A Harris Texas Subordination Agreement Subordinating Existing Mortgage to New Mortgage is a legal document that allows a borrower to prioritize one mortgage over another when refinancing or taking out a new loan. This agreement is commonly used in real estate transactions to ensure that the new mortgage lender gets a higher priority lien on the property in the event of default. In Harris County, Texas, there are two types of subordination agreements commonly used: general subordination agreements and specific subordination agreements. A general subordination agreement applies to all existing mortgages on the property, subordinating them to the new mortgage. This is often necessary when the borrower wants to refinance their property or take out a new loan with a different lender. By signing this agreement, the borrower is allowing the new lender to have a first lien position on the property, while the existing mortgages become secondary liens. On the other hand, a specific subordination agreement applies to a particular existing mortgage and allows the borrower to prioritize the new mortgage over that specific loan. This type of agreement is usually utilized when the borrower wants to take out a second mortgage or obtain a home equity loan while keeping the current mortgage intact. Executing a Harris Texas Subordination Agreement Subordinating Existing Mortgage to New Mortgage involves various steps. Firstly, both the existing and new lenders (or their representatives) need to agree to the terms of the subordination agreement. Once the agreement is reached, the borrower must sign the document and have it notarized. It is crucial to understand that the subordination agreement is a legally binding contract, thus it should be reviewed by legal professionals to ensure compliance with state laws and to protect the rights of all parties involved. In conclusion, a Harris Texas Subordination Agreement Subordinating Existing Mortgage to New Mortgage is an essential legal tool used in real estate transactions. Whether it's a general or specific subordination agreement, it clarifies the lien priority of mortgages, ensuring that the new lender's rights are protected. It is crucial to consult with legal professionals to draft and review the agreement accurately.

Harris Texas Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Harris Texas Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

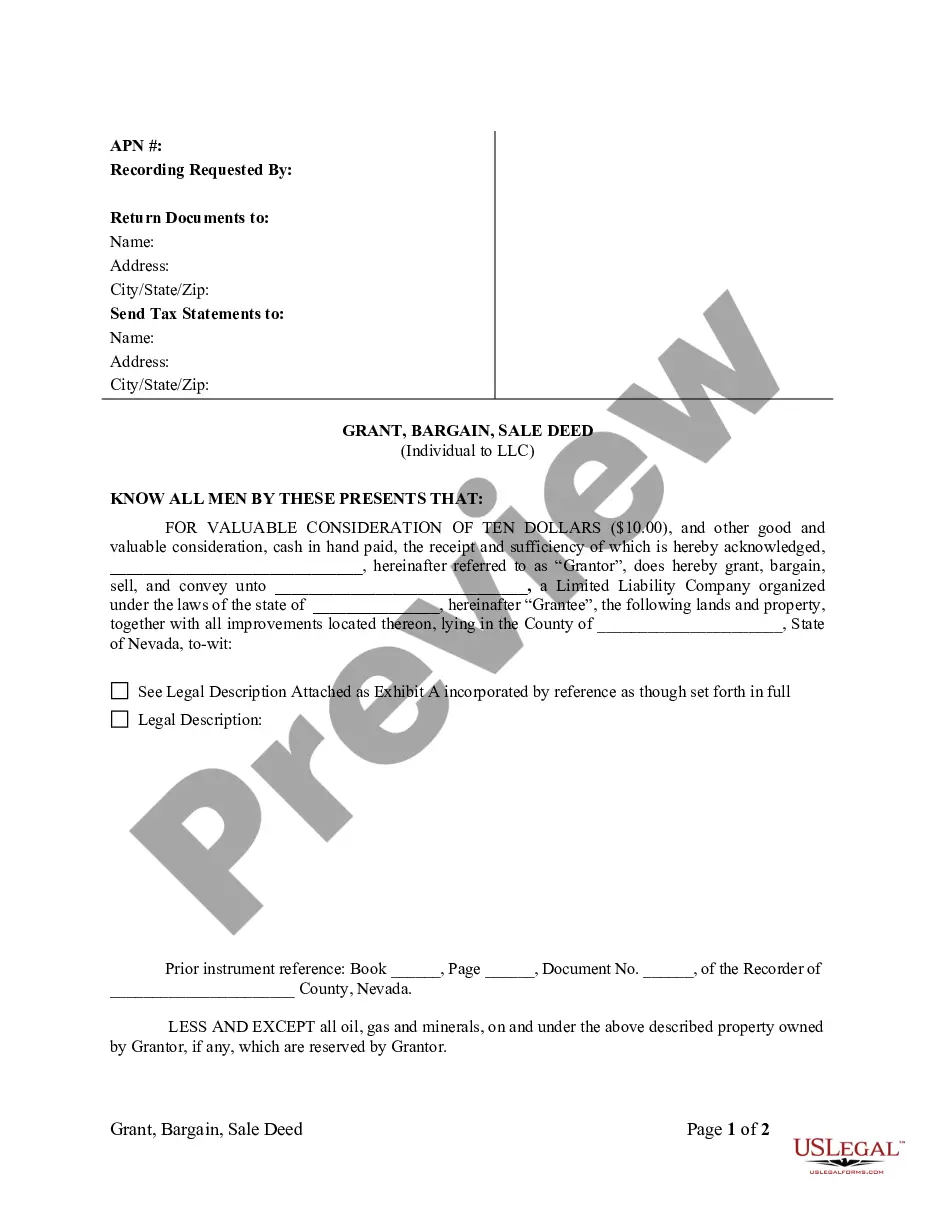

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Harris Subordination Agreement Subordinating Existing Mortgage to New Mortgage, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities related to paperwork execution straightforward.

Here's how to purchase and download Harris Subordination Agreement Subordinating Existing Mortgage to New Mortgage.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the similar document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and purchase Harris Subordination Agreement Subordinating Existing Mortgage to New Mortgage.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Harris Subordination Agreement Subordinating Existing Mortgage to New Mortgage, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you have to deal with an extremely difficult situation, we advise getting a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!