Title: Understanding Maricopa Arizona Commission Buyout Agreement Insurance Agents: Types and Descriptions Introduction: Maricopa, Arizona, is home to several Commission Buyout Agreement Insurance Agents who specialize in assisting individuals, businesses, and organizations with their insurance needs. These agents play a crucial role in negotiating and finalizing commission buyout agreements, thus ensuring a smooth transition for their clients. Let's delve into the different types of Maricopa Arizona Commission Buyout Agreement Insurance Agents and understand their unique offerings. 1. Life Insurance Commission Buyout Agreement Agents: Life insurance commission buyout agreement agents in Maricopa, Arizona, are experts in handling life insurance policies. They possess extensive knowledge about the intricacies of commission buyout agreements associated with life insurance, such as policy transfer, beneficiary changes, surrender value calculations, and payout options. These agents guide clients through the entire buyout process while providing valuable insights and strategies to maximize returns. 2. Health Insurance Commission Buyout Agreement Agents: Health insurance commission buyout agreement agents are well-versed in the complex world of health insurance. They focus on helping individuals and businesses navigate through commission buyout agreements related to health insurance policies. These agents guide clients to ensure a smooth transition, optimizing coverage benefits, understanding pre-existing conditions clauses, and evaluating the impact on premiums and deductible limits. 3. Auto Insurance Commission Buyout Agreement Agents: Auto insurance commission buyout agreement agents specialize in handling automobile-related commission buyout agreements. They assist clients in transferring coverage, updating policy details, and ensuring a seamless switch between insurance providers. These agents possess in-depth knowledge of auto insurance regulations specific to Maricopa, Arizona, and assist clients in securing the most suitable coverage at competitive rates. 4. Home Insurance Commission Buyout Agreement Agents: Home insurance commission buyout agreement agents cater to clients seeking assistance with their homeowner's insurance policies. They navigate through the intricacies of commission buyout agreements related to home insurance, ensuring smooth policy transfer, updating property details, evaluating coverage limits, and understanding specific regional risks. These agents ensure that clients receive adequate coverage and protection for their homes. 5. Business Insurance Commission Buyout Agreement Agents: For businesses in Maricopa, Arizona, commission buyout agreement agents specializing in business insurance are pivotal. They possess an in-depth understanding of commercial insurance policies, including liability coverage, property insurance, and workers' compensation. These agents help businesses transition between insurers, ensuring uninterrupted coverage and optimizing policy terms to safeguard their assets and operations. Conclusion: Maricopa, Arizona, is home to a range of Commission Buyout Agreement Insurance Agents, each catering to unique insurance needs. Whether one requires assistance with life insurance, health insurance, auto insurance, home insurance, or business insurance, these agents provide expert guidance throughout the commission buyout process, ensuring smooth policy transfers and optimizing coverage. By partnering with a knowledgeable Maricopa Arizona Commission Buyout Agreement Insurance Agent, clients can secure the most suitable insurance solutions for their specific requirements.

Maricopa Arizona Commission Buyout Agreement Insurance Agent

Description

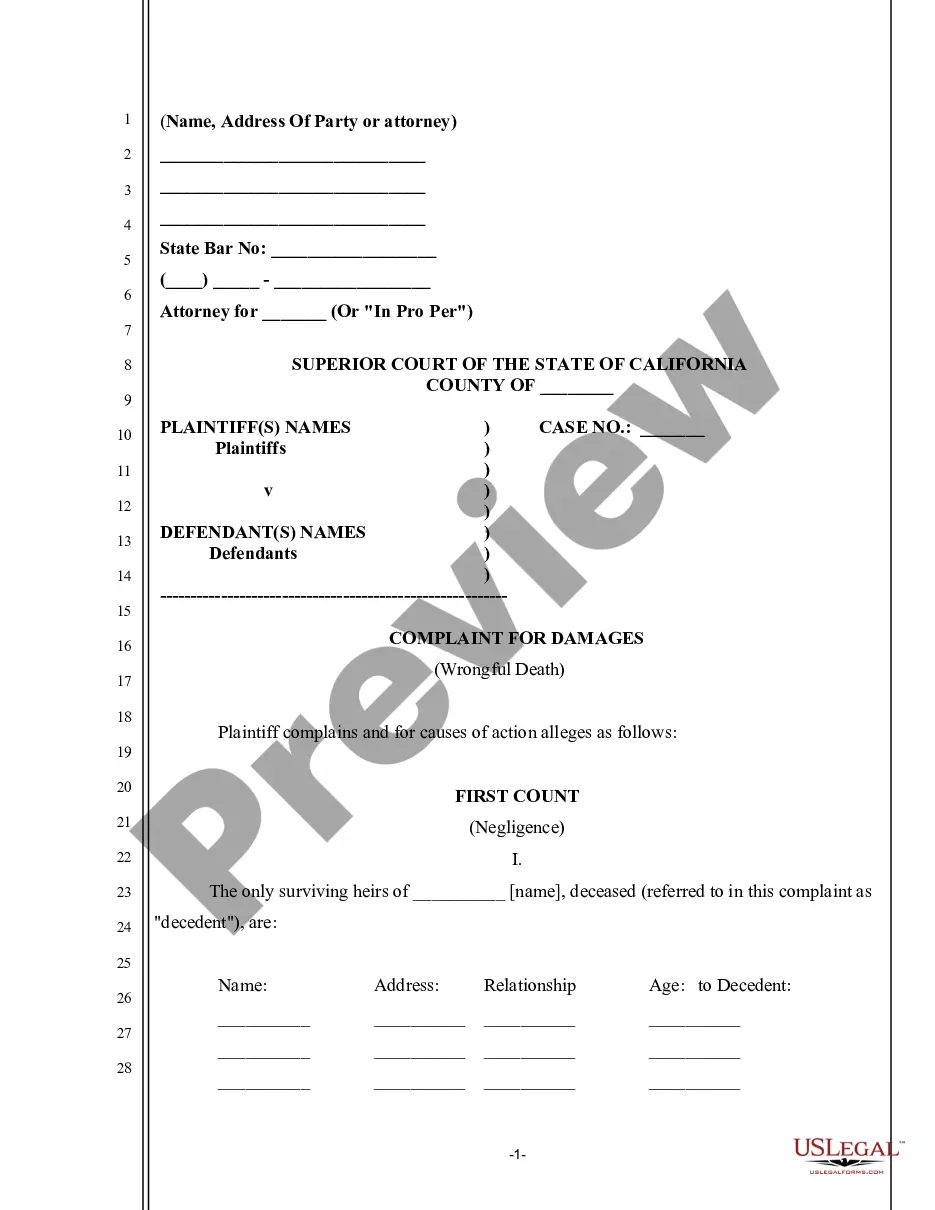

How to fill out Maricopa Arizona Commission Buyout Agreement Insurance Agent?

Creating paperwork, like Maricopa Commission Buyout Agreement Insurance Agent, to manage your legal affairs is a difficult and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Maricopa Commission Buyout Agreement Insurance Agent template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting Maricopa Commission Buyout Agreement Insurance Agent:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Maricopa Commission Buyout Agreement Insurance Agent isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start utilizing our website and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!