A San Antonio Texas Subordination Agreement to Include Future Indebtedness to Secured Party is a legal document that establishes the priority of repayment for multiple creditors in case of default or bankruptcy. This agreement essentially determines the order in which creditors will be repaid in relation to the secured party. In San Antonio, Texas, there are two main types of Subordination Agreements to Include Future Indebtedness to Secured Party commonly used: 1. General Subordination Agreement: This type of agreement is frequently used when a borrower needs to secure additional debt or credit from a different lender while having existing obligations to a particular secured party. By signing this agreement, the borrower consents to subordinate the new indebtedness to the existing debts. This means that in the event of default, the existing debts would be repaid before the new obligations acknowledged in the agreement. This type of agreement offers some flexibility for borrowers who need to secure future financing or credit. 2. Specific Subordination Agreement: Unlike a general agreement, a specific subordination agreement focuses on a specific indebtedness rather than future obligations. It is commonly utilized when a borrower needs to refinance or modify a specific loan but requires the consent of the existing secured party. This agreement allows the current lender to maintain their priority position in the payment hierarchy while recognizing and acknowledging the new terms of the refinanced or modified loan. Both types of Subordination Agreements to Include Future Indebtedness to Secured Party are crucial instruments to manage the rights and priorities of various creditors in San Antonio, Texas. They ensure that in the event of default or bankruptcy, the secured party's interests are protected and repaid before any subsequent creditors. It is essential to consult with legal professionals to draft these agreements properly, as they involve complex legal terminology and require a comprehensive understanding of the borrower's financial situation, the existing obligations, and the specific terms and conditions of the new indebtedness. A properly executed agreement will provide clarity and protection to all parties involved in the loan and borrowing process.

San Antonio Texas Subordination Agreement to Include Future Indebtedness to Secured Party

Description

How to fill out San Antonio Texas Subordination Agreement To Include Future Indebtedness To Secured Party?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a San Antonio Subordination Agreement to Include Future Indebtedness to Secured Party meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the San Antonio Subordination Agreement to Include Future Indebtedness to Secured Party, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your San Antonio Subordination Agreement to Include Future Indebtedness to Secured Party:

- Check the content of the page you’re on.

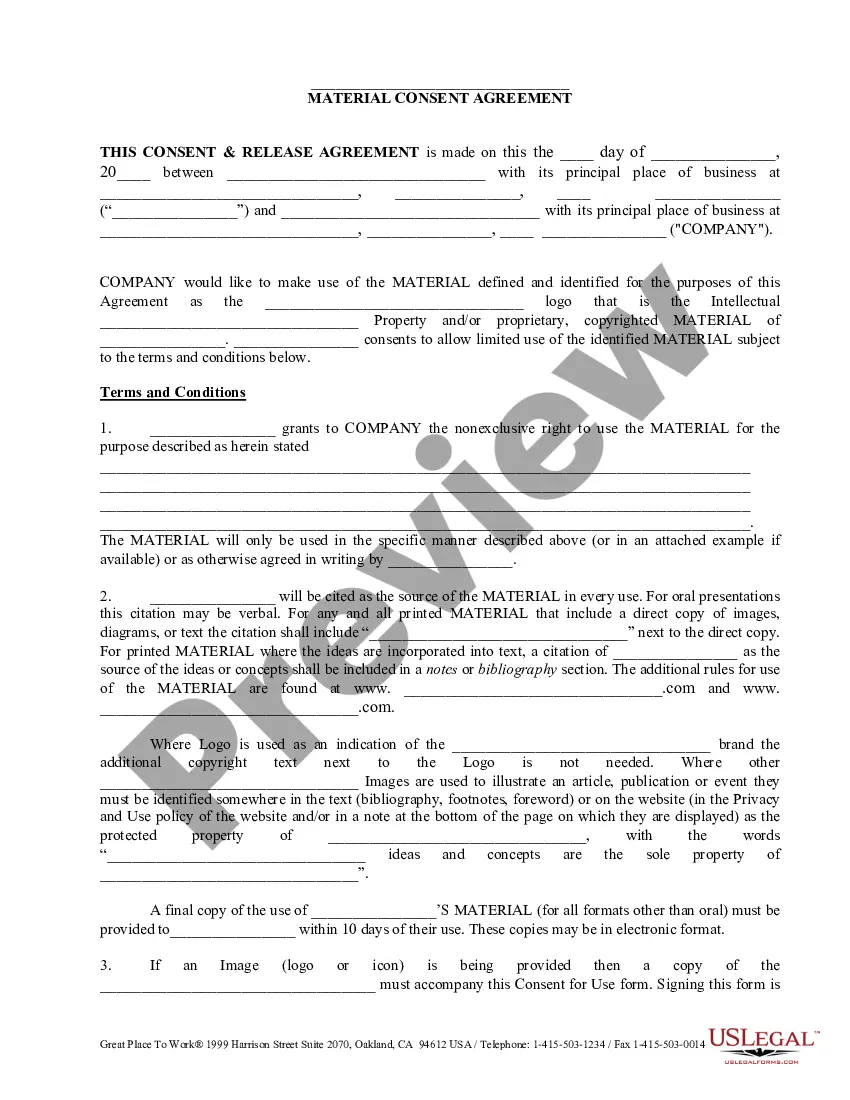

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Antonio Subordination Agreement to Include Future Indebtedness to Secured Party.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!