A Nassau New York Subordination Agreement Subordinating Existing Mortgage to New Mortgage is a legal contract that outlines the relationship between multiple mortgages on a property in Nassau County, New York. This agreement is typically used when a property owner wishes to refinance or obtain a new loan while still having an existing mortgage in place. In this agreement, the existing mortgage is subordinated to the new mortgage, meaning that the new mortgage takes priority in terms of lien position. This allows the borrower to secure additional financing without the existing mortgage interfering with the new loan. By subordinating the existing mortgage, the lender of the new mortgage is protected in the event of default or foreclosure. Keywords: Nassau New York, Subordination Agreement, Subordinating Existing Mortgage, New Mortgage, refinance, loan, lien position, borrower, financing, default, foreclosure. Different types of Nassau New York Subordination Agreement Subordinating Existing Mortgage to New Mortgage may include: 1. Home Equity Line of Credit (HELOT) Subordination: This type of subordination agreement is used when a borrower wants to obtain a HELOT on a property with an existing mortgage. By subordinating the existing mortgage to the HELOT, the borrower can access additional funds while maintaining the priority of the HELOT. 2. Cash-Out Refinance Subordination: If a homeowner wishes to refinance their existing mortgage and take out extra cash from the equity, they may need a subordination agreement. This agreement would subordinate the existing mortgage to the new cash-out refinance loan. 3. Construction Loan Subordination: When a property owner wants to secure a construction loan while an existing mortgage is still in place, a subordination agreement must be obtained. This protects the lender of the construction loan by ensuring their lien position is superior to the existing mortgage. 4. Second Mortgage Subordination: If a homeowner wants to take out a second mortgage on their property while still owing on the first mortgage, a subordination agreement is required. Subordinating the first mortgage to the second mortgage allows the borrower to access additional funds or consolidate debt. In summary, a Nassau New York Subordination Agreement Subordinating Existing Mortgage to New Mortgage is a legal contract that prioritizes a new mortgage over an existing mortgage on a property. With various types of subordination agreements available, borrowers can refinance, take out additional loans, or secure construction financing while ensuring lenders have proper lien positions in Nassau County, New York.

Nassau New York Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Nassau New York Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Nassau Subordination Agreement Subordinating Existing Mortgage to New Mortgage, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Nassau Subordination Agreement Subordinating Existing Mortgage to New Mortgage from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Nassau Subordination Agreement Subordinating Existing Mortgage to New Mortgage:

