Oakland, Michigan Promissory Note Payable on a Specific Date: Exploring the Different Types A promissory note is a legal document that outlines the specifics of a loan agreement between a borrower and a lender. In the case of Oakland, Michigan, there are several types of promissory notes payable on a specific date that individuals and businesses can utilize. These notes serve as evidence of a debt and provide a formal agreement for repayment terms. Let's delve into the various types of Oakland, Michigan promissory notes available: 1. Personal Promissory Note: A personal promissory note is commonly used between friends, family members, or acquaintances. This type of note typically involves smaller loan amounts and shorter repayment periods. Oakland, Michigan residents can utilize this form of promissory note to facilitate personal loans, such as lending money for a car purchase, education expenses, or home repairs. 2. Business Promissory Note: Business owners in Oakland, Michigan often turn to promissory notes for financial transactions within their companies. These notes are commonly used to secure funds for operational expenses, expansion projects, or equipment purchases. The terms and conditions of a business promissory note will vary based on the needs of the company and the agreement between the borrower and lender. 3. Real Estate Promissory Note: Real estate transactions in Oakland, Michigan can involve promissory notes as well. When purchasing or selling a property, buyers or sellers might use a promissory note to outline the terms of a loan used in the transaction. The note specifies the loan amount, repayment schedule, and any interest rates agreed upon by the parties involved. 4. Student Promissory Note: As a hub for education, Oakland, Michigan sees student loans being facilitated through promissory notes. Students seeking financial assistance for college tuition or related expenses may engage in promissory notes as an agreement to repay the borrowed funds. These notes often come with specific terms, such as deferment options or interest accrual during the repayment period. Regardless of the type of Oakland, Michigan promissory note, it is important to draft the document accurately and ensure both parties sign it. The note should include important details like the names of the borrower and lender, the loan amount, the interest rate (if any), the repayment schedule, and the specific due date. Consulting with a legal professional or using a promissory note template can help guarantee that all necessary components are included. In conclusion, Oakland, Michigan offers various types of promissory notes payable on a specific date, catering to personal, business, real estate, and student loan needs. Regardless of which type of note you require, it is essential to approach the process with thoroughness and strive for clarity in the document's details. Always consult legal professionals or online resources to ensure compliance with local laws and optimize the likelihood of a successful loan agreement.

Oakland Michigan Promissory Note Payable on a Specific Date

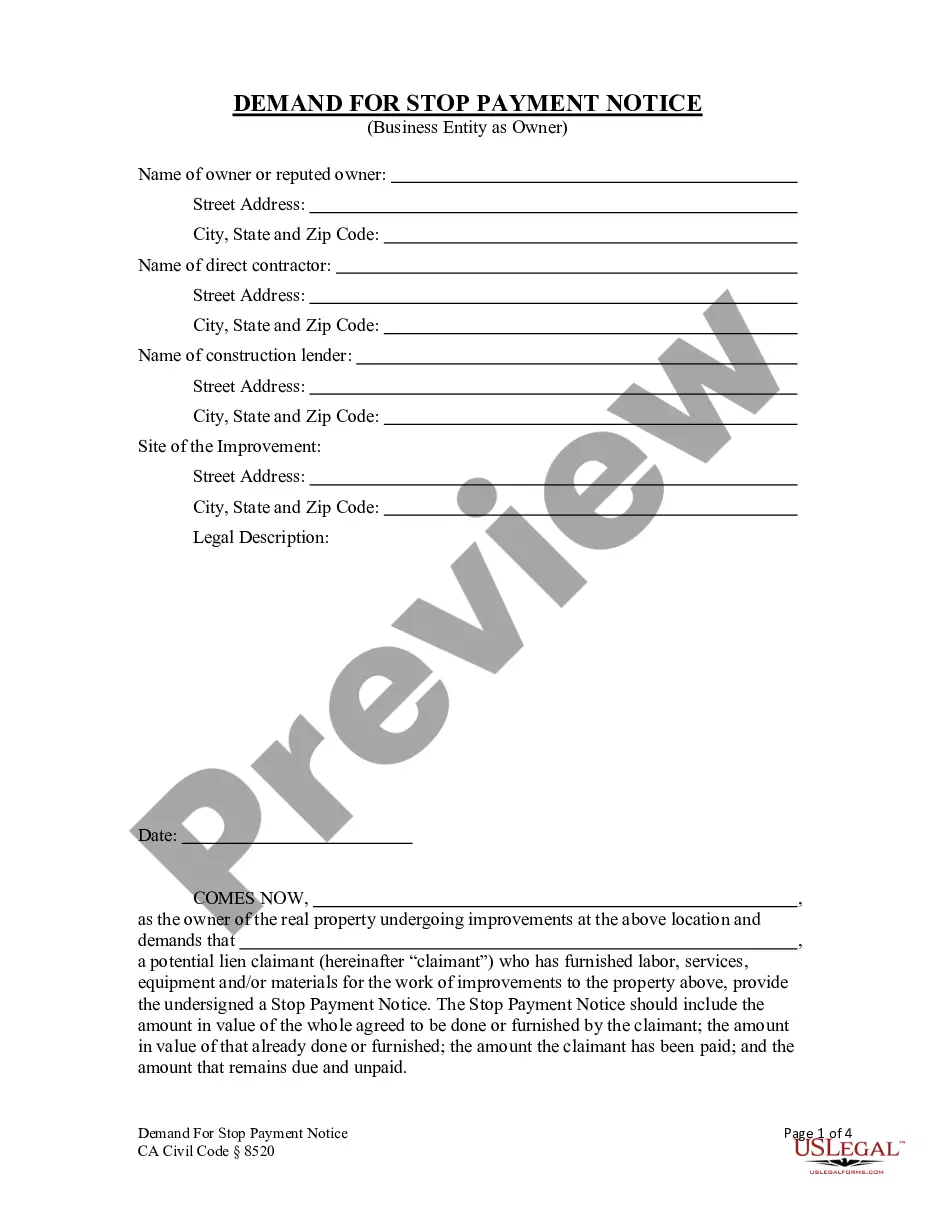

Description

How to fill out Oakland Michigan Promissory Note Payable On A Specific Date?

Draftwing paperwork, like Oakland Promissory Note Payable on a Specific Date, to take care of your legal matters is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for a variety of cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Oakland Promissory Note Payable on a Specific Date form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Oakland Promissory Note Payable on a Specific Date:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Oakland Promissory Note Payable on a Specific Date isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start using our website and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!