A Chicago Illinois Promissory Note Payable on a Specific Date refers to a legal document that outlines a formal agreement between two parties in Chicago, Illinois. This document functions as a written promise, where one party, known as the maker, agrees to pay a set amount of money to another party, referred to as the payee, on a specific date in the future. The promissory note acts as a binding contract and establishes the terms and conditions of the loan or debt, including the principal amount, interest rate, repayment schedule, and any additional fees or penalties. The note indicates a specific due date when the lender can expect repayment along with any agreed-upon interest. There are various types of Chicago Illinois Promissory Notes Payable on a Specific Date, each designed to suit different lending purposes. These include: 1. Simple Promissory Note: This is the most basic type of promissory note that outlines the primary obligations, such as loan amount, interest rate, and repayment terms. 2. Secured Promissory Note: In this type, the borrower pledges collateral, such as real estate or personal property, to secure the loan. If the borrower defaults on payment, the lender has rights to seize and sell the pledged assets to recover the debt. 3. Unsecured Promissory Note: Unlike a secured note, this type does not require collateral. The lender relies solely on the borrower's promise to repay the loan, making it a riskier option for lenders. 4. Demand Promissory Note: This promissory note doesn't have a specific maturity date. Instead, the lender can demand repayment at any time, making it flexible for both parties. However, it is typically used for short-term loans. 5. Installment Promissory Note: This type splits the total debt into regular installment payments over a specified period, including both principal and interest. The borrower repays the loan in predetermined amounts until the debt is fully satisfied, making it suitable for long-term loans. 6. Balloon Promissory Note: This note structure requires smaller periodic payments for a set period, with a large "balloon" payment due at the end. This type is often used when the borrower anticipates having the necessary funds to make the significant final payment. 7. Renewable Promissory Note: This note contains a provision that allows the parties to extend or renew the loan term after the original maturity date. It provides flexibility in case the borrower is unable to repay the full amount on time. In conclusion, a Chicago Illinois Promissory Note Payable on a Specific Date is a legally binding contract that establishes the terms and conditions of a loan between two parties in Chicago, Illinois. Various types of promissory notes exist, allowing for flexibility in loan repayment structures and options for both lenders and borrowers.

Chicago Illinois Promissory Note Payable on a Specific Date

Description

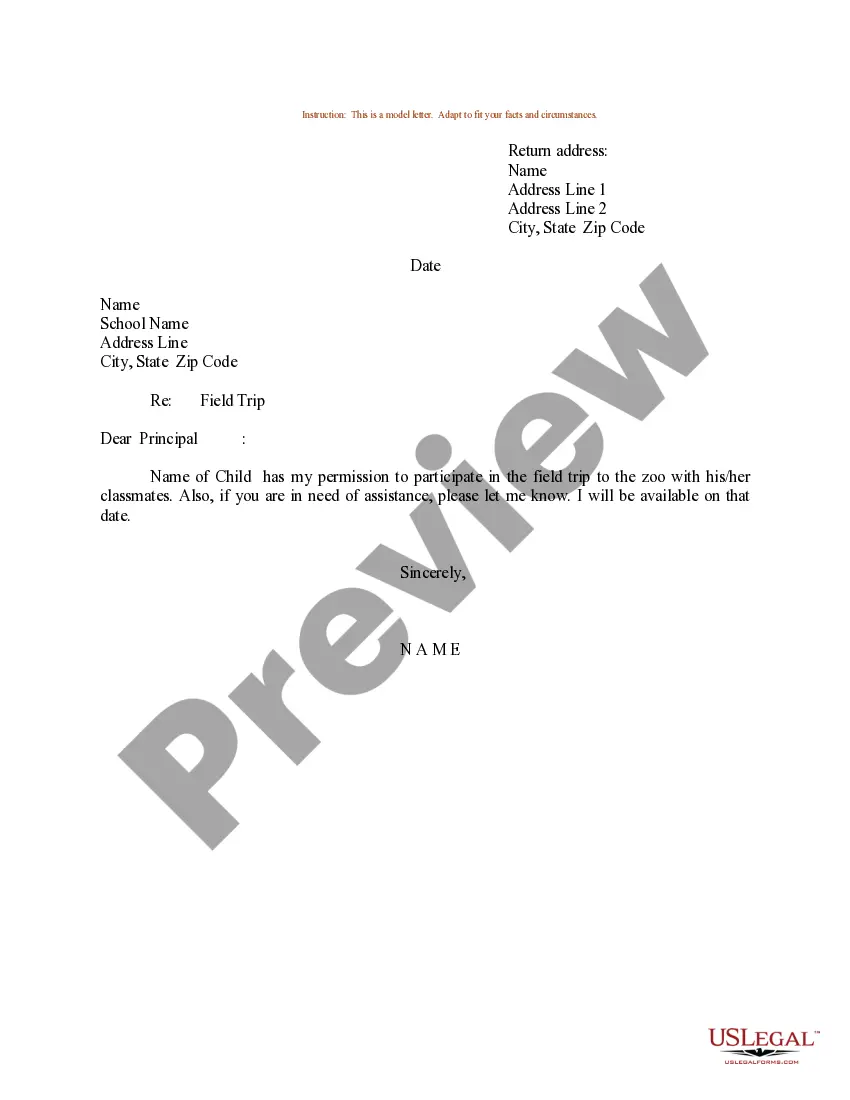

How to fill out Chicago Illinois Promissory Note Payable On A Specific Date?

If you need to get a trustworthy legal paperwork provider to find the Chicago Promissory Note Payable on a Specific Date, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support team make it easy to get and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Chicago Promissory Note Payable on a Specific Date, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Chicago Promissory Note Payable on a Specific Date template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate agreement, or execute the Chicago Promissory Note Payable on a Specific Date - all from the comfort of your sofa.

Sign up for US Legal Forms now!