A Montgomery Maryland Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan agreement between two parties in Montgomery County, Maryland. It is a written promise by the borrower to repay a specific amount of money to the lender on a predetermined date. Key Features: 1. Loan Amount: The promissory note specifies the exact amount borrowed, which can be either a fixed sum or a variable amount depending on the agreement. 2. Interest Rate: This note includes the interest rate at which the borrowed funds will accrue, if applicable. It may be a fixed rate or a variable rate, typically expressed as an annual percentage. 3. Repayment Terms: The note outlines the repayment terms, including the duration of the loan and the date by which the borrower must repay the principal and interest in full. 4. Late Payment Penalties: It may also include provisions for late payment penalties or default consequences in case the borrower fails to repay the loan on time. 5. Collateral: Depending on the type of loan, the note may mention any collateral offered to secure the loan. If the borrower defaults, the lender may have the right to seize the collateral to recover the outstanding balance. 6. Signatures: This document requires the signatures of both the borrower and lender, along with the date of execution, to make it legally binding. Different Types of Montgomery Maryland Promissory Notes Payable on a Specific Date: 1. Personal Promissory Note: A loan agreement between individuals, often used for personal loans, where one person borrows money from another. 2. Business Promissory Note: A loan agreement between a business entity and an individual or another business, typically used for business financing or start-up capital. 3. Mortgage Promissory Note: A specific type of promissory note used in real estate transactions, where the loan is secured by a property. 4. Installment Promissory Note: This note divides the loan into regular installment payments over a specific period, including principal and interest, similar to a mortgage. In Montgomery County, Maryland, these promissory notes serve as legal instruments to outline the terms and conditions of loans, ensuring the rights and obligations of both borrowers and lenders are protected.

Montgomery Maryland Promissory Note Payable on a Specific Date

Description

How to fill out Montgomery Maryland Promissory Note Payable On A Specific Date?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Montgomery Promissory Note Payable on a Specific Date without expert assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Montgomery Promissory Note Payable on a Specific Date by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Montgomery Promissory Note Payable on a Specific Date:

- Look through the page you've opened and check if it has the document you need.

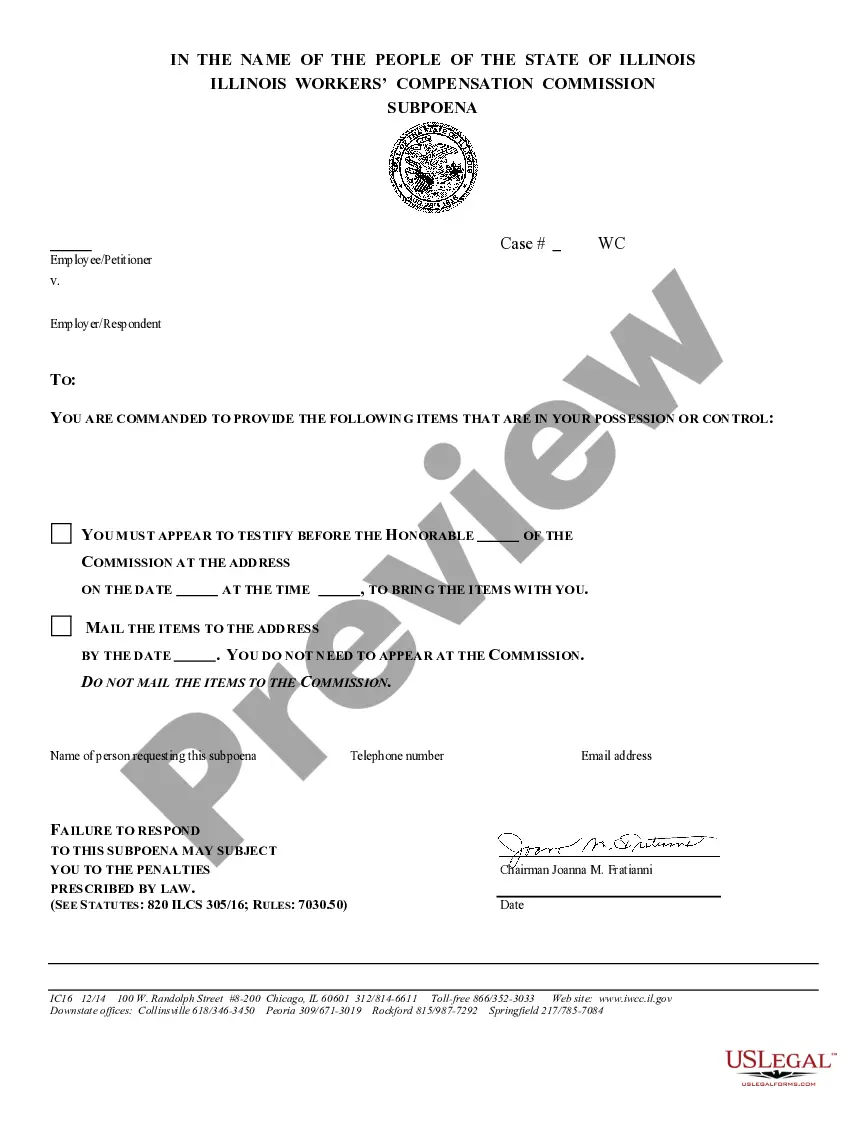

- To do so, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!