Suffolk County, located in the state of New York, employs a specific legal process known as the Notice of Intention to Foreclose and Liability for Deficiency after Foreclosure of Mortgage. This process is vital in outlining the responsibilities and consequences for all parties involved in mortgage default scenarios within the jurisdiction. The Suffolk New York Notice of Intention to Foreclose serves as an official notification provided to property owners who have fallen behind on their mortgage payments. This document signifies the lender's intent to initiate foreclosure proceedings if the outstanding debt is not addressed promptly. The notice is typically delivered by certified mail or through personal service, ensuring its legal validity and receipt by the property owner. Once the foreclosure process is initiated, it is crucial for property owners to be aware of the potential liability for deficiency that may arise. The Suffolk New York Notice of Liability for Deficiency after Foreclosure of Mortgage emphasizes the potential monetary consequences that property owners may face following the completion of a foreclosure sale. To further understand the different types of Suffolk New York Notice of Intention to Foreclose and Liability for Deficiency after Foreclosure of Mortgage, it is essential to consider various circumstances that may result in these notices being issued: 1. Standard Notice of Intention to Foreclose: This notice is typically sent to property owners who have failed to meet their mortgage payment obligations for an extended period, prompting the lender to officially declare their intention to initiate foreclosure proceedings. 2. Acceleration Notice of Intention to Foreclose: In situations where property owners have violated the terms of their mortgage agreement, such as engaging in fraudulent activities or transferring ownership without consent, lenders may issue an acceleration notice. This notice accelerates the due date of the entire outstanding loan amount, making the full balance immediately payable. 3. Notice of Intent to Foreclose on a Delinquent Tax Lien: In Suffolk County, property owners who fall behind on their property tax payments may receive a notice specific to their tax delinquency. This notice emphasizes the potential foreclosure action being pursued by the county if the tax lien remains unpaid. 4. Notice of Liability for Deficiency after Foreclosure of Mortgage: Once a foreclosure sale is completed, there is a possibility that the property's sale price may not cover the full outstanding mortgage debt. In such cases, the lender may issue a notice to the property owner, alerting them to the potential liability for the remaining deficiency. This notice explains the property owner's responsibility to repay the shortfall amount, which could have legal implications if left unresolved. Suffolk County's comprehensive system of notices relating to foreclosure and deficiency liability serves to ensure transparency and clarity throughout the mortgage default and foreclosure process. It is essential for property owners to carefully review and understand the implications outlined in these notices, seeking legal advice if necessary, to protect their rights and make informed decisions moving forward.

Suffolk New York Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

How to fill out Suffolk New York Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

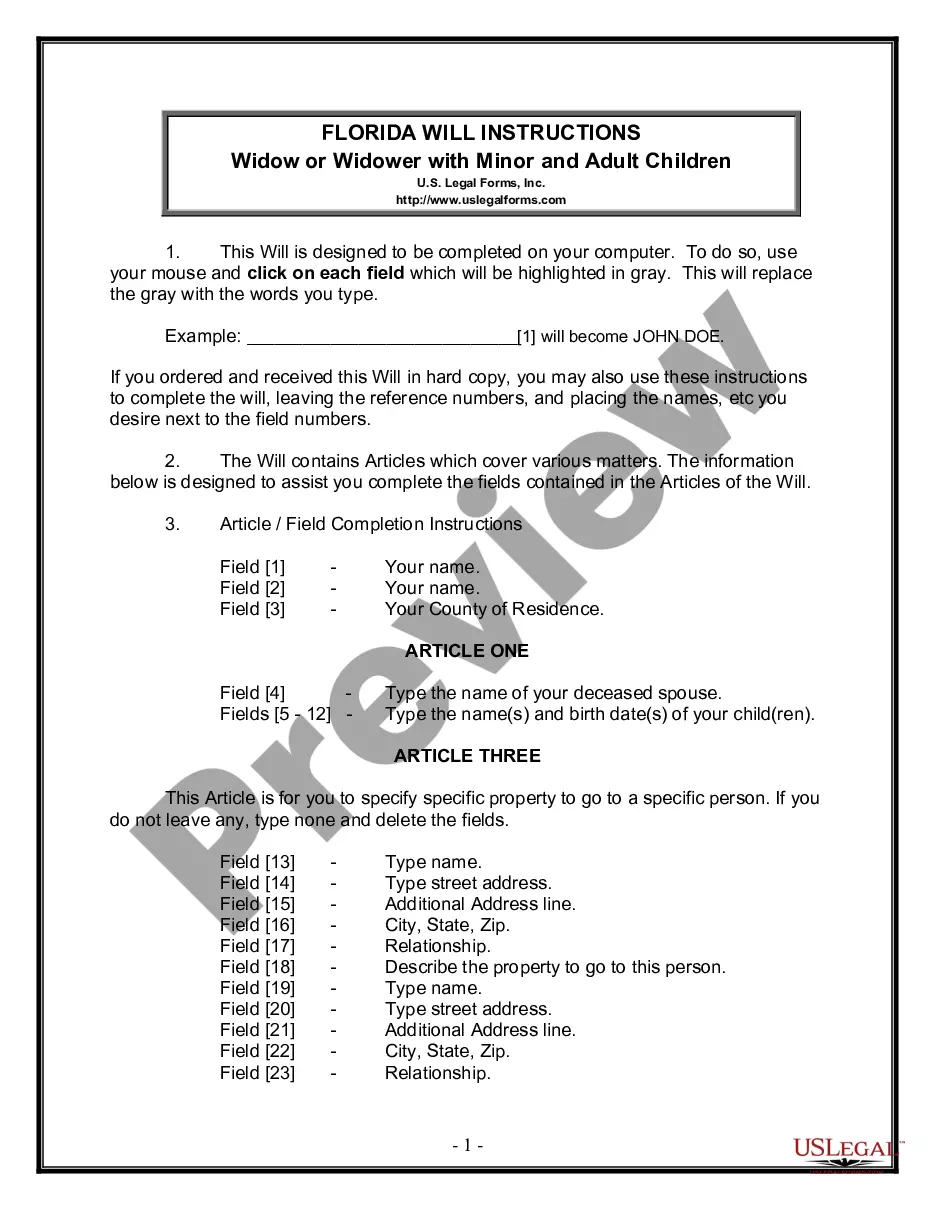

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Suffolk Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any activities associated with paperwork completion simple.

Here's how you can locate and download Suffolk Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar document templates or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase Suffolk Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Suffolk Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to cope with an extremely difficult situation, we advise getting a lawyer to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-specific paperwork with ease!