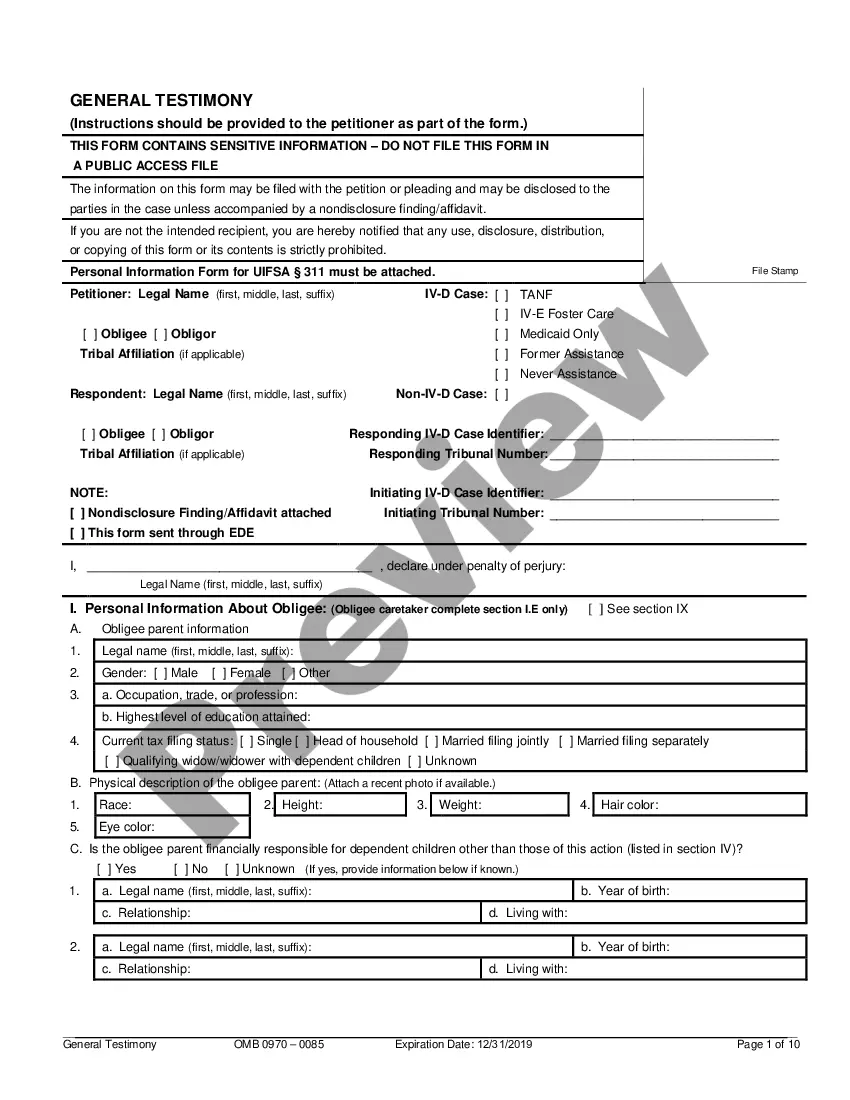

Allegheny Pennsylvania Surety Agreement is a legal contract that establishes a surety bond between three parties, namely the principal, the surety, and the obliged. This agreement serves as a guarantee that the principal will fulfill their obligations and commitments as stated in the contract, providing financial security to the obliged in case of default or failure to meet the agreed terms. The Allegheny Pennsylvania Surety Agreement plays a vital role in various industries, including construction, real estate, licensing, and other businesses requiring a guarantee of performance or payment. It ensures that the obliged is protected against any potential losses resulting from the principal's non-compliance or inability to meet contractual obligations. There are different types of Allegheny Pennsylvania Surety Agreements, each serving a specific purpose: 1. Performance Bond: In construction projects, this type of surety agreement guarantees that the principal will complete the project as specified in the contract. It protects the project owner (obliged) from financial loss in case the principal fails to deliver the completed project as promised. 2. Payment Bond: This type of surety agreement ensures that subcontractors, suppliers, and laborers involved in a construction project will be paid by the principal. It provides financial security to the beneficiaries (obliges) in case the principal fails to fulfill their payment obligations. 3. License and Permit Bond: This surety agreement is often required by government agencies for individuals or businesses seeking licenses or permits. It guarantees compliance with applicable laws and regulations, ensuring financial compensation for any potential damages caused by the principal's actions. 4. Court Bond: This type of surety agreement assures the court of financial compensation in legal proceedings. It may include appeal bonds, injunction bonds, or probate bonds, among others. Court bonds safeguard the interests of plaintiffs, defendants, and beneficiaries, ensuring that the principal fulfills their obligations as ordered by the court. 5. Fidelity Bond: This surety agreement protects employers from dishonest acts committed by their employees, primarily related to theft, fraud, or embezzlement. It provides financial compensation to the employer in case of financial loss caused by the employee's actions. It is important for all parties involved to understand the terms and conditions stated in the Allegheny Pennsylvania Surety Agreement. By establishing such an agreement, the principal showcases their commitment to fulfill their obligations, the surety acts as a guarantor of this commitment, and the obliged gains assurance and financial protection.

Allegheny Pennsylvania Surety Agreement

Description

How to fill out Allegheny Pennsylvania Surety Agreement?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Allegheny Surety Agreement is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Allegheny Surety Agreement. Follow the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Surety Agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!