automobile-related details such as make, model, and vehicle identification number (VIN). — Residential Collateral: If consumer goods securing the loan include real estate properties, a Notice of Public Sale of Residential Collateral on Default could be issued, highlighting relevant property details, location, and additional legal requirements applicable to real estate transactions. — Personal Property Collateral: For loans involving personal property as collateral, a Notice of Public Sale of Personal Property Collateral on Default is used, including descriptions and details of items such as jewelry, furniture, or electronics. Conclusion: The Notice of Public Sale of Collateral (Consumer Goods) on Default is a vital aspect of the legal process in Palm Beach, Florida. It ensures transparency, protects the rights of involved parties, and facilitates the recovery of debt. Understanding the contents and variations of this notice empowers both creditors and debtors to navigate the situation correctly and act accordingly to enforce or protect their interests.

Palm Beach Florida Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Palm Beach Florida Notice Of Public Sale Of Collateral (Consumer Goods) On Default?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Palm Beach Notice of Public Sale of Collateral (Consumer Goods) on Default without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Palm Beach Notice of Public Sale of Collateral (Consumer Goods) on Default by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Palm Beach Notice of Public Sale of Collateral (Consumer Goods) on Default:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!