Franklin Ohio Surety Agreement is a legally binding contract that establishes the responsibilities and obligations between a principal, a surety, and an obliged. The principal is the party who is required to perform a certain obligation or fulfill a specific task. The surety, on the other hand, is a third-party entity that provides a guarantee or assurance to the obliged that the principal will carry out the agreed-upon duties. This agreement is primarily used in various industries and business transactions in Franklin, Ohio, to ensure that the principal fulfills their contractual obligations. By entering into the surety agreement, the surety takes on the risk and liability of fulfilling the obligations if the principal fails to do so. In case of any breach or default by the principal, the obliged can seek financial compensation or performance from the surety. There are several types of Franklin Ohio Surety Agreements, namely: 1. Contract surety bonds: These agreements are commonly used in construction projects to guarantee the performance and completion of a project on time and as per the contractual requirements. 2. License and permit bonds: These agreements are required by certain government agencies in Franklin, Ohio, as a prerequisite for obtaining licenses or permits for specific activities, such as contractors, auto dealers, and mortgage brokers. 3. Court surety bonds: These agreements are mandated by courts in legal proceedings and are typically required to secure the release of funds or assets, provide indemnity, or facilitate the appeal process. 4. Public official surety bonds: These agreements are necessary for elected or appointed officials in Franklin, Ohio, as a safeguard against any fraudulent or unethical behavior, ensuring public trust and financial security. 5. Fidelity surety bonds: These agreements protect businesses from dishonest or fraudulent actions committed by their employees or agents, covering losses resulting from theft, embezzlement, or other acts of deceit. Franklin Ohio Surety Agreement plays a critical role in ensuring compliance, risk mitigation, and proper execution of contractual obligations in various sectors. It provides a sense of security for all parties involved, assuring that even if the principal fails to fulfill their duties, there is a financial backup to compensate for any losses incurred.

Franklin Ohio Surety Agreement

Description

How to fill out Franklin Ohio Surety Agreement?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Surety Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the latest version of the Franklin Surety Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Franklin Surety Agreement:

- Look through the page and verify there is a sample for your region.

