A Nassau New York Commission Buyout Agreement Insurance Agent is a professional insurance agent based in Nassau, New York, who specializes in commission buyout agreements. These agreements refer to agreements between insurance agencies and agents, which allow the agent to receive a lump sum payment in exchange for giving up future commissions on policies sold. This type of insurance agent plays a crucial role in assisting insurance agencies with managing their cash flow and financial planning. By offering commission buyout agreements, insurance agencies can provide agents with the option to access a lump sum of money upfront, rather than waiting for the commission payments to be received gradually over time. Nassau New York Commission Buyout Agreement Insurance Agents are well-versed in the insurance industry and possess in-depth knowledge of the local market trends and regulations specific to Nassau, New York. These agents are skilled negotiators who work closely with insurance agencies and agents to structure fair and mutually beneficial buyout agreements. Key responsibilities of a Nassau New York Commission Buyout Agreement Insurance Agent include conducting thorough assessments of an agent's commission structure, evaluating the financial viability of potential buyouts, and offering expert guidance to insurance agencies and agents regarding the terms and conditions of the agreement. Types of Nassau New York Commission Buyout Agreement Insurance Agents: 1. Life Insurance Commission Buyout Agreement Agent: This type of agent specializes in commission buyout agreements related to life insurance policies. 2. Health Insurance Commission Buyout Agreement Agent: These agents focus on commission buyout agreements pertaining to health insurance policies. 3. Property and Casualty Insurance Commission Buyout Agreement Agent: This agent is experienced in commission buyout agreements specific to property and casualty insurance policies. 4. Commercial Insurance Commission Buyout Agreement Agent: These agents specialize in commission buyout agreements relating to commercial insurance policies for businesses and organizations. By choosing a Nassau New York Commission Buyout Agreement Insurance Agent who specializes in a specific type of insurance, insurance agencies and agents can ensure they receive the most tailored and expert advice pertaining to their specific needs and circumstances. Overall, a Nassau New York Commission Buyout Agreement Insurance Agent is a highly knowledgeable and skilled professional who plays a pivotal role in facilitating commission buyout agreements and assisting insurance agencies and agents in navigating the complex landscape of insurance commissions and financial planning.

Nassau New York Commission Buyout Agreement Insurance Agent

Description

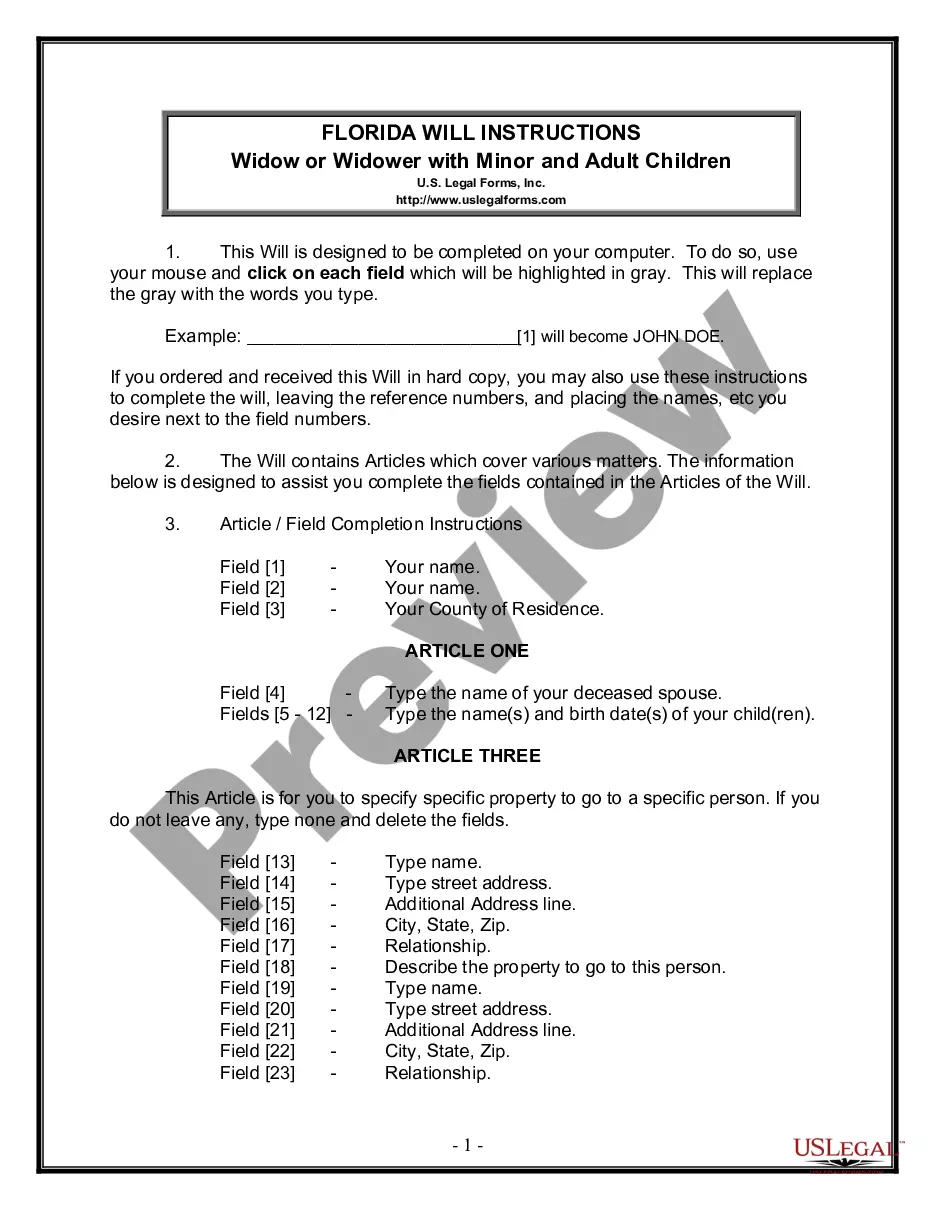

How to fill out Nassau New York Commission Buyout Agreement Insurance Agent?

Do you need to quickly draft a legally-binding Nassau Commission Buyout Agreement Insurance Agent or probably any other document to take control of your personal or business matters? You can go with two options: hire a legal advisor to write a legal document for you or draft it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get professionally written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific document templates, including Nassau Commission Buyout Agreement Insurance Agent and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, double-check if the Nassau Commission Buyout Agreement Insurance Agent is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Nassau Commission Buyout Agreement Insurance Agent template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!