Wake North Carolina Commission Buyout Agreement Insurance Agent is a professional who specializes in providing insurance services related to commission buyout agreements in the area of Wake, North Carolina. These insurance agents are well-versed in the intricacies of commission buyout agreements and offer valuable expertise to individuals and businesses involved in such agreements. Commission buyout agreements typically occur when a commission-based employee or contractor decides to receive a lump sum payout for future commissions instead of waiting for them to be paid out over a period of time. This arrangement provides the employee or contractor with immediate cash flow while allowing the employer or client to manage their finances and obligations more efficiently. In Wake, North Carolina, there are various types of commission buyout agreement insurance agents who cater to different needs and preferences: 1. Personal Commission Buyout Agreement Insurance Agent: These agents specialize in working with individuals who have commission-based income and are considering a buyout agreement. They provide personalized advice, assess the financial implications, and guide clients through the process. 2. Business Commission Buyout Agreement Insurance Agent: Businesses in Wake, North Carolina often seek the assistance of these agents when entering into commission buyout agreements with their sales team or independent contractors. These agents have extensive knowledge in the business context and help ensure smooth transactions and risk management. 3. Legal Commission Buyout Agreement Insurance Agent: These insurance agents have a legal background and specialize in commission buyout agreement policies. They collaborate closely with legal professionals to ensure compliance with local regulations, contract validity, and coverage adequacy. 4. Investment Commission Buyout Agreement Insurance Agent: These agents have expertise in investment strategies and financial planning. They assist individuals or businesses who wish to invest the lump sum acquired through a commission buyout agreement, providing tailored investment solutions according to their risk tolerance and financial goals. 5. Risk Management Commission Buyout Agreement Insurance Agent: This type of insurance agent focuses on assessing and mitigating potential risks associated with commission buyout agreements. They carefully analyze the financial situation, evaluate possible threats, and recommend appropriate insurance coverage to protect the parties involved. In summary, Wake North Carolina Commission Buyout Agreement Insurance Agents are professionals who provide specialized insurance services related to commission buyout agreements. Their expertise varies, with options including personal, business, legal, investment, and risk management agents who cater to different needs and preferences in Wake, North Carolina.

Wake North Carolina Commission Buyout Agreement Insurance Agent

Description

How to fill out Wake North Carolina Commission Buyout Agreement Insurance Agent?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Wake Commission Buyout Agreement Insurance Agent, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with document completion simple.

Here's how you can purchase and download Wake Commission Buyout Agreement Insurance Agent.

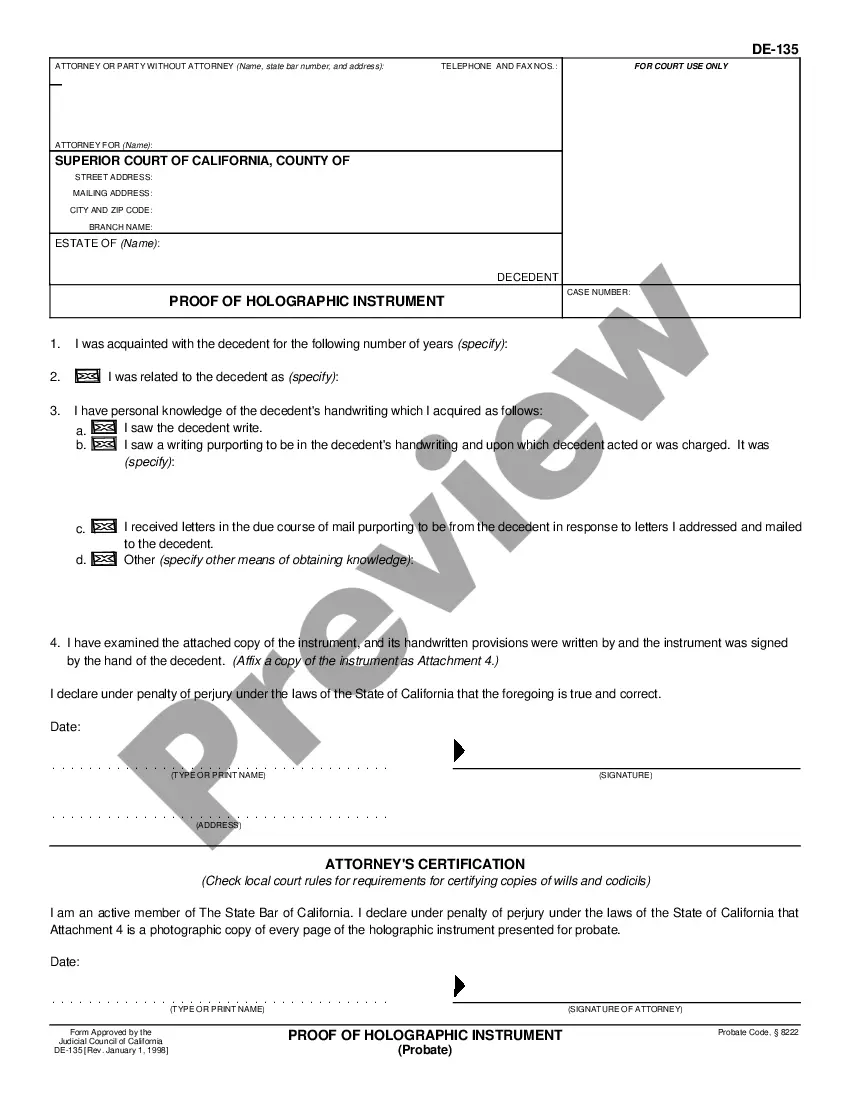

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to find the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Wake Commission Buyout Agreement Insurance Agent.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Wake Commission Buyout Agreement Insurance Agent, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you need to deal with an exceptionally complicated case, we recommend getting a lawyer to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

Licensed Only Agent or LOA means (a) for purposes of Sales, any licensed insurance agent who is either employed by or under exclusive contract with Upline to sell insurance products for Upline; and (b) for purposes of Referrals, any licensed insurance agent who is either employed by or under exclusive contract with

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

One of the first methods you should consider is life insurance. The life insurance that funds your buy-sell agreement will create a sum of money at your death that will be used to pay your family or your estate the full value of your ownership interest.

The four types of buy sell agreements are: Cross-purchase agreement. Entity purchase agreement. Wait-and-See. Business-continuation general partnership.

Commissions vary by policy and company, but life insurance agents often receive 80% to 100% of the first year's policy premium as commission.

Here is how buy-sell agreements work: Determine which events invoke a triggered buyout. Establish who has rights and purchase obligations. Identify the names and address of the purchasers. Set a purchase price or valuation with applicable discounts. Establish payment terms as well as their intervals.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.