A San Antonio Texas Security Interest Subordination Agreement is a legal document that determines the priority of security interests in a San Antonio, Texas jurisdiction. This agreement is typically used in situations where multiple parties have claims to the same collateral or assets, and it seeks to establish a hierarchy of rights in the event of default or bankruptcy. The purpose of a Security Interest Subordination Agreement is to establish the order in which creditors are entitled to receive repayment from the collateral or assets in the event of a foreclosure or liquidation. By signing this agreement, parties involved voluntarily agree to subordinate their claim or security interest to another party, thus allowing them to have priority in the event of default. Some common types of San Antonio Texas Security Interest Subordination Agreements include: 1. Real Estate Subordination Agreement: This type of agreement is used when there are multiple loans or liens on a property. It establishes the priority of repayment in case of foreclosure or sale of the property. 2. Vehicle Subordination Agreement: This agreement is often used in situations where there are multiple loans or liens on a vehicle. It determines the order in which the creditors will be paid if the vehicle is repossessed and sold. 3. Business Asset Subordination Agreement: In cases where a business has multiple loans or liens on its assets, this agreement sets out the priority of repayment in the event of default or liquidation. 4. Intellectual Property Subordination Agreement: This type of agreement is specific to intellectual property rights, such as patents, trademarks, or copyrights. It establishes the priority of rights and claims when multiple parties have an interest in the same intellectual property. In conclusion, a San Antonio Texas Security Interest Subordination Agreement is a crucial legal document used to determine the order of repayment in cases of default or bankruptcy. It ensures that parties with security interests are paid in an orderly and fair manner. Various types of agreements exist, depending on the nature of the collateral or assets involved, such as real estate, vehicles, business assets, and intellectual property.

San Antonio Texas Security Interest Subordination Agreement

Description

How to fill out San Antonio Texas Security Interest Subordination Agreement?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the San Antonio Security Interest Subordination Agreement.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the San Antonio Security Interest Subordination Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the San Antonio Security Interest Subordination Agreement:

- Ensure you have opened the correct page with your localised form.

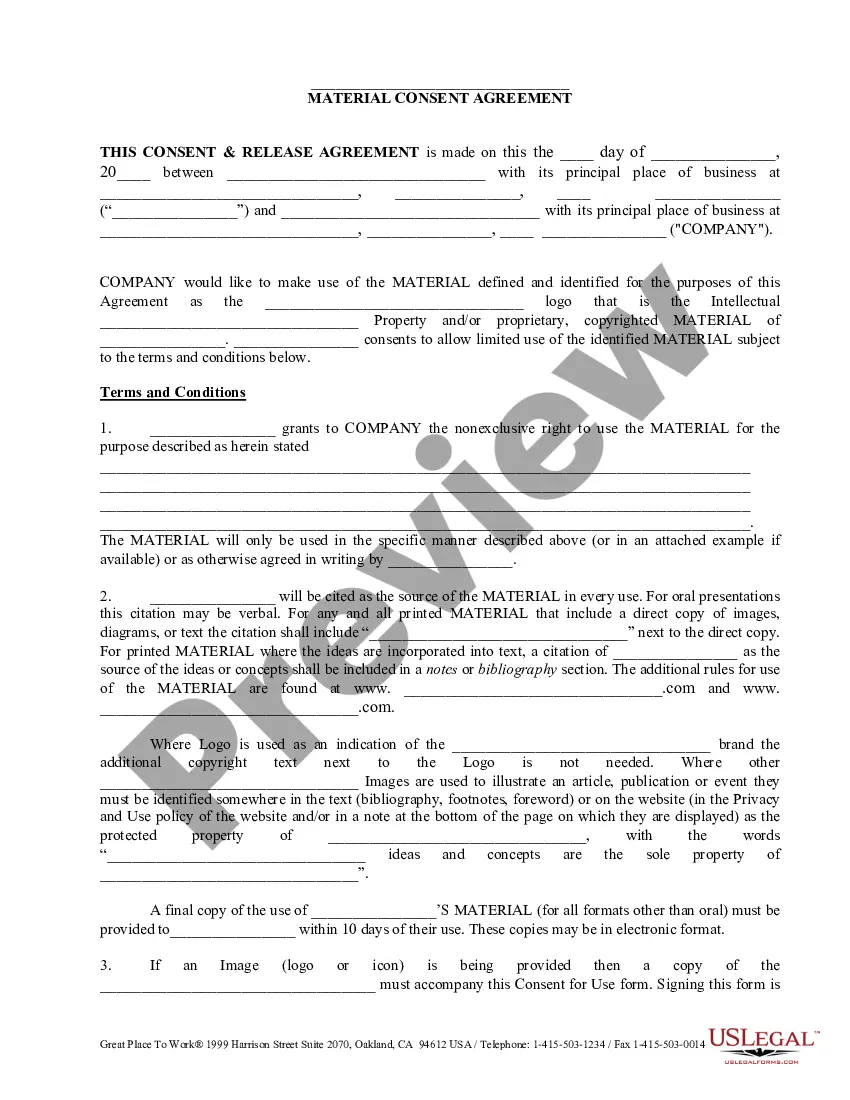

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the San Antonio Security Interest Subordination Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!