The Cook Illinois Commission Buyout Agreement Insurance Agent refers to a specific type of insurance agent who specializes in handling commission buyout agreements for Cook County, Illinois residents. This agent assists individuals in understanding, negotiating, and obtaining insurance policies that cover the risks associated with commission buyout agreements. Keywords: Cook Illinois, Commission Buyout Agreement, Insurance Agent, Cook County, residents, insurance policies, risks, negotiate, understanding. Different types of Cook Illinois Commission Buyout Agreement Insurance Agents: 1. Life Insurance Agent: This type of agent offers life insurance policies that protect individuals involved in commission buyout agreements from the financial impact of unexpected events like disability or death. They assess the risk and provide suitable coverage options. 2. Disability Insurance Agent: These agents specialize in disability insurance coverage tailored for individuals participating in commission buyout agreements. They help protect clients by offering policies that provide income replacement in the event of disability preventing them from fulfilling their agreement. 3. Liability Insurance Agent: Liability insurance agents focus on policies that protect individuals in commission buyout agreements from potential lawsuits and legal claims. This coverage safeguards them in case of a breach of contract or other issues related to the agreement. 4. Property and Casualty Insurance Agent: This category of agents provides insurance solutions designed to protect the physical and financial assets involved in commission buyout agreements. They offer coverage against property damage, theft, or natural disasters that may impact the assets. 5. Legal Insurance Agent: Legal insurance agents assist clients in obtaining policies that cover the legal expenses related to commission buyout agreements. They ensure that individuals have the necessary support in case of any legal disputes or challenges. In summary, the Cook Illinois Commission Buyout Agreement Insurance Agent specializes in helping Cook County residents analyze and navigate the risks associated with commission buyout agreements. Various types of insurance agents cater to different aspects, such as life insurance, disability insurance, liability insurance, property and casualty insurance, and legal insurance. These agents aim to provide clients with comprehensive coverage that mitigates potential financial losses and protects their interests throughout the agreement period.

Cook Illinois Commission Buyout Agreement Insurance Agent

Description

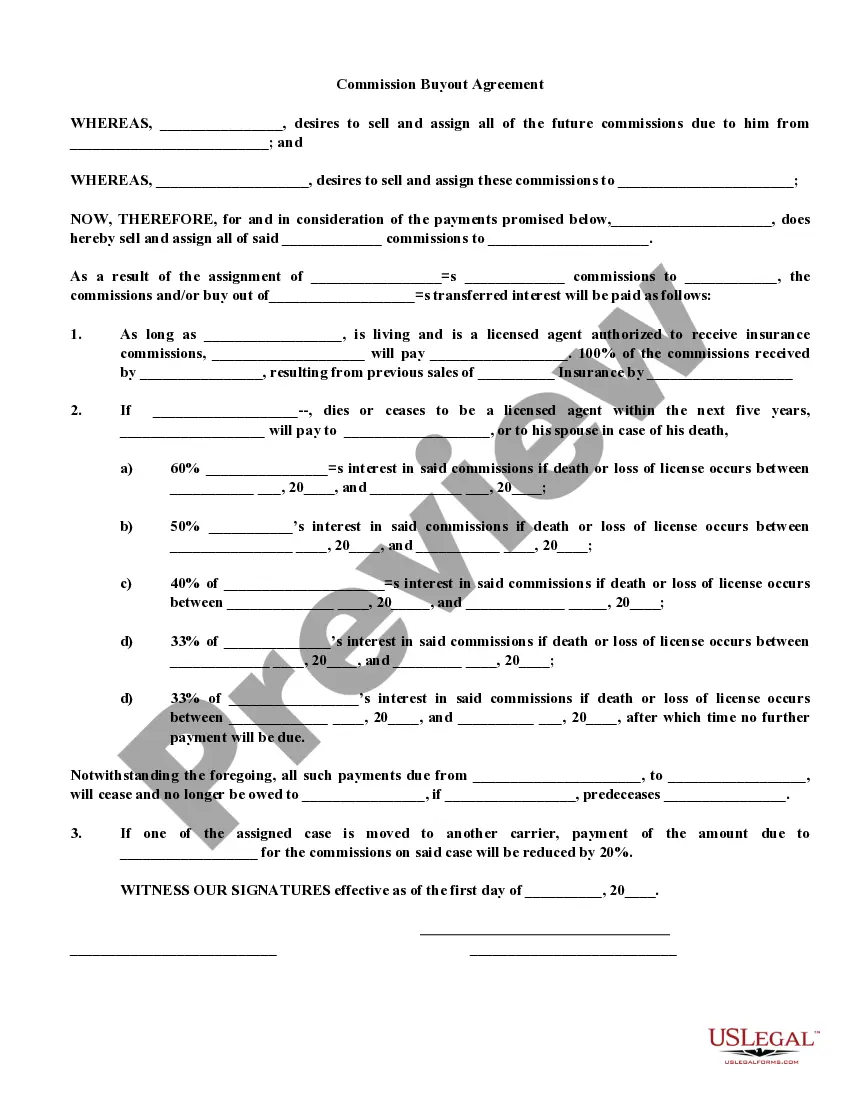

How to fill out Cook Illinois Commission Buyout Agreement Insurance Agent?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Cook Commission Buyout Agreement Insurance Agent, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Cook Commission Buyout Agreement Insurance Agent from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cook Commission Buyout Agreement Insurance Agent:

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!