Los Angeles California Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage is an important legal document that serves as a formal notice to the borrower regarding the lender's intention to initiate foreclosure proceedings on their property in Los Angeles, California. This notice contains crucial information about the foreclosure process and outlines the borrower's potential liability for any deficiency that may arise after the property is sold at auction. The notice typically includes key details such as the borrower's name, address, and loan account number, as well as the lender's information. It informs the borrower of the lender's intention to foreclose on the property due to non-payment or breach of the mortgage agreement. This notice acts as a warning and gives the borrower an opportunity to take necessary actions to rectify the default or explore alternatives, such as loan modification or short sale. The Los Angeles California Notice of Intention to Foreclose is designed to comply with state laws and regulations, ensuring that the borrower is aware of the pending foreclosure and understands the potential consequences. Lenders are required to send this notice a specific number of days before initiating foreclosure proceedings, allowing the borrower time to either cure the default or seek legal advice. Regarding the liability for deficiency after foreclosure, there are two types commonly associated with Los Angeles, California: 1. Judicial Foreclosure: In some cases, lenders may choose to pursue judicial foreclosure, which involves filing a lawsuit against the borrower in court. If the property is sold at auction and the proceeds do not cover the outstanding loan amount, the lender may seek a deficiency judgment against the borrower for the remaining balance. This type of notice outlines the borrower's potential liability for the deficiency and informs them of their rights in the legal process. 2. Non-Judicial Foreclosure: This type of foreclosure, also known as "trustee sale," does not involve court intervention. Instead, the lender follows a specific procedure outlined in the mortgage or deed of trust. If the property is sold at auction and the proceeds are insufficient to cover the outstanding loan balance, the borrower may still be liable for the deficiency amount. The Notice of Intention to Foreclose in a non-judicial foreclosure will provide information regarding the borrower's liability and any available options to mitigate their loss. It is important for borrowers in Los Angeles, California, who receive a Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage to seek legal advice promptly. This will help them fully understand their rights and options, such as negotiating a settlement, pursuing a loan modification, or exploring legal defenses to foreclosure. By adhering to the relevant keywords in this content, such as Los Angeles California, Notice of Intention to Foreclose, Liability for Deficiency, and Foreclosure of Mortgage, it can effectively capture the essence of the topic and provide valuable information for readers seeking details about the foreclosure process in the region.

Los Angeles California Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

How to fill out Los Angeles California Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Los Angeles Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities associated with document completion straightforward.

Here's how to purchase and download Los Angeles Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

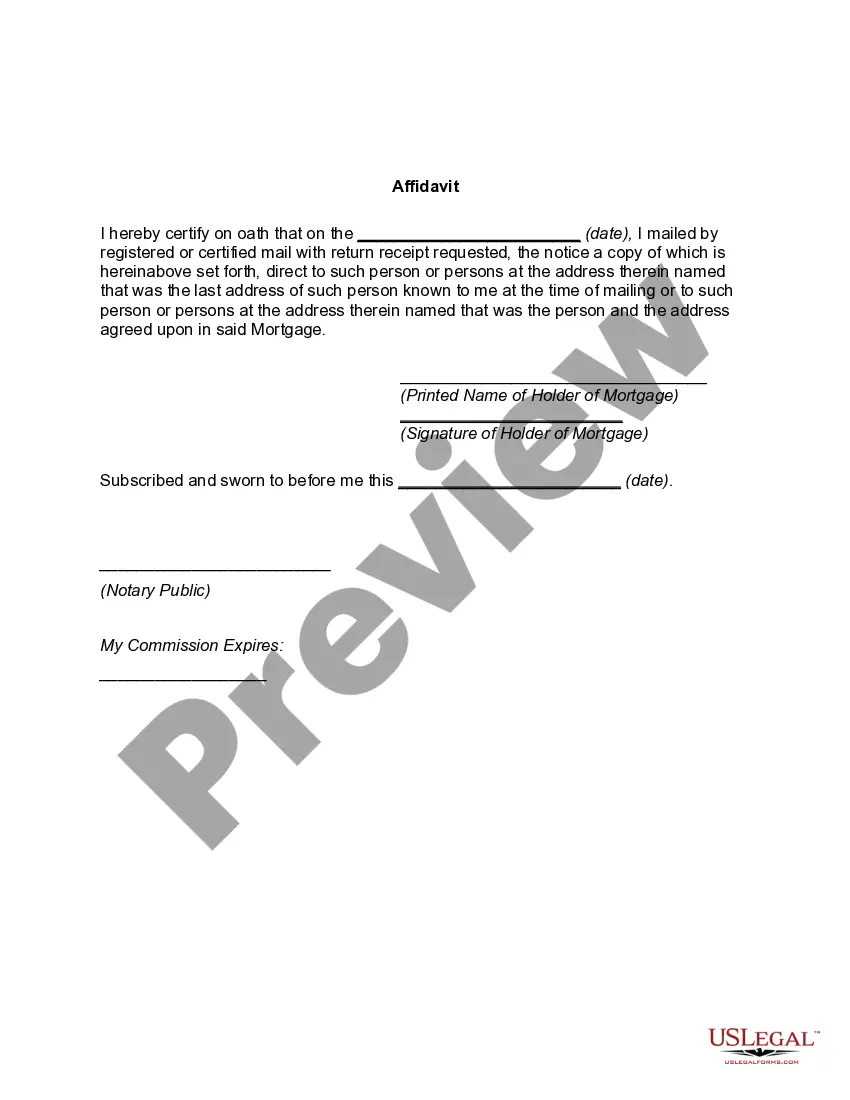

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the legality of some records.

- Check the related forms or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Los Angeles Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Los Angeles Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to deal with an exceptionally complicated case, we recommend using the services of a lawyer to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!