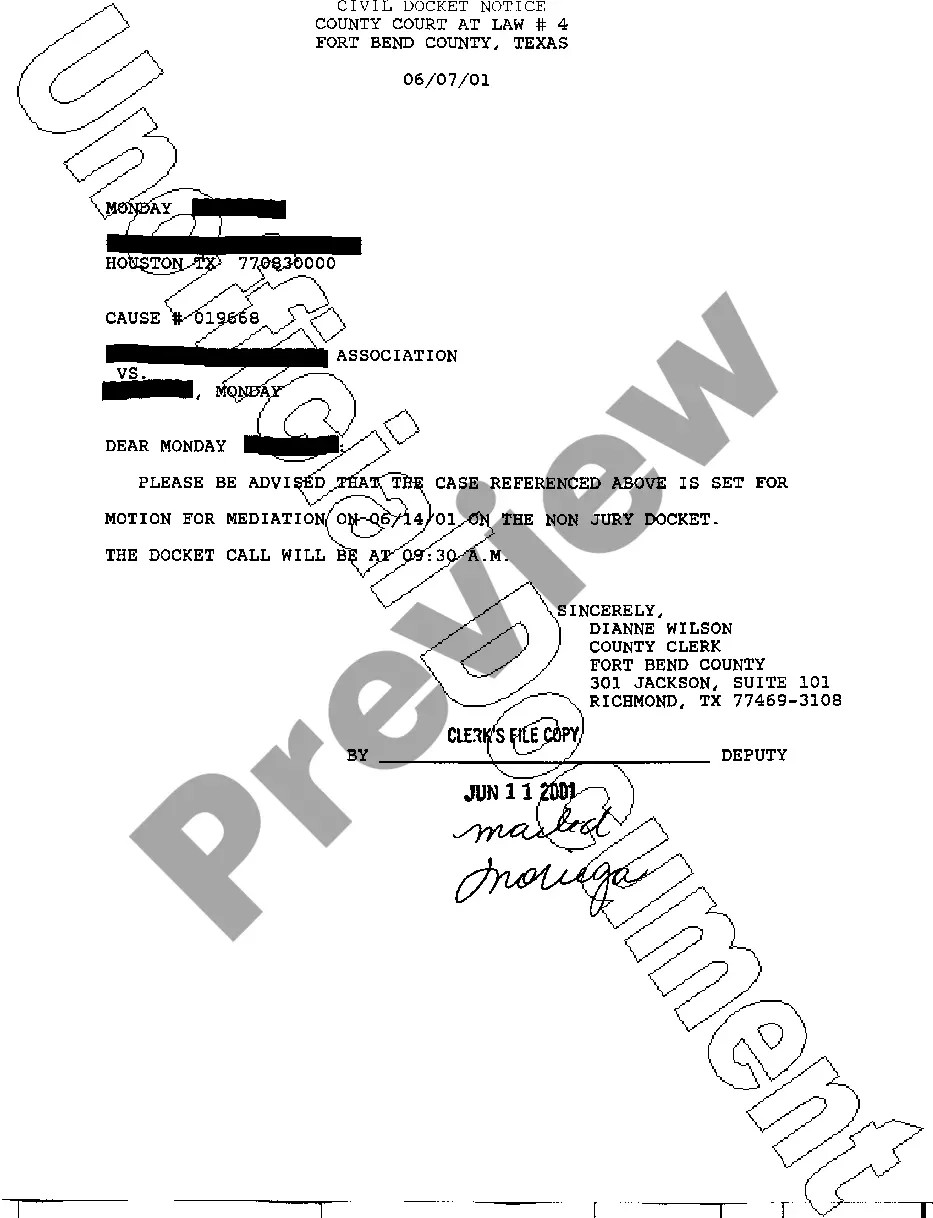

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Franklin Surety Agreement and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

You do not have to pay the full bond amount to get bonded. You will pay anywhere from 1-15% of the total bond amount. The best way to see what you'd pay for a Michigan surety bond is to get a free quote.

The first step to getting an Illinois surety bond is to apply for your bond. Not everyone can get approved for a bond, so this is the first step to getting bonded. Most companies all you to apply for your bond online. You can apply for a bond at your local insurance agency, or a specialized surety bond company.

What Do Pennsylvania Surety Bonds Cost? Surety bonds generally cost 1-15% of the required bond amount. Surety bond costs vary significantly depending on the bond amount that you need and your rate (which is the percentage of the full bond amount you must pay).

A surety bond is a three-party agreement between the principal, obligee, and surety.

Contract Surety Bonds Bid bonds guarantee that a contractor who puts in a bid will enter into a contract if the bid is accepted. Performance bonds guarantee that the contractor will fulfill the terms of the construction contract.

Surety bond premiums usually range from 1-15% of the total bond amount. For example, if you get quoted a 2% rate on a $50,000 bond, you will pay $1,000 for your surety bond.

In the state of Pennsylvania, bonds purchased from the NNA are mailed to you. If you need your bond delivery expedited, the NNA provides plenty of options for you. We offer Next Day and 2-Day delivery on all Notary surety bonds. Call 1-800-876-6827 and we will assist you with any expedited shipping request.

A surety bond is a form of insurance protection that is essentially a promise by one party to be liable for the debt, default, or failure of another party. They ensure that a service that is being performed by one party for another party is fully completed.

The most common type of surety bonds that are required from individuals and businesses are license and permit bonds, also known as commercial bonds. If you want to get a professional license as an auto dealer, freight broker, or one of a variety of other trades, you may need to post a license bond.

There are many types of surety bonds, and each state has its own bonding requirements for different industries. However, there are three major types of surety bonds that you should know: license and permit bonds, construction and performance bonds, and court bonds.

Interesting Questions

More info

Click the link for the surety bond application. How can I get a Surety Bond in Franklin County? For more information on how to get a surety bond: Call (502) 624.6600 Fax (502) 624.6627 E-mail: BailBondfranklincourt.gov How will the bond amount be determined? Performance bond offers a bond of at least 1 million to secure the performance of each party in the transaction and will not exceed 1% of the value of the property. The court will review this amount to determine whether the surety is suitable for the project and that it meets the terms of the agreement. For more information, please call (502) 624.6600 or visit.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.