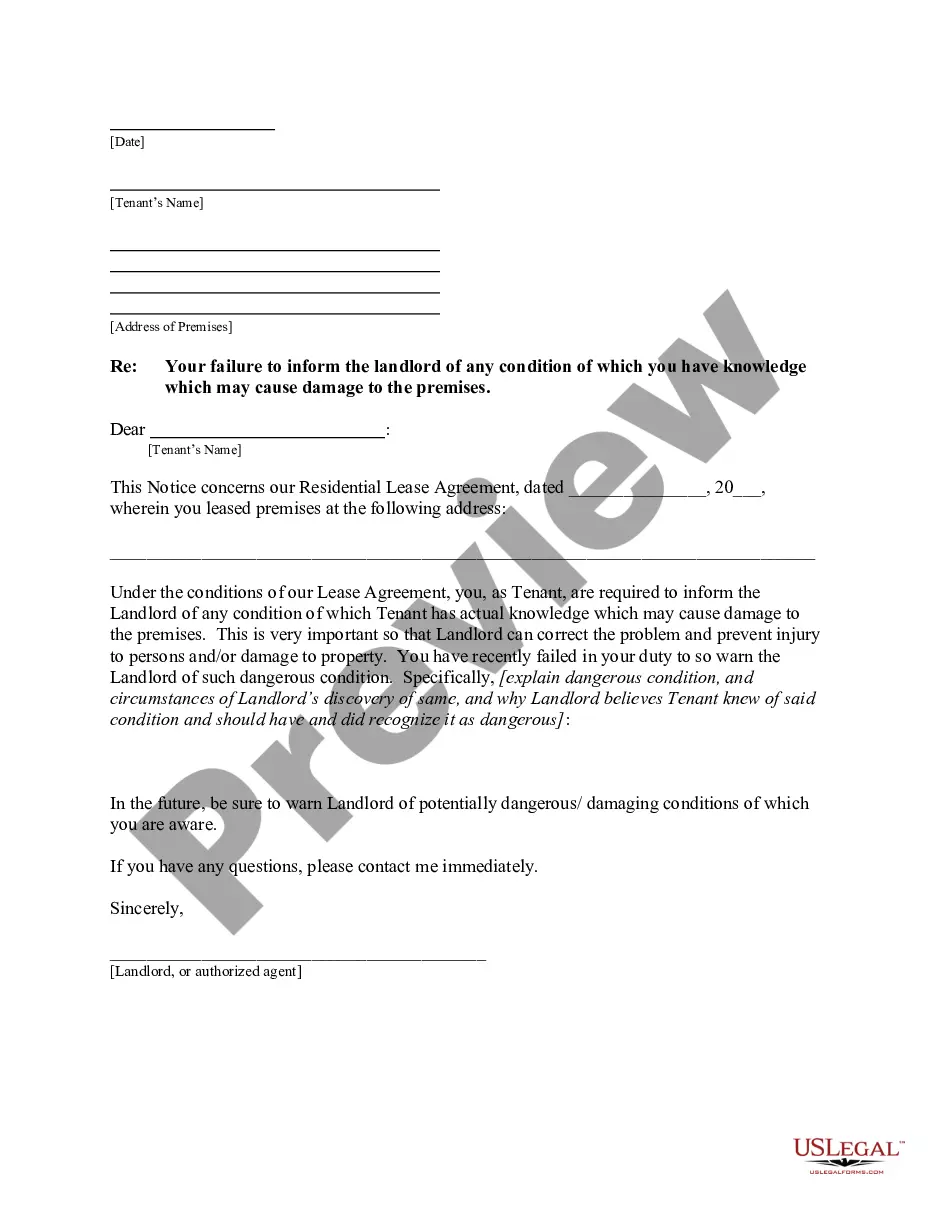

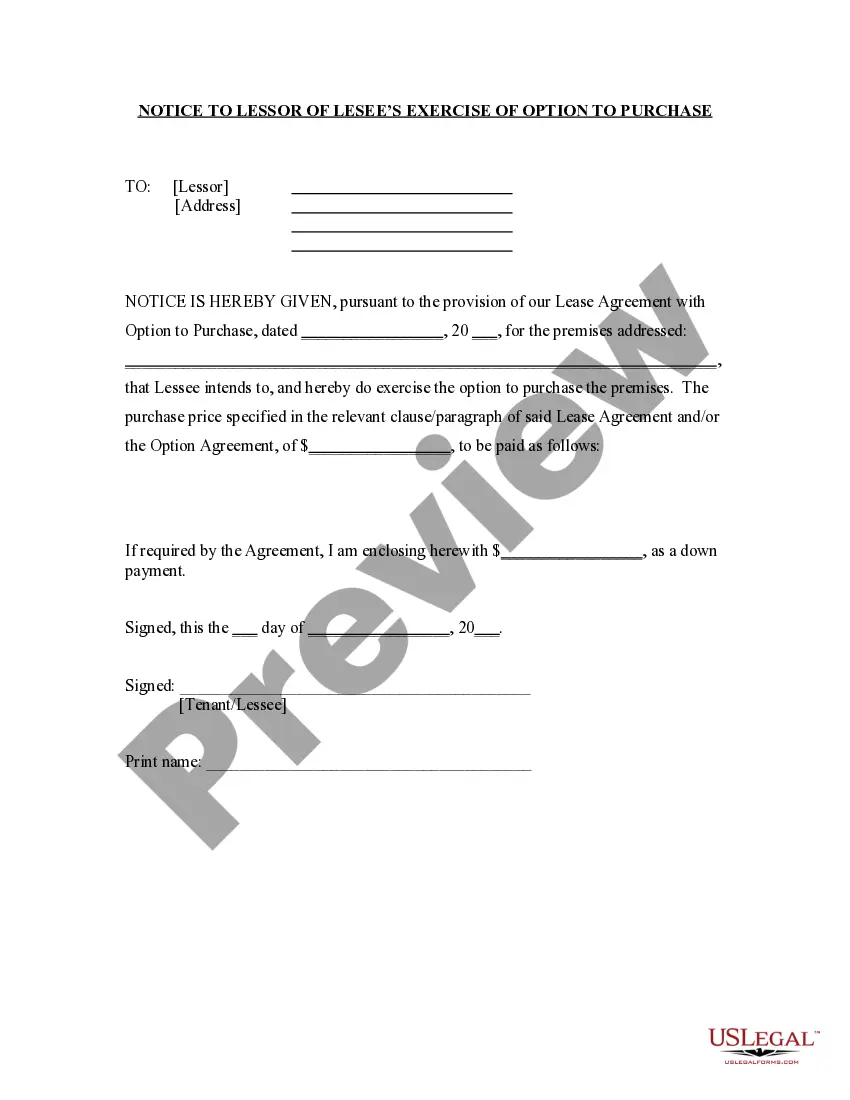

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!