Cook Illinois is a transportation company that provides a wide range of transportation services, including school bus services, charter services, and shuttle services. In order to secure funds for its operations, Cook Illinois may enter into a Letter Agreement to Subordinate Liens against Personal Property. A Cook Illinois Letter Agreement to Subordinate Liens against Personal Property is a legal document that outlines the agreement between Cook Illinois and a lender or creditor. The purpose of this agreement is to subordinate any existing liens on Cook Illinois' personal property to the lender or creditor, allowing them to have a higher priority in the event of default or bankruptcy. This agreement is especially important for lenders or creditors who have provided additional finance to Cook Illinois, as it helps to secure their position and ensure that their interests are protected. By subordinating the liens on Cook Illinois' personal property, these lenders or creditors can have a greater chance of recovering their investment in case of financial turmoil. There are different types of Cook Illinois Letter Agreement to Subordinate Liens against Personal Property, depending on the specific circumstances and requirements involved. Some common types include: 1. Cook Illinois Letter Agreement to Subordinate Liens in a Loan: This type of agreement is frequently used when Cook Illinois seeks additional financing from a lender. By signing this agreement, Cook Illinois agrees to subordinate the liens on its personal property, enabling the lender to have a higher priority in case of default. 2. Cook Illinois Letter Agreement to Subordinate Liens in a Credit Facility: Cook Illinois may also enter into this agreement when obtaining a revolving line of credit or credit facility. By subordinating the liens against its personal property, Cook Illinois gives the lender greater security and a higher priority in the event of financial difficulties. 3. Cook Illinois Letter Agreement to Subordinate Liens in Equipment Financing: This type of agreement is specific to equipment financing. Cook Illinois may use it to secure funds to purchase new vehicles, such as buses or shuttles. By subordinating the liens on the purchased equipment, Cook Illinois grants the lender priority rights over the equipment in case of default. In conclusion, a Cook Illinois Letter Agreement to Subordinate Liens against Personal Property is a legal contract that allows Cook Illinois to secure additional financing while subordinating the liens on its personal property to lenders or creditors. By doing so, Cook Illinois grants these lenders or creditors higher priority in the event of financial difficulties, safeguarding their investments. Different types of agreements may exist based on the specific circumstances, such as loans, credit facilities, or equipment financing.

Cook Illinois Letter Agreement to Subordinate Liens against Personal Property

Description

How to fill out Cook Illinois Letter Agreement To Subordinate Liens Against Personal Property?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Cook Letter Agreement to Subordinate Liens against Personal Property.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Cook Letter Agreement to Subordinate Liens against Personal Property will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Cook Letter Agreement to Subordinate Liens against Personal Property:

- Ensure you have opened the right page with your localised form.

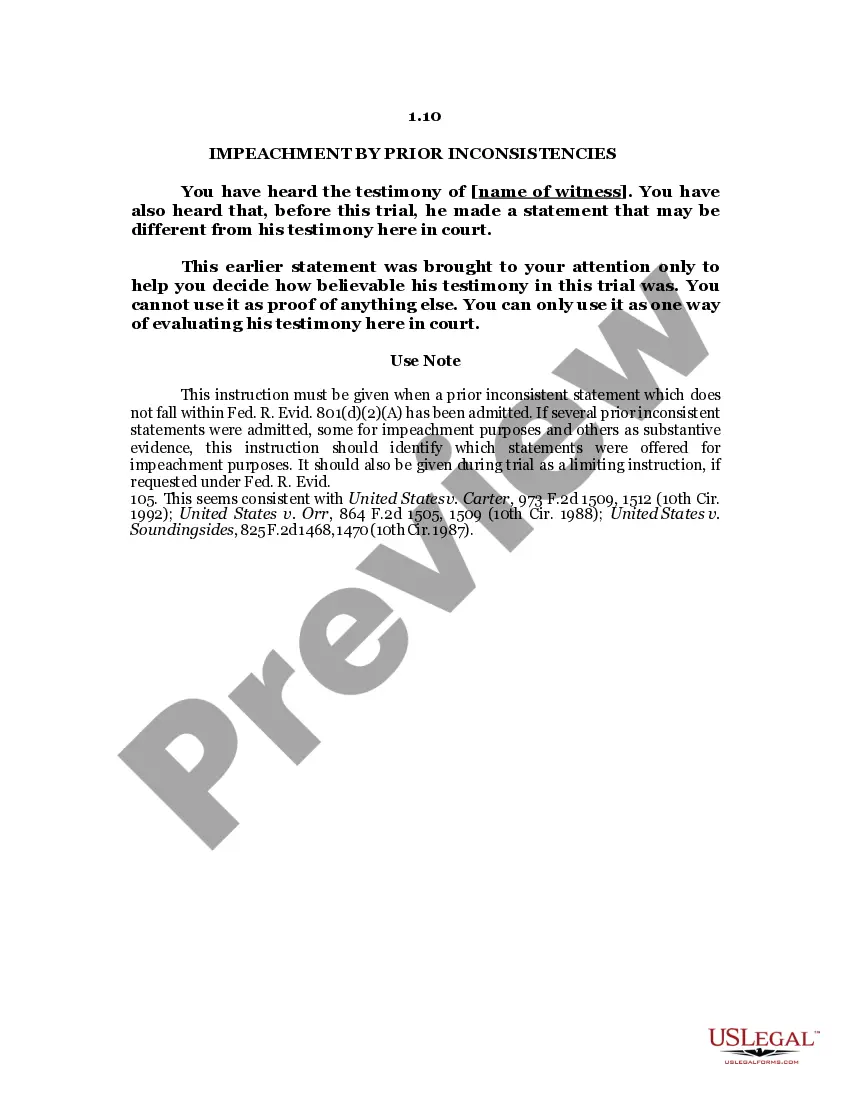

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Cook Letter Agreement to Subordinate Liens against Personal Property on